3 analytics habits of highly successful credit unions

What sets the fastest-growing credit unions apart from the rest? Increasingly, the answer lies in how they use their data. These institutions know that integrated member insights are a necessary first step for better timed and targeted offers, more personal communication, and better service overall.

Here are 3 ways top credit unions leverage their goldmine of member data. Integrate these habits into your approach to sales, marketing, and service, and you’ll be on the fast track to data-driven success as well.

1. Make every offer a targeted offer

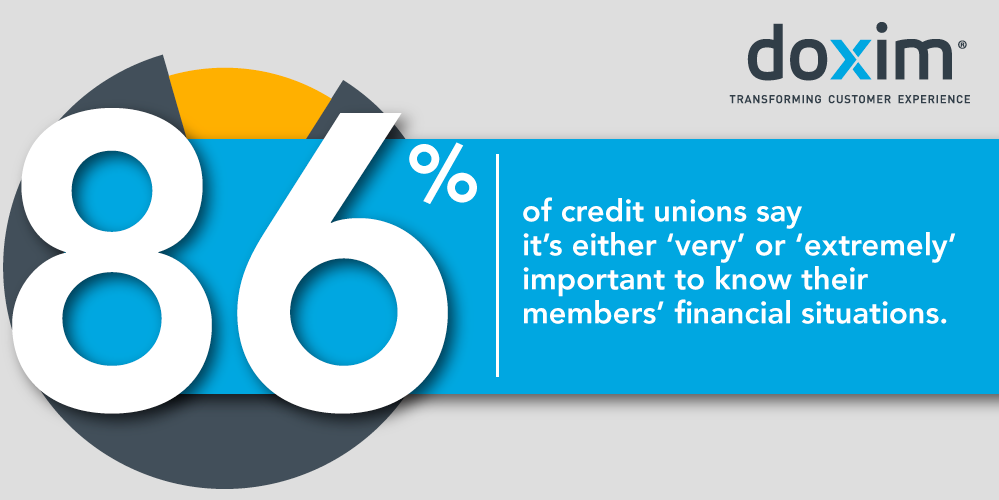

According to the Digital Banking Report, 86% of credit unions say it’s either ‘very’ or ‘extremely’ important to know their members’ financial situations. And credit unions are also blessed with a rich trove of member data. But not every credit union takes advantage of that data. Many still adhere to product-centric selling strategies.

So, how to pull ahead of the pack? Move towards using analytics for insight-driven marketing, and away from the “one-size-fits-all” approach.Start your shift towards relationship-based selling by analyzing your data to identify members with upcoming life events (like a mortgage renewal, or a college-bound child). Then send them a personalized offer through their preferred channel, at exactly the right moment. You will see much higher response rates, and also boost the sense of emotional connection between credit union and member.

Then, going forward, consider adding sources of third-party data to your analytics mix to increase your understanding of your members. If you pick the right business analytics tool upfront, you’ll be able to integrate these additional sources effortlessly into your analytics practice. And having a broader set of data will also help you when it’s time to consider incorporating AI into your tech stack.

2. Take every opportunity to communicate your value

Today’s members are bombarded with content and offers, which means it’s easy for your brand to get lost in the mix. But the solution isn’t to give up – in fact, you need to be communicating more often than ever before, to cut through the noise.

But here’s the hitch; for your content to grab a member’s attention, it needs to be hyper-personal and timely. And for your content to hit the personalization “sweet spot,” you’ll need to use analytics to segment your target audience very precisely, and not solely on their demographics. Think about behavioral signals, financial well-being indicators, propensity to buy and invest, and other very unique traits you can glean from the rich data you have or can get access to with the right tools.

Communications that make your brand top of mind need to go beyond marketing offers as well. Credit unions can use outbound communications to create stronger relationships by reaching out to members about the following topics:

- Notifications about reduced or holiday hours at the member’s preferred branch

- Invitations to financial literacy seminars or online webinars

- Retention offers for members displaying churn behaviours

- Charitable events within the members’ community

- Transactional notifications about low balances, cleared checks, etc.

- Local networking opportunities for small business clients

- Events for members’ children, if analytics indicate they have them

An email marketing platform that integrates with your analytics solution to automatically can help you increase the cadence of member communications without increasing your costs or taking up too many marketer hours. Trigger-based emails can be sent based on changes in member data, arriving in the member’s inbox at precisely the right moment.

As a complement to these targeted outbound communications, be sure your website lives up to your personalization promise. Analytics can be used to inform the content and offers a member sees there, based on their current relationship to the credit union, location, demographics, and browsing history.

3. Make every service interaction effortless

One of the major moments of truth for any credit union occurs when a member has a service inquiry or complaint. In fact, one in five customers who switch banks says they did so because of a bad service experience.

Here too, analytics-driven credit unions have the upper hand when it comes to member retention. With business analytics and CRM in place, these institutions put all necessary data at their MSR’s fingertips, making it simple to resolve issues during the first call or interaction. One of our clients uses the shorthand “the member only has to tell their story once” to describe this commitment to efficient service.

Once the service interaction is complete, insight-focused credit unions are careful to close the loop by soliciting feedback from the member, and using that feedback to improve member service processes. They can do so without increasing operational burden by surveying members through email using a proven approach like Net Promoter Scoring, and feeding the results back into their database for analysis. This evergreen process allows them to take an agile approach to service improvement, modifying parts of the process that are called out as needing improvement, and watching the effect on CSAT scores.

Know your Members Like the Back of Your Hand

What do all the insight-driven habits above have in common? Every one demonstrates that your credit union really knows and respects its members, and uses data effectively to help them succeed. These are the differentiators that are probably already reflected in your credit union’s mission statement. But making sure you live up to them in today’s digital world means approaching them in a fresh way.

Today, the information you need to be member-focused and insight-driven is all contained in your data, waiting to be acted on with business analytics. By extracting insights from your data, and then acting on them in a timely fashion, you’ll be able to emulate the habits of your most successful peers, who have already made the transition to data-driven, hyper-personal relationship banking.

Ready to get started with contextual, relationship-based selling? Here’s one simple example of how to use your data to promote products to members who need them. Read this eBook to learn how to accelerate your mortgage and HELOC loan growth.