The bankers are right

by: Henry Meier

If Nixon can go to China, then I can darn well compliment the American Bankers’ Association when it makes a good point. That is what I am doing today. Besides, if the bankers succeed in getting a petition approved the Federal Communications Commission (FCC), credit unions will benefit as well.

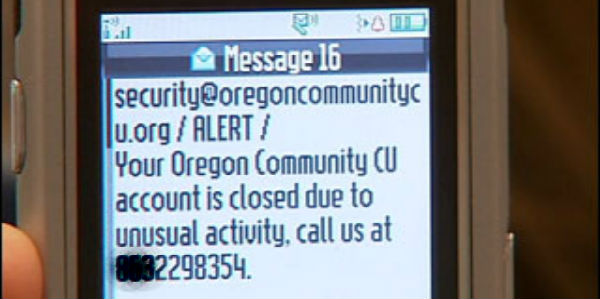

We all know that identity and data theft prevention are all the rage. Suppose that you are approached by a vendor with a great new system that will send out automated voice messages to a member’s cell phone anytime there is an indication that fraudulent activity may be taking place. Given the volume of potential fraud alerts, as well as the speed at which hackers can do their damage, using automated voice messaging and texting is the quickest, most cost effective way of getting the word out. In addition, since the cell phone has become an adult umbilical cord, it makes perfect sense to send the message right to the smart phone, provided that a member has given the number to the financial institution.

However, these services have run up against a compliance speed trap. The Telephone Consumer Protection Act (TCPA) generally prohibits companies from calling cell phones using an automatic dialer telephone system or artificial pre-recorded voice unless the call is “made with the prior consent of the party called.” See 47 USC 227(b)(1).

continue reading »