Mobile RDC taking you where you want to be

In 2010, a wave of mobile RDC providers stormed onto the credit union scene in full force with the promise of irreplaceable ROI, member retention and a business promoting solution for the future. The ability for mobile deposit has been available since 2009, the solutions are improving rapidly, and outlooks on eligibility are loosening with the consumer demand. However, cost, compliance and risk-based considerations all have effected credit unions management and their appetite to move and adopt mRDC capability.

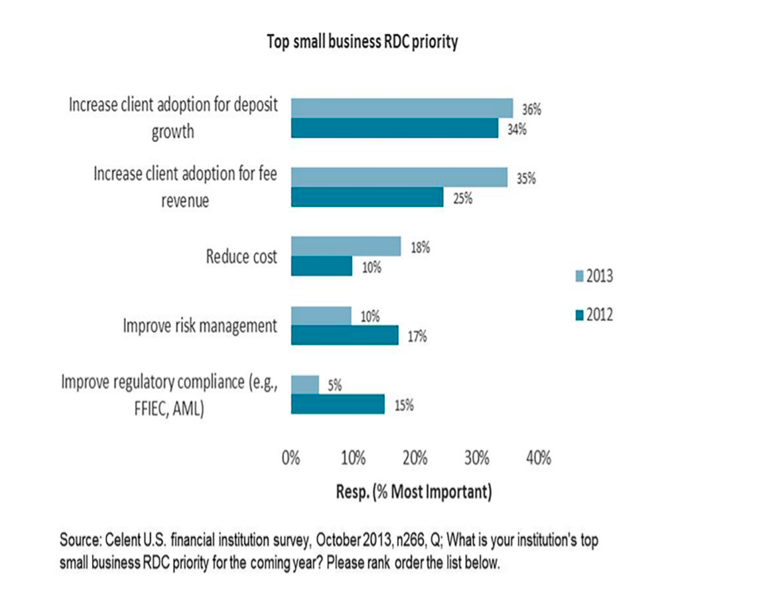

The value proposition and risk vs. reward in compliance and fraud have credit unions wondering, when is the right time to adopt, what is reasonably considered by most analysts as a requirement of the next generation member? Celent Blog, a strategy consulting blog for financial institutions, reported in January of this year, “The most encouraging news in my opinion is that compliance worries are mostly a thing of the past – in both retail and wholesale banking lines of business at most banks” (Meara, 2014).

As part of an annual survey conducted by Celent during the last four years, US banks and credit unions responded to questions of adoption and risk, and their attitudes towards mRDC adoption and priorities.

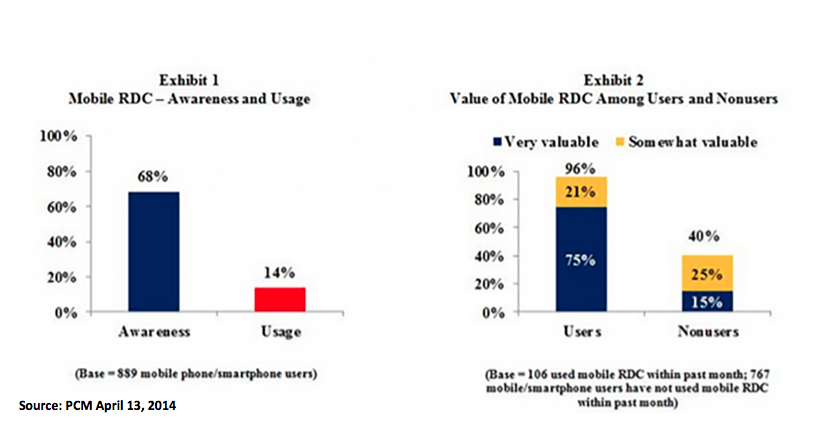

If we truly are past the compliance concerns and increased adoption now holds the largest majority’s priority for 2015, how does a credit union move adoption forward? Payments Cards and Mobile (PCM) recently reported the chasm between mobile phone user’s awareness of mRDC solutions and use of the capability. PCM noted that the value proposition of mRDC among both user and nonusers was high. “Virtually all report the service to be very or somewhat valuable, with three-quarters rating it ‘very’ valuable” (PCM, 2014).

So what is the challenge? Adoption is the challenge. While nearly 75% of customers polled reported mRDC was very or somewhat valuable and that they were aware of the capability, only one in seven mobile phone users have actually used the mRDC offering available to them.

At eDOC Innovations, we are seeing some interesting insights from our clients who are using mRDC.

- Credit unions implementing mobile RDC have an average growth rate of 17% month-over-month during their first year.

- Credit unions who implement mobile RDC as a stand-alone strategy have an average growth rate of 14% month-over-month during the first year.

- Credit unions who implement mobile RDC as an option in their mobile banking application, sometimes called integrated, have an average growth rate of 18% month-over-month during the first year.

The statistics, however, do not reveal the drag on adoption within credit unions who are aggressively marketing this offering or who have not placed hurdles in the path of utilization, such as arduous enrollment processes, delaying of adoption for additional automation, or qualification requirements such as credit approvals or comparable considerations.

It is clear is that selling the value and marketing mRDC capability is the game changer! Credit unions that aggressively market and promote the offering and remove any artificial barriers for mRDC are seeing members benefiting from the use of mRDC 5%+ more than their peers. William McCracken, CEO of Synergistics summed it up this way, “[Credit Unions] will need to aggressively promote the service to customers, explaining clearly its usage and benefits. Those who have actually used the service highly value it” (PCM, 2014).

If mobile RDC isn’t impacting your business, consider your next move.

References

Meara, Bob, January 13, 2014, Celent Strategy Consulting for Financial Institutions, ‘The Best News About RDC in a Long While’, [Online], Available at: http://bankingblog.celent.com/2014/01/13/the-best-news-about-rdc/, viewed September 29, 2014.

Payments Cards and Mobile (PCM), April 3, 2014, ‘Mobile remote deposit capture – once consumers use it they love it’, [Online], Available at: http://www.paymentscardsandmobile.com/mobile-remote-deposit-capture-consumers-use-love/, viewed September 29, 2014.