Repos and dollar rolls: Solid choices to manage liquidity

It’s a dilemma many financial institutions face today: how to best manage loan growth while identifying the most beneficial liquidity source.

Throughout the year, the economy has continued a slow recovery, as economic indicators are showing some improvement (although geopolitical forces have proven to be a challenge). Despite the slow recovery, many financial institutions are experiencing an increase in consumer and mortgage loan growth driven primarily by current attractive borrowing rates. In order to increase liquidity, these institutions are faced with a decision to borrow from the Federal Home Loan Bank, sell investments, issue brokered CDs and maybe even securitize assets. It’s important to identify alternative liquidity sources early on and understand how to rank order financeable assets based on haircut and collateral requirements. In order to manage short-term liquidity, financial institutions can interchangeably select among short-term FHLB, reverse repurchase agreements and dollar rolls. The decision will be determined after comparing the explicit/implicit financing rate inherent in each of these short-term liquidity sources.

Repurchase and Reverse Repurchase Agreements

The repo market is one of the largest and most actively traded markets providing short-term credit to many market participants. In the simplest form, a repo is a collateralized borrowing. From the financial institution’s standpoint:

- Repo involves lending cash by receiving securities with an agreement to sell the securities back at a future date, plus interest.

- Reverse repo is borrowing cash by selling securities coupled with the agreement to repurchase same securities at a future date.

Repos have a stated interest rate called the repo rate and the maturity can be as short as one day. In addition, there is a haircut, which can simply be thought of as the loan to value of the trade. The size of the haircut reflects the risk associated with holding the asset, as well as market liquidity.

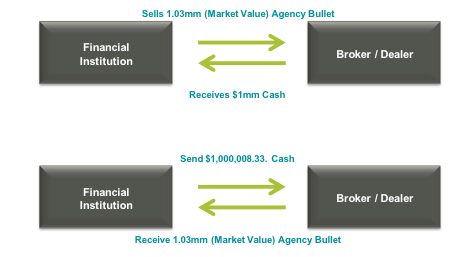

The diagram below demonstrates a reverse repo transaction in which the financial institution borrowed overnight with 0.30 percent repo rate and 3 percent haircut.

Dollar Roll Financing

In order to transact a dollar roll, an investor must own on-the-run current coupon mortgage- backed securities. The dollar roll provides short-term liquidity and can be viewed as simultaneously selling securities with an agreement to purchase “substantially similar” securities in the future at a predetermined price. It’s important to consider stipulations such as maximum weighted average loan age (WALA), maximum purchased CUSIPs, and zero variance in order to assure “substantially similar” securities is satisfied.

Currently, dollar rolls are trading “special,” which means the implied financing rate is below current market rates. Since the Federal Reserve continues large purchases of mortgage bonds, demand for these assets has outpaced the supply. This means it is more expensive to buy and settle some current coupon mortgages; therefore, the investor should defer settlement into the next month’s settlement date.

Since the TBA (To Be Announced) mortgage market is very liquid and transparent, the economics of the dollar roll transaction can be decided by asking yourself:

- Should I settle the mortgage backed security and earn the coupon income, or should I defer settlement into the next month and earn the cash return?

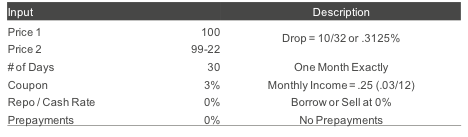

In the simplified example below, the price for the next good day settle for TBA’s is 100 or par. The price for next month’s good day settle is 99-22. The difference between these two prices is called the drop, which would be 10/32 or 0.3125 percent. In the dollar roll transaction, the financial institution is agreeing to sell at price 1 with the agreement to purchase “substantially similar” securities at price 2. If the investor decided to buy mortgage-backed securities and settle them, the investor would earn the monthly income of 0.25 percent. Since this is a simplified example, it is assumed the repo/cash rate is 0 percent and there is no prepayment assumption. The dollar roll is advantageous by 0.0625 percent due to the drop exceeding the coupon income. Therefore, the investor would choose to dollar roll over buying/settling the mortgage securities.

Compare and Contrast

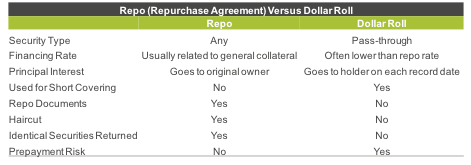

While there are differences to consider when comparing repo funding with dollar roll financing (see chart below), these options provide short-term liquidity in order to support new loan growth. Funding loan growth solely with deposits can result in uncertain funding costs as market rates increase/decrease.

Financial institutions should select the cheapest alternative after considering short-term funding options such as short-term FHLB borrowing, repos/reverse repos and dollar rolls. Doing so can provide the desired flexibility in funding asset growth.