Service culture Is killing credit unions

A key differentiator that credit unions promote is superior customer (member) satisfaction. This is a well-intentioned virtue, but is creating a distraction from what credit unions must have to survive – a sales and service culture.

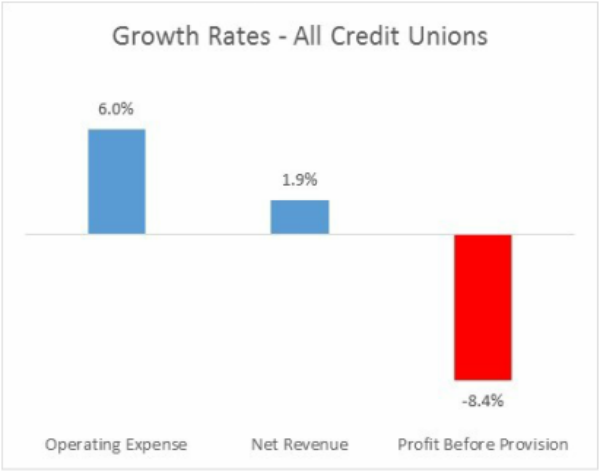

Let me run some numbers by you to show you why sales culture is so important and how credit unions are failing when it comes to revenue and expense.

Using NCUA 5300 data, credit unions that were still in existence at the end of last year invested $33.3 billion in day-to-day operating expense, excluding extraordinary items and assessments. The year before that, it was $31.5 billion. Operating expense increased by 6.0% or $1.8 billion year over year.

Last year, those same credit unions generated $44.6 billion in net revenue as defined by the sum of net interest income and non-interest income. This figure excludes provision for loan loss expense and extraordinary items, so it is a clean measure of routine operating revenue generated by sales activity. The year before that, it was $43.8 billion. Net revenue increased by 1.9% or $0.8 billion year over year.

continue reading »