Press

Combining forces to create the financial industry’s most powerful mobile banking experience

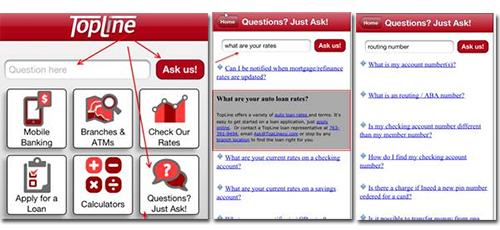

PORTSMOUTH, NH (November 26, 2013) — FI-Mobile, the premier mobile presence provider for the financial industry, today announced the launch of the most integrated mobile solution available with the inclusion of SilverCloud, Inc.’s fully embedded self-service knowledgebase technology – BreezeTM. The integration provides for a completely seam less user experience while maximizing channel efficiency, lowering operating expenses, and enhancing revenue opportunities for the institution.

The question’s facing many organizations and their IT teams are how they can gain the most out of their mobile channel. This is vital as a recent study conducted by Javelin found that mobile transactions are the cheapest for the organization to process with an average savings of $4.15 in processing costs for every check that is deposited through mobile rather than the branch. Not to mention the demand from the Gen X and Y consumers who are pushing organizations to improve their mobile apps and services.

“FI-MOBILE has always delivered a complete, engaging and profitable banking experience across mobile devices but we are always seeking ways to maximize the experience and provide enhanced value for our clients,” says Dan Chaney, CEO of FI-MOBILE. “SilverCloud’s integration was the logical next step. Their technology solutions are the self-service wave of the future enabling users to instantly access answers to their questions. That benefits the users, while our clients get the added perks of streamlined operations through lower costs to operations, and more opportunities to cross sell products and services through this channel.”

By combining the two solutions an institution will be able to reduce the mobile application clutter by unifying all of the mobile services they offer into one downloadable application. This enables an institution to be agile and quickly deliver new, innovative offerings to meet their consumer needs and organizational goals. Plus, their consumers will get INSTANT and accurate answers to their questions any time of the day. SilverCloud’s most recent data shows that 54% of consumer inquiries are taking place between the hours of 5pm and 9am – when a traditional branch location is typically closed. An institution needs to maximize the value of this channel as an enhancement to the consumer experience and a revenue generator.

“TopLine is pleased to be able to include our 24/7 online service support feature into our mobile app,” said Harry Carter, President and CEO of TopLine Federal Credit Union. “In this ever increasing mobile society, members come to expect the ease of doing their banking business on the go – with the integration between SilverCloud and FI-Mobile this allows us to deliver greater convenience and an enhanced member service experience.”

To learn more about FI-MOBILE and SilverCloud, Inc. and the range of solutions they deliver please visit www.fi-mobile.com or www.silvercloudinc.com or contact info@silvercloudinc.com.

About SilverCloud, Inc.

SilverCloud, Inc. is a SaaS company located in Portsmouth, NH and specializes in enhanced self-service solutions for the financial industry. SilverCloud delivers easy-to-launch solutions that unify channels with consistent and accurate information. SilverCloud’s hundreds of Bank and Credit Union clients are more competitive, experience greater operational efficiency, and are more compliant – all through a simple monthly subscription. Find out more by visiting www.silvercloudinc.com.

About FI-MOBILE

FI-MOBILE helps financial institutions deliver a complete, engaging and profitable banking experience across mobile devices. FI-MOBILE solutions deliver a wide-range of banking services, are now available to more than 1.4 million consumers and have earned an average customer loyalty rate of 97 percent. More information on FI-MOBILE is available at www.fi-mobile.com.

About TopLine Federal Credit Union

TopLine Federal Credit Union, a Twin Cities-based credit union, is Minnesota’s 13th largest, with assets of more than $340 million. Established in 1935, the not-for-profit cooperative offers a complete line of financial services, as well as auto and home insurance, from its five locations — in Bloomington, Brooklyn Park, Maple Grove, Plymouth and in St. Paul’s Como Park — as well as by phone and online at www.TopLinecu.com. Membership is available to anyone who lives, works, worships, attends school or volunteers in Anoka, Carver, Dakota, Hennepin, Ramsey, Scott or Washington Counties and their immediate family members.