CHICAGO, IL (January 6, 2015) - Member Loyalty Group, the CUSO acclaimed for its industry benchmark for external service and Voice of the Member program, recently released its Fall 2014 Internal Service Benchmark. MLG's Internal Service Survey program was launched in late 2011 to help credit unions measure, manage and take action on employee feedback. Each participating institution uses the same methodology and asks consistent questions of employees to determine Net Promoter Scores and collect feedback at a departmental level.

“In order to create exceptional service experiences for members, it is crucial that the entire organization is working effectively as a team,” said Michelle Bloedorn, CEO of Member Loyalty Group. “This internal service survey program allows participating credit unions to accurately gauge how well each department is serving other employees and make changes to strengthen the organization and ultimately improve the member experience.” The benchmark also ensures that participants understand their scores relative to other credit unions utilizing the same methodology.

According to the Fall 2014 Benchmark, the overall internal Net Promoter Score for all participating credit unions averaged 65.30, with the highest ranked credit union at 86.81 and the lowest at 44.27. This broad range of scores carries over and even becomes more pronounced when we review specific departments within the participating credit unions.

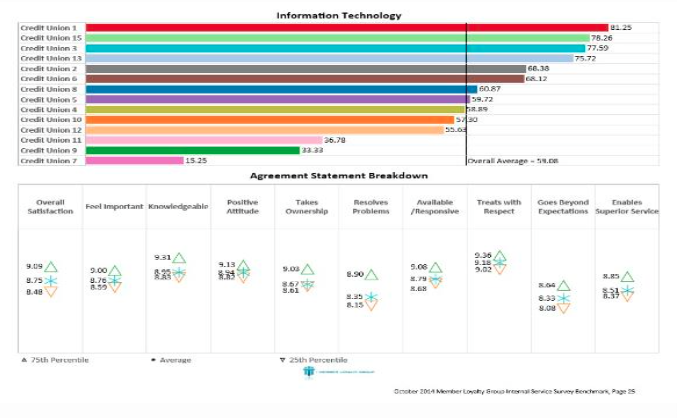

The chart below shows the broad range of scores for Information Technology, one of the key departments that everyone in the credit union relies upon.

What makes the top-performers different from their peers?

“Comments from top performing IT teams show a collaborative nature between employees and the IT teams. It is evident these top performing IT teams are not order takers, rather they’re included in the decision making process. This appears to yield a strong sense of ownership and commitment to resolving any issues that arise,” said Jake Foreman, Program Manager for Member Loyalty Group.

Top performers also tend to focus on making their processes as easy as possible for those who need their help while lower-performers' processes tend to be more inwardly focused. "Comparing your internal NPS at the credit union and department levels with others using the same methodology can help your credit union set realistic goals and identify the areas with the greatest room for improvement," shared Bloedorn.

For more information about Member Loyalty Group’s Internal Service Survey program, credit unions should visit www.memberloyaltygroup.com or contact info@memberloyaltygroup.com.

About Member Loyalty Group

Member Loyalty Group is a CUSO formed by leading credit unions in 2008 to develop a common member loyalty benchmark for the credit union industry and is the 2012 winner of NACUSO's Collaboration & Innovation Award. The CUSO has an exclusive relationship with Satmetrix, the Net Promoter® company, to provide credit unions with the most effective tools for managing a Net Promoter® program to collect and act on member feedback that increases loyalty, growth and retention. Member Loyalty Group serves over 65 credit unions, many of which are over $1 billion in assets, across the country. For more information visit www.memberloyaltygroup.com

About Net Promoter®

Net Promoter® is both a customer loyalty metric and a discipline for using customer feedback to fuel profitable growth in your business. Net Promoter® has been embraced by leading companies worldwide as the standard for measuring and improving customer loyalty. Financial Institutions obtain their Net Promoter Score® by asking customers a simple question on a 0 to 10 rating scale: “How likely is it that you would recommend the organization to a colleague, family member or friend?” Based on their responses, consumers can be categorized into one of three groups: Promoters (9-10 rating), Passives (7-8 rating), and Detractors (0-6 rating). The percentage of Detractors is then subtracted from the percentage of Promoters to obtain a Net Promoter Score®.

Net Promoter, NPS, and Net Promoter Score are trademarks of Satmetrix Systems, Inc., Bain & Company, Inc., and Fred Reichheld.