Double your credit union’s email marketing results

Nod your head if you get a lot of emails. I promise we’re not spying on you, but it’s clear you’re nodding.

But (oh the irony) we’re also responsible for our fair share of marketing emails bulging other folks’ inboxes. Knowing first-hand how easy it is to get e-buried, how do you ensure your email is effective in motivating your target audience?

Let’s examine a formula that more than doubled the conversions in a recent email campaign.

You Can Do Better Than Target

No, we don’t mean the well-known retailer. They’re doing just fine. We mean you can do better than “target audience.”

As a credit union, you’re often working with a known audience. Existing members that you’d like to deepen the relationship, cross-sell, and further engage. Even better, you have data specific to each member. With the right insight, strategy, and execution, this can get you a long way toward that doubling of success.

We promised a formula, so taking things literally, here it is: (PG + PB) – PI = $

The variables stand for: (Personal Greeting + Personal Behaviors) – Personally Irrelevant = More Conversions, aka $

Translated from fake math to real English: Leverage the known activity for each specific individual and tailor the email accordingly. Meanwhile, be sure to leave out any components that are not of use to that particular individual. When all rolled together the results will far exceed a one-for-all message.

Seeing the Results

More detail on automating and executing the formula is available in Top 4 Personalization Techniques to Drive Non-Interest Income. That post spawned a lot of interest and inquiries, hence this follow up and sample case study.

One of the examples in Top 4 Personalization Techniques was the Pot O’ Points email campaign. This campaign incorporated customized gamification while following the formula. The results were stunning.

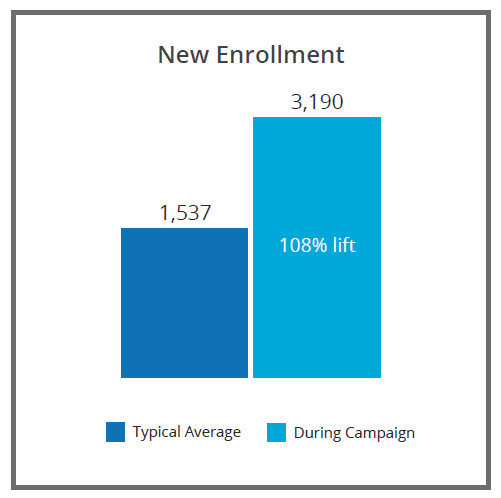

By one metric — enrollment in the program — the campaign more than doubled the average results over typical enrollment efforts.

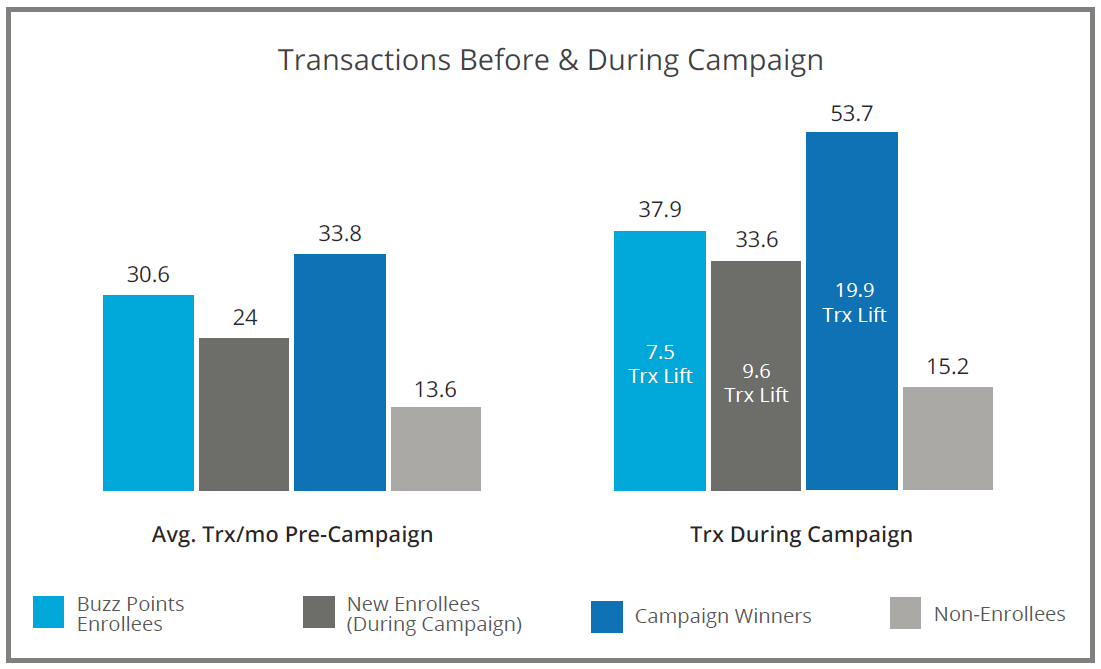

More poignantly, Pot O’ Points was designed to increase debit card transactions (and thereby, interchange revenue for the issuing credit union), and again following the formula knocked it out of the park. The chart below shows the transaction lift broken down by various cardholder segments.

Download Case Study: Engagement Campaign for a detailed report on how the campaign was executed and a deeper dive into the results.

Effective Campaigns Yield Sustained Results

Perhaps the most eye-opening measurement is the sustained results. The campaign called for recipients to modify their behavior for a month. They would be rewarded for this modification, and so would their financial institution (in the form of increased interchange revenue). Of course, a credit union would love for this profitable modification to be long-term, not just for one month.

Turns out an effective campaign, though having a finite duration, can spawn long-term effects. In some ways this is common sense: Coke doesn’t spend millions of dollars on its high-production value TV commercials in hopes someone buys one can of Coke one time. But we’re not as accustomed to this with fleeting email marketing.

We should be.

It’s as simple as (PG + PB) – PI = $. And assuming you’re interested in that $, it’s a formula very worth following.

See details on the sustained results in the case study. And happy marketing!