Top 4 personalization techniques to drive non-interest income at your credit union

If there’s one thing marketers and their clients can agree on, it’s this:

Marketing is harder in the Age of the Consumer.

With a world of information available at their fingertips, consumers are less swayed by a single ad. In fact, shoppers refer to more than 10 sources of information before making a purchase decision.1

But the Age of the Consumer is also the Age of Data. And you can leverage data and technology to cut through the clutter like Don Draper couldn’t even dream of. We’re talking personalization: speaking to one specific person instead of a one-size-fit-all (it never does) ad.

Keep reading to see examples of marketing personalization that drive a lift in non-interest income. But first, let’s understand the context.

“It’s All About Me”

Messages customized for who is viewing them are everywhere. Netflix recommends movies based on what you’ve watched recently. Amazon suggests products based on what pages you’ve viewed. Facebook presents posts that correspond to your tastes and activities.

No wonder your members expect a message to be personally relevant to them. It’s so common that general “for the masses” marketing – especially online – is a knee-jerk trigger for a consumer to move along…nothing to see here.

Great. But how do you personalize your marketing?

For the nuts and bolts, there are a number of inexpensive marketing platforms a credit union can use themselves. Or tap third-party platforms to incorporate it into their offering.

But the real takeaways here are in the tactics.

Name Personalization

Simple merge fields that automatically inject the member’s name are a worthwhile first step.

Even with the rest of the ad the same, personalized emails deliver 6X higher transaction rates.2 Apparently “Dear Jessica,” is enough to get Jessica reading. And adding names to the subject line boosts open rates by 26%.2

But the name game goes both ways. Turns out people like receiving emails from people, not buildings. So don’t send emails from info@MyCreditUnion.com. Adding a name to the “from” field, like debbie@MyCreditUnion.com, moves the needle on opens and clicks too.

Segmentation

The concept is simple…

Don’t send something to people who already have it, or clearly don’t want it.

This conditions the recipient to not open your emails. If what they’ve received is irrelevant, members are likely to assume future correspondences are also irrelevant.

If you’re promoting e-statement enrollment, only send materials to members who aren’t already enrolled. Running a HELOC special? Don’t put it in front of renters. Again, this is only conditioning them to ignore you.

Community

Many companies and brands are having a field day creating a community around their product. In this fashion, the product itself is its own marketing. Genius!

For example, Nike+ Training creates a community among strangers with similar fitness goals and workout favorites. They actively share progress, tips, tricks, and build personal bonds. Oh, and it just so happens to keep Nike apparel front and center of this perfect target audience.

Credit unions have a tougher row at this. To be blunt, folks aren’t typically passionate about checking accounts.

But you do have “community” built into your DNA. Many credit unions are leveraging their debit card rewards program to capitalize on that. “We actually will give you more points to shop at a local establishment as compared to a big-box store,” explains David Seeger, President/CEO, Great Lakes Credit Union.

This creates a community around “buy local.” There are other opportunities out there. It requires knowing what your members truly value, and meeting them there.

Behavior-based Personalization

Behavior targeting, perhaps the holy grail, is akin to Netflix and Amazon suggestions based on each unique visitor’s behavior.

Do this well and you can watch your non-interest income rise.

Let’s look at a few examples where the Age of the Consumer and the Age of Data converge.

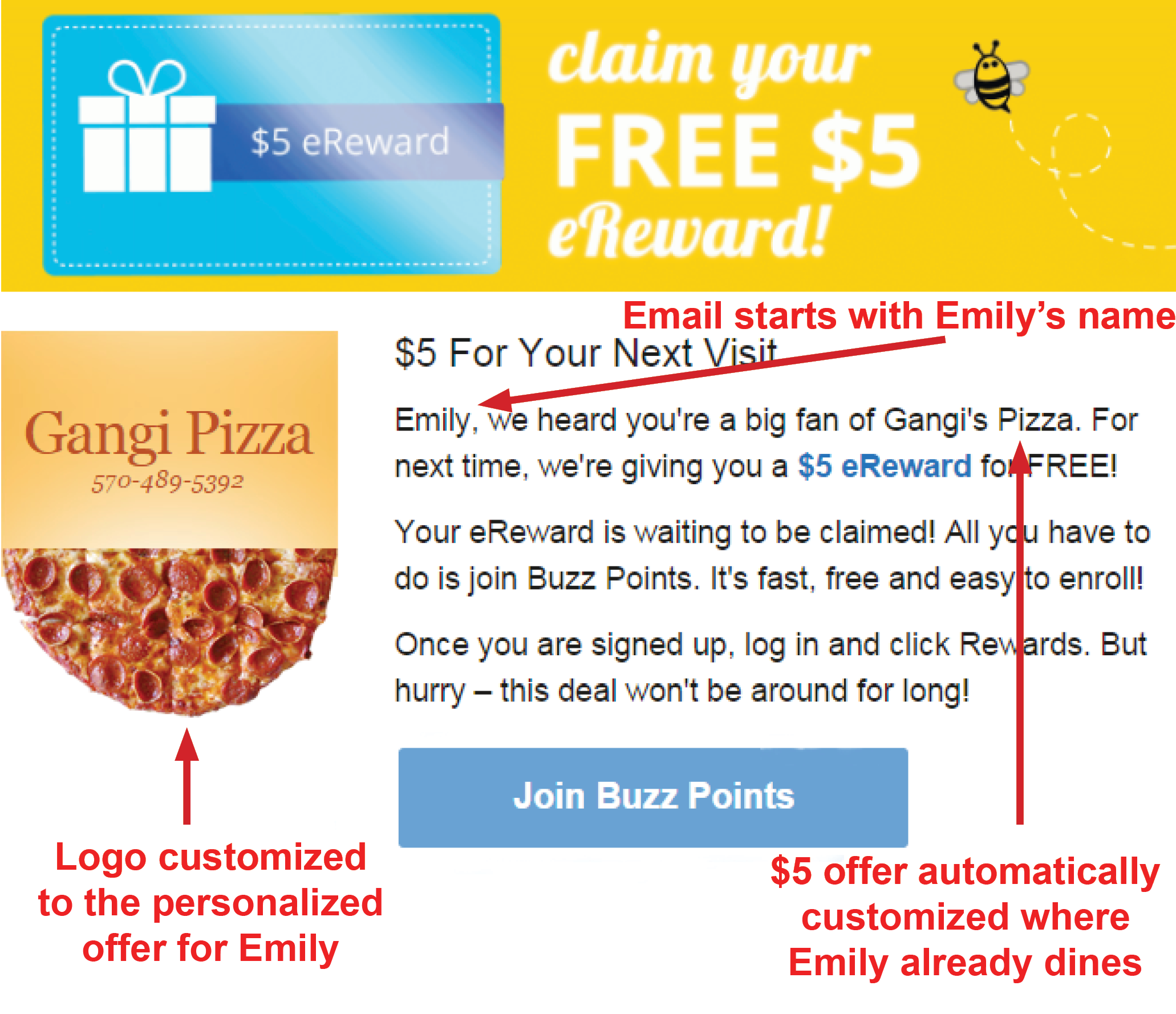

In this campaign, the automated email platform integrates with the credit union’s cardholder transaction data. It turns out, Emily frequents Gangi Pizza regularly. So the email automatically customizes the offer to be a coupon for Gangi Pizza.

This email can be sent to thousands of cardholders at once, each one receiving an offer to a business where they frequently shop!

No surprise, Emily is more likely to open an email with a subject line that includes her name, and her favorite pizza restaurant. All she has to do to get the $5 off is enroll in the free rewards program.

This all boils down to non-interest income.

This behavior-targeted marketing enrolls more members into the rewards program, which in turn is proven to:

- Drives more debit card swipes

- Resulting in more interchange yield per account

- And leads to more loyalty and a lower churn rate

Another example incorporates gamification, which is a fancy marketing term for contest.

Here’s why this email campaign succeeded. First, the challenge is issued to every member by name. Second, the challenge is based on the individual’s existing behavior. Third, the campaign includes periodic updates tracking the individual’s progress.

That’s the recipe.

From there, what the actual game entails is almost limitless. In this case the objective was to use their debit card at least seven more times than their typical average. The member gets bonus points, the credit union nets interchange revenue.

How’d it turn out? 3

- 42% of enrollees succeeded with at least 7 more swipes than their average

- In fact, they actually increased their averages by 22 additional card swipes

- Enrollment in the rewards program was over 60% greater than a typical month – even non-enrollees were motivated by the personalized gamification!

Take Things Personally

There we have it! Four ways to incorporate personalization in your marketing…with a direct correlation to lifting non-interest income. There’s a world of possibilities within these four categories alone.

So go ahead…get personal!

1Google/Shopper Sciences, Zero Moment of Truth Macro Study, U.S., 2011

2Experian Marketing Services, 2013 Email Marketing Study

3Buzz Points analytics, 2015