3 tips for executing a digital strategy to support changing member expectations

Today’s credit union members have very different expectations of your credit union than their predecessors. They are pressed for time, tech-focused, and expect a fast, personal experience through their preferred channel at their convenience.

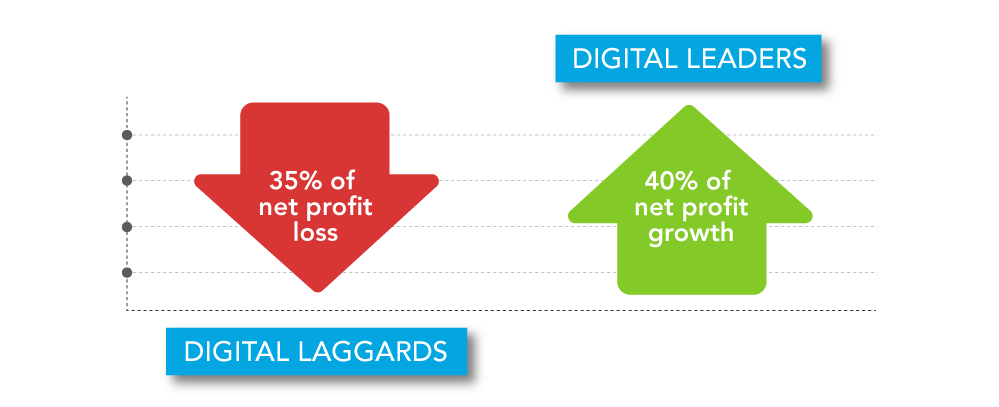

The cost of not responding to this sea change in expectations is very high, with McKinsey & Company predicting that that digital laggards could see up to 35% of net profit eroded, while digital leaders may see a profit upside of 40% or more. But the question of how to approach digital strategy execution is a complex one, and credit unions aren’t always certain of where to begin this multifaceted process.

Recently, I spoke with 2 digitally-savvy credit unions about their successful digital strategies. Here are 3 key practical tips they shared on how to plan and execute a simple, staged program for digital transformation:

1. Balance your approach to physical and digital channels

Your members, especially your younger members, are adopting digital self-service tools at an astounding rate. In fact, IBM suggests that 75% of Millennials now prefer self-serve options as a first step. But physical channels still play a key role in your credit union’s success. Your younger members are likely to turn to these channels when making complex financial decisions, like choosing a mortgage or planning their retirement. And, of course, many older members still prefer to conduct daily banking in-branch, and you don’t want to alienate them.

A balanced approach to “being all things to all people” will include selecting technology that works across all channels. That way, you can use the same technology stack to extend personal offers online to younger members and to provide essential data instantly to staff serving members at your branch. Our clients also observe that taking the time to walk new members through using your digital tools during onboarding goes a long way towards encouraging adoption.

2. Focus on speed and ease of use

If you want your digital channels to be adopted by the broadest possible segment of your member base, you’ll also need to focus on simplicity of design and an intuitive user interface. As Jay Reed, CCE and CIO of Service 1st Federal Credit Union told us during a recent webinar, “the bottom line is, your tool doesn’t have to be the most feature-rich… it has to be easy to use.”

Rather than trying to build out digital solutions that accommodate every possible use case, use an agile approach to focus on delivering the fast, convenient, and seamless experiences your members are seeking most often. For example, you might automate account opening for your most popular checking and savings accounts first. You can grow from there by gathering feedback on how members are actually using the technology you have implemented, and what they want next.

3. Collaborate effectively and reduce vendor headcount

With the expanding complexity of your omnichannel strategy comes an ever-expanding roster of vendors supporting your credit union. Proactive vendor management becomes necessary to ensure your institution, and your valued members, are getting the service they need.

“It’s hard to find those vendors who react to you the way that you react to your customers or members,” says Jay Reed of Service 1st FCU, “but you can do it with better management of your vendors.”

Managing vendor relationships starts during the RFP process. Being sure the vendors you select have experience in the credit union ecosystem can save you headaches down the line. You can also mitigate your risks by choosing vendors who have a proactive approach to customer success, and use proven customer satisfaction tracking methodologies like NPS scoring.

And finally, consider consolidating your vendor relationships by choosing a single service provider for as many of your digitization projects as possible. The benefits of consolidation can include cost savings, a single point of contact for service integrations, and pre-built integrations between your solutions (so, for example, your CRM can feed leads to your email marketing software automatically).

A Digital Strategy for the Future

One final thing the tech-savvy credit unions we partner with have in common is that they understand that their digital strategy is always a work in progress, because it has to evolve to meet the changing needs of their members. To understand what’s next, their leaders take the time to monitor not only what’s new in credit union technology, but also what’s happening in other industries, like retail.

These industries are often the bellwether of change in consumer expectations, so keeping a close eye on their evolution is a good way to figure out how to keep your credit union ahead of the curve on member engagement management.

Do you want a more in-depth look at how the two credit unions I interviewed created and executed on their digital plans using many of the strategies outlined above? Watch members of their leadership teams talk about their digitization journeys here.