Cultivating success with support

Here’s an eye-opening stat: About 80% of highly effective loyalty programs have a dedicated team.1 Which leads us to a conundrum. Employees focused exclusively on a rewards program are critical for success…but how can an often resource-strapped credit union afford that?

A witty (or perhaps smart-alecky) response would be, how can you afford not to? In Rewards Come Roaring Back, we learned how consumers increasingly expect rewards for basic banking activities as financial institutions nationwide continue marketing them heavily. Running a robust rewards program has become a table stake for credit unions. The question is how to squeeze that into the busy day!

Deepen Your Bench With Third-party Support

One option that works best for many credit unions is to partner with a full-service third-party rewards provider. What full-service means is mostly subjective. But the key is to research how much support and hands-on cardholder engagement the rewards provider delivers, such as:

- Wide range of advertising materials

- Frequent, ongoing e-mail campaigns to cardholders

- Plug-and-play social media content

- Member support from real human beings

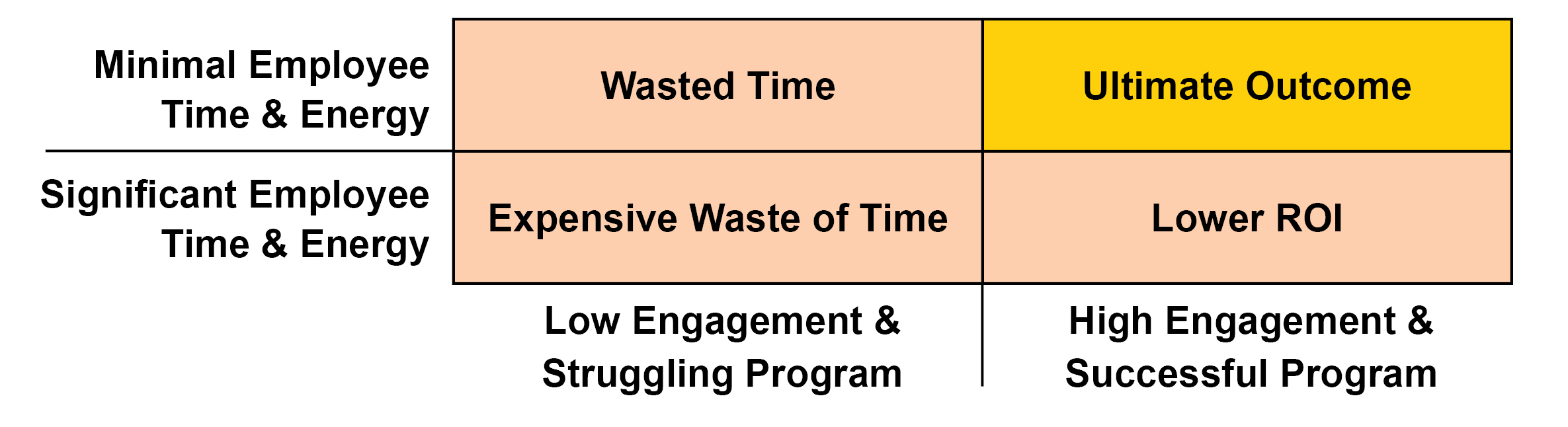

Alternatively, some credit unions choose to handle all of the above internally. This can work if there are ample resources and expertise in running such a program. Though it’s still worth evaluating the all-in costs, meaning both the program expense and the employee time to run it. This simple chart highlights the typical impact on ROI.

The Power of Engagement

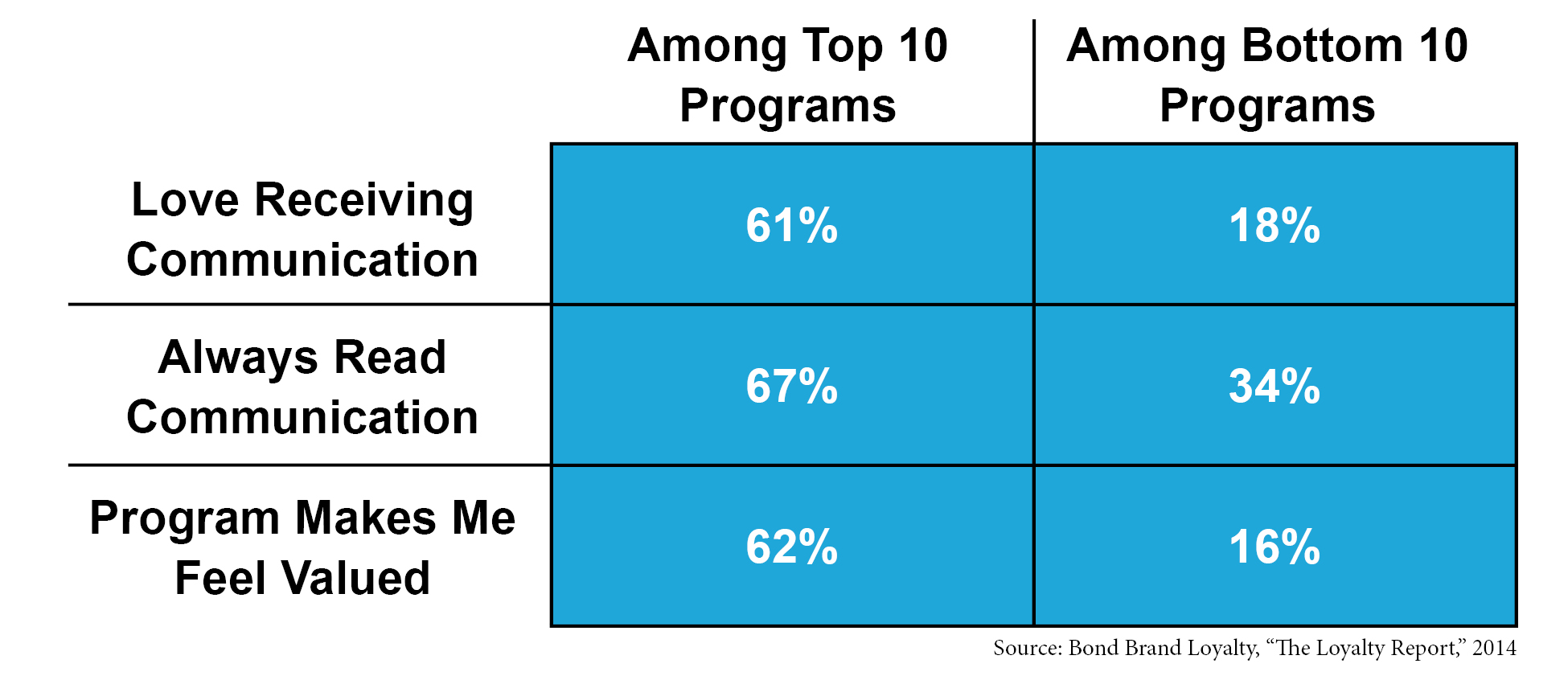

Among the critical support elements, the hardest to maintain just might be the frequent engagement required. It takes the entire workweek to plan, create, and deliver interactive communications that keeps consumers engaged with your rewards program. But the effort is worth it. It’s no coincidence the most successful programs have the best ongoing content.

The Bottom Line: Time = Money

Since time equals money, time needs to be tracked. Internal hours spent should be factored into the cost of any rewards program. This affects the ROI even if that salary line item isn’t attributed to the program on your balance sheet. On the flipside, member satisfaction is harder to quantify than increased interchange revenue, but certainly boosts the ROI as well.

The ultimate takeaway is to recognize it takes more than flipping a switch to have a successful rewards program. Some credit unions fall prey to launching a program in a “check the box, we got it done” approach. The problem with that is it will likely fail in delivering the desired results of increased revenue, engagement, and loyalty. So before launching your program, be sure you have the solutions for the ongoing support in place.