Outsourcing tactical HR functions enables credit union management to focus on more strategic initiatives

As competition for market share and the need for a knowledgeable, skilled workforce continue to challenge financial services providers, human resources departments have taken a more strategic role within organizations than many would have imagined a few short years ago. Today HR professionals spend more of their time and energy on activities geared toward building and maintaining the strongest workforce possible – such as policy development and workplace improvement initiatives – leaving fewer hours to manage the more traditional, tactical HR functions.

However, while duties like tracking job applicants, administering payroll and managing employee benefit programs have less of an impact on the daily needs of employees, they are none-the-less important in the overall formula required to maintain a positive work experience. And while often difficult to manage – due to complex compliance requirements – if maintained skillfully these activities can be the retention glue that leads to workplace stability and helps an institution to build employee engagement and quality long-term relationships.

But for credit unions that don’t have the in-house expertise to manage the growing responsibilities of human resource administration, outsourcing all or a portion of the more tactical activities to a third-party HR specialist can improve workplace management, reduce overall HR costs and allow more time for internal HR staff to address big picture employee management concerns.

It starts with the big picture

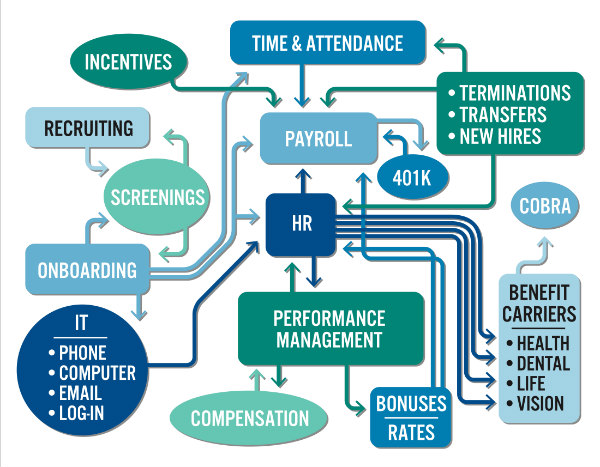

An HR management expert can review your existing human relations processes to help determine the best approach for improving your overall strategy. By identifying all of the programs, procedures and policies that are currently in place, a consultant can recommend the best way to streamline essential functions, show you where outsourcing can provide better staff support and enable you to more effectively reach your HR goals.

And the good news is, this doesn’t necessarily mean that you will need to totally shift all HR functions to an outsource provider. Nor will this cause you to do away with an internal HR presence. Once you have identified the credit union’s human resources priorities and needs, the outsourcing expert can recommend a plan to help you transfer essential “hire to retire” human resource functions to an automated solution. And while your in-house HR personnel will continue to play an important communications role in the overall process, once some of the more tactical administrative functions have been outsourced, staff will have time to focus on such things as maintaining effective staffing levels across facilities, and identifying and fulfilling possible staff training needs.

Beware the temptation to shop for an out-sourcing partner based on price alone

Oftentimes when financial institutions make the decision to outsource HR functions, they look for the cheapest solution or the best stand-alone resource – that only specializes in one aspect of the HR function. However, if the institution experiences growth or is involved in a merger or acquisition, its HR needs could increase beyond the outsource provider’s expertise or scope. After a few years, the institution may have amassed solutions from multiple providers whose systems aren’t compatible. This requires the institution to create a work-around or pay extra fees for a special interface to keep the operation running smoothly. In the end, the situation can lead to additional expenses and create a frustrating workplace environment for employees.

A better approach is to identify a scalable outsourcing solution at the outset that can holistically grow as your credit union and its HR needs grow. Or, plan to incorporate a full-service system in layers as you need them.

Cost of ownership and potential savings may be surprising

Engaging in an out-sourcing relationship doesn’t necessarily mean adding expenses. With the help of a cost-benefit analysis, an HR services provider can identify all of the costs a credit union incurs in staff time and expenses to manage all of the tactical administration functions in-house. Then, with a full understanding of the institution’s HR needs, he or she can recommend automated platform options that will reduce the amount of staff time required to complete these tasks, and outline the savings that can be realized by no longer needing multiple software applications to maintain the different functions.

As a result, HR staff can spend their time on more strategic activities while the credit union’s overall HR costs are reduced, and functionality and efficiency are improved.

If your credit union is cost-sensitive, make sure an outsource provider’s solution doesn’t require the installation of new hardware, expensive software or a complete conversion to ensure that your system will be compatible with upgrades that may be made at a later date. To ensure continuous operation in the future, consider a web-based solution that can integrate all HR disciplines and provide seamless upgrades that don’t disrupt service to employee portals.

Keep security and service expectations high

With instances of identification theft on the rise, maintaining secure information technology is imperative. Make sure your employee and credit union data will be handled with the utmost security protection on provider servers and through employee portals.And verify that information will be available to you and your employees, even if there is a technology malfunction, or a natural or man-made disaster.

Keep in mind: whatever solution you choose will only be as successful as the level of support it provides your employees. In some cases, outsource provider contracts include service to their software, but don’t furnish additional assistance to ensure that all of the related functions will work together.

By contracting with a provider that operates from a “software with a service” philosophy, your credit union will benefit from comprehensive employee training programs and access to a dedicated account manager who is familiar with the credit union industry and knowledgeable about your institution’s complete HR system. This can prove extremely beneficial when you have questions regarding policy and compliance issues, especially during critical periods – such as employee health benefits enrollment – when seamless access to information and quick responses to staff questions or concerns is essential.

Keep all HR systems running seamlessly

From a best practice and business continuity standpoint, credit unions need to consider the disruption that can occur if the person who handles important HR functions is unavailable – due to illness, vacation or work-related reasons. Or, if there is only one person in the institution who has the knowledge to manage this important task, what happens if he or she would leave the credit union permanently? Is the CEO or CFO in a position to approve employee hours and time-off requests, or complete necessary reporting duties?

While credit unions come in all sizes and face different challenges and opportunities every day, they have one thing in common: The secret to their success lies in the people who come to work every day to provide the excellent service that members expect and deserve. By outsourcing the everyday tactical HR functions to a management expert that understands the credit union culture, institutions can create a more supportive workplace environment for all employees and get a more satisfactory return on their HR investment.