Trends of the mobile member

Targeting the mobile member

What is Mobile?

It was less than two decades ago that being “mobile” meant you could move around easily. Today, the term takes on a whole new meaning. Mobile devices such as smartphones and tablets have enabled people to conduct daily tasks while on the move. In tandem with this trend, mobile banking has gained momentum and is becoming a new norm for consumers. According to the Federal Reserve’s Board of Governors, mobile banking refers to “Services that allow consumers to obtain financial account information, conduct transactions with their financial institution, and allow consumers to make payments, transfer money, or pay for goods and services.” Within this definition, mobile banking includes everything from depositing a check by taking a photo from your smartphone to paying for a sweater at Macy’s by using your phone as a wallet.

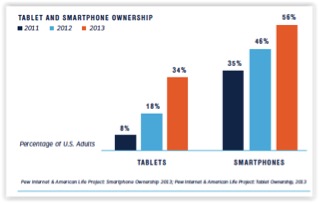

Adapting to the mobile world is crucial for the continued success of credit unions. While some credit unions have adopted a mobile strategy, many still lag behind when it comes to embracing this technology. With upward sales of smartphones and tablets over the past several years, as well as an increase in mobile banking usage, credit unions need to adapt to new user behaviors and evolving technologies.

Consumers live in a society of instant gratification and demand information from their mobile device 24/7. The cell phone has become such a gravitational tug on our attention that 67% of cellphone owners find themselves frequently monitoring their phone for messages, alerts or calls — even when they don’t notice their phone ringing or vibrating. Data from the Kleiner Perkins Caufield & Byers Internet Trends report shows that smartphone users check their phones at least 150 times a day, which averages about 15 times an hour. Since mobile devices have become the “remote controls” for our lives, it’s vital for credit unions to become a part of those experiences in order to stay relevant with members. According to Pew Research:

- 90% of all Americans own cell phones

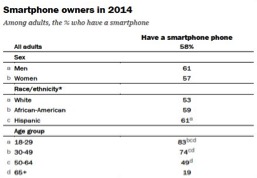

- 58% of American adults own a smartphone

- 42% own a tablet

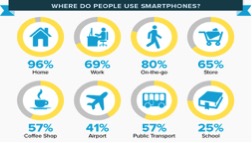

And consumers are interacting with their devices everywhere. The Onbile Group table indicates where people use their mobile device:

Who Is Mobile?

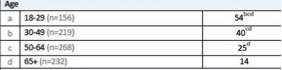

Mobile device usage is not just limited to one particular demographic, as noted in the Pew graphic below. However, reaching mobile user communities are imperative for long term credit union success, since 83% of adults aged 18-29 and 74% of adults aged 30-49 own smartphones. 50% of mobile consumers use mobile as their primary Internet access, while 80% of mobile time is spent in apps. With that in mind, it’s no surprise that mobile Web adoption is growing eight times faster than Web adoption through a PC or laptop. Financial institutions, and credit unions in particular, must take advantage of the upward trend in mobile usage to continue to build membership, which in turn, will build member loyalty.

It’s become apparent that making phone calls is no longer the primary use for a mobile device. Consumers now use their mobile device for virtually every task related to their daily activities, including mobile banking. 48% of smartphone owners have used mobile banking in the past 12 months, up from 42% in 2011. The most common use of mobile banking is to check balances or recent transactions (87%), followed by mobile bill payment (42%).

Data from a Nielson study conducted in November 2013 reveals, “82% of U.S. consumers have entered the digital arena, [and have] banked online at least once in the last 30 days … staying abreast of consumer banking preference will help maintain loyalty, engage new customers and serve consumers wherever they want to bank.” But while your members are moving to mobile, it doesn’t mean they are leaving the branch behind. Mobile consumers prefer checking their account balances or making deposits using their smartphones or tablets, but still prefer to seek investment advice in the branch.

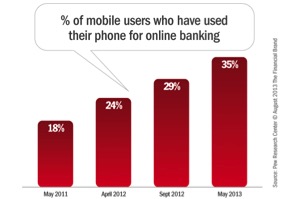

When we think of the typical smartphone user we tend to think in terms of Millennials (ages 18-34) or younger. But in reality, for credit unions to grow and retain membership they must make a concerted effort to include all age groups when devising a mobile strategy. Younger adults (ages 18-29) currently lead the mobile banking trend. Adults between the ages of 18 to 34 are driving the growth in both online and mobile banking. 35% of cell phone owners bank using their mobile phones. Millennials have become the target market for many credit unions, and these statistics illustrate how mobile is a logical avenue to reach them. Furthermore, if credit unions desire to be at the forefront of technology and member experience, the adoption of evolving technology is essential. As Nessa Feddis, American Bankers Association senior counsel and retail banking expert states, “…results show customers are embracing new technologies that make managing a bank account simpler, easier and more convenient…”

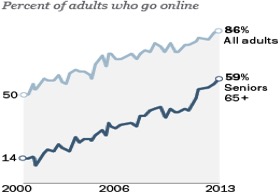

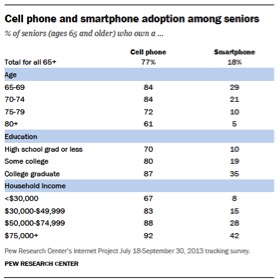

Adults over 50 comprise nearly 40% of the mobile banking community and over three quarters have bank accounts, according to the FDIC.[11] Convenience and ease-of-use are part of their reason to go mobile as well. Today, 59% of seniors (defined as those ages 65 or older) report that they use the Internet—a six-percentage point increase over the course of a year. In fact, recent trends have demonstrated upward usage of mobile among older generations.

Recently released data from Pew Research Center confirms that there are actually two different groups of seniors:

- Group 1:

o Represents younger, more highly educated or more affluent seniors

o Possesses relatively substantial technology assets

o Has positive view toward the benefits of online platforms

- Group 2:

o Older and less affluent, often with significant challenges with health or disability

o Largely disconnected from the world of digital tools and services

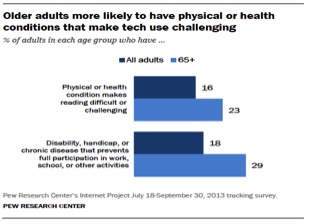

It is important for credit unions to consider this demographic when launching mobile platforms, since online adoption is growing among this group. Seniors remarked that they encounter several challenges to becoming more tech-savvy:

- Skeptical attitudes about the benefits of technology – many seniors are simply unaware of the convenience that newer technology provides

- Difficulties learning to use new technologies:

- A significant majority of older adults say they need assistance when it comes to using new digital devices

- o 77% indicate they would need someone to help walk them through the process

- Physical challenges to using technology. Two in five seniors indicate that they have a “physical or health condition that makes reading difficult or challenging”

To counter this challenge, credit unions can invite all demographics into their mobile banking channel through education such as conducting mobile banking seminars, providing step-by-step instructions within the app or on a brochure, or utilizing ad-hoc coaching and demonstrations when members come to the branch to transact. Being proactive and making mobile banking easy and enjoyable will clear any member misconceptions about mobile banking being difficult. Remember that a credit union’s mobile message is all about convenience to members and being an alternative to the branch for some transactions will appeal to members of all ages.

How to Reach the Mobile Community

Now that the “what” and “who” of mobile have been established, the question remains of “how” to market to mobile users. Matt Wilcox, managing director of marketing strategy and innovation at Fiserv, states, “Development of new mobile capabilities will attract new digitally-oriented consumers to retail financial institutions. A commitment to innovation on behalf of the consumers’ needs and preferences is required to build the financial services franchise of the future.”

Terry Redding, vice president of marketing at CFI Group, an Ann Arbor, Michigan-based research firm that studies consumer sentiment, states that credit unions can do better when it comes to promoting non-branch channels for consumers. “Credit unions have been slow to jump on the bandwagon to aggressively promote their online and mobile offerings,” Redding says. “This applies to both recruiting new members and promoting the features and benefits to their existing members.”

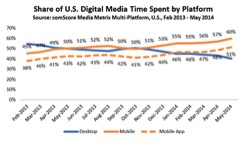

2014 marks a milestone in Internet usage, as mobile Internet usage now surpasses desktop usage. As a result, the potential for mobile marketing seems endless with financial institutions embracing mobile banking, mobile payments and the mobile wallet concept. Mapa Research analyzed 35 institutions in ten countries and discovered three main ways in which credit unions and banks are reaching their mobile members/customers:

- Implementing mobile optimized, adaptive or responsive sites to welcome mobile shoppers

- Selling within the mobile banking app pre-login

- Selling within the mobile banking app post-login

These findings bring one vital mobile marketing element to the forefront – responsive website design. Since a poor user experience can alienate even the most loyal member, incorporating a website design that will automatically format to the device type of the user will enable your credit union can provide an exceptional customer experience to every user, every time.

With the shift to mobile Internet usage comes a shift in mobile ad spending. eMarketer projects that mobile ad spending for both smartphones and tablets will increase 83% to nearly $18 billion in 2014. Facebook will follow suit with 50% of the social media giant’s revenue coming from mobile ads next year. Google is projecting mobile ads will count for $4 billion of its revenue in 2015.

For credit unions, this can mean a seismic shift in marketing strategy. A recent study from Aite Group and The Financial Brand[18] identified marketing priorities for 233 credit unions and banks in 2014, as revealed by senior marketing executives. 78% of respondents stated online advertising was a top priority, closely followed by mobile advertising at 71%.

Mobile advertising is the ideal way to reach an audience when cross-selling your credit union’s products and services. Whether you advertise to potential customers through a mobile-friendly website, or whether you choose to use a landing page to advertise to members before or after user login, it’s imperative to include your mobile members within your marketing strategy.

Contributing Author Amy Neale, Content Marketing Manager

References:

- Consumers and Mobile Financial Services 2013. March 2013 http://www.federalreserve.gov/econresdata/consumers-and-mobile-financial-services-report-201303.pdf

- Pew Internet & American Life Project: Smartphone and Tablet Ownership, 2013. http://www.pewinternet.org/2013/06/05/smartphone-ownership-2013/

- Pew Research Internet Project. “Mobile Technology Fact Sheet”. January 2014 http://www.pewinternet.org/fact-sheets/mobile-technology-fact-sheet/

- Onbile Group. “Where Do People Use Their Smartphone?” October 2012 http://www.onbile.com/info/where-do-people-use-their-smartphones/

- Digital Buzz. Infographic: 2013 Mobile Growth Statistics http://www.digitalbuzzblog.com/infographic-2013-mobile-growth-statistics/

- Nielsen. “The Evolution of Modern Banking.” March 2014 http://www.nielsen.com/us/en/newswire/2014/the-evolution-of-modern-banking.html

- American Bankers Association Survey: Popularity of Mobile Banking Jumps. October 2012 http://www.aba.com/Press/Pages/100912PreferredBankingMethods.aspx

- Pew Research Internet Project. “Older Adults and Technology Use.” April 2014 http://www.pewinternet.org/2014/04/03/older-adults-and-technology-use/

- The Financial Brand. “Online/Mobile Banking Adoption Trends & Demographic Profiles.” August 2013. https://thefinancialbrand.com/32428/pew-research-online-banking-users-demographic-trends/

- Pew Research Internet Project. “Attitudes, Impacts, and Barriers to Adoption.” April 2014 http://www.pewinternet.org/2014/04/03/attitudes-impacts-and-barriers-to-adoption/

- The Financial Brand. “8 Critical Digital Marketing Skills for Banks and Credit unions.” April 2014 http://thefinancialbrand.com/38429/8-critical-digital-skills-for-financial-marketers/

- The Financial Brand. “Mobile Channels Are Turning Financial Marketing Upside Down.” September 2013 http://thefinancialbrand.com/33760/marketing-banking-services-in-mobile-channels/

- FoxBusiness.com. “6 Myths About Joining Credit Unions”. March, 2014 http://www.foxbusiness.com/personal-finance/2014/03/03/6-myths-about-joining-credit-unions/

- comScore. “Major Mobile Milestones in May.” May 2014

http://www.comscore.com/Insights/Blog/Major-Mobile-Milestones-in-May-Apps-Now-Drive-Half-of-All-Time-Spent-on-Digital - eMarketer. “Total US Ad Spending to See Largest Increase Since 2004.” July 2014 http://www.emarketer.com/Article/Total-US-Ad-Spending-See-Largest-Increase-Since-2004/1010982

- The Financial Brand. “Bank and Credit Union Marketing Trends, 2014.” March 2014

http://thefinancialbrand.com/35713/2014-digital-marketing-trends-in-banking/