Starbucks will let you pay for your Caramel Macchiato with it. Whole Foods is happy to accept it for that deli container of buckwheat pilaf. And Microsoft—a corporate granddaddy in the space— embraced it for some digital payments way back in 2014.

The “it” in question? Cryptocurrency.

Cryptocurrency has shed much of its reputation as the currency of choice for black marketers and users of the dark web, but it has yet to gain a lot of traction in the credit union space. If your credit union is crypto-curious, these five questions are a good place to start:

- How is cryptocurrency impacting the financial services industry?

Most of us know that crypto “coins” are essentially digital files stored in digital wallets. People can hold onto a coin or use it—or a portion of it—to buy things from anyone who accepts it as a form of currency.

When these transactions happen, they’re logged into the blockchain, which is a database that monitors all cryptocurrency transactions. The blockchain ledger gives all blockchain users collective control over the currency and ensures the validity of all cryptocurrency transactions. There’s no government overseeing the process, every blockchain user can view the blockchain and once a transaction is entered into the blockchain, it’s permanently recorded.

But in addition to understanding what cryptocurrency is, it’s helpful to understand what it’s not. I liked this definition from Caroline Willard, president and CEO of Cornerstone League:

“First, let’s talk about what cryptocurrency is not. It is not traditional fiat currency. There is no checkbook for consumers to carry around and no debit card to swipe at the store. As a digital asset that can be transferred without the assistance of a financial institution, cryptocurrency’s almost ethereal existence, thus far, can be described as invisible or even mythological.

But it’s definitely real.”

While many articles focus on the rags to riches stories of a few lucky investors, the real story here is that cryptocurrency offers people a way to move money around without relying on a third party. To that end, cryptocurrency investors may enjoy more data privacy and be less vulnerable to hacks and fraud.

- What are the risks involved in cryptocurrency?

For individual investors, volatility certainly tops the list. Bitcoin—the most well-known cryptocurrency— skyrocketed to nearly $65,000 in April, only to lose nearly half its value by May. It will have to become stable before it can become a viable, widely used form of currency.

And although cryptocurrency is often touted as far less vulnerable to hacks and fraud than more traditional financial assets, the owner must use a digital “key” to prove ownership and access the assets. If the key is lost or stolen, that could mean a complete loss of assets (here’s a not-so-funny story on that). Plus, Tata Consultancy Services (TCS) points out that many cryptocurrency exchanges are unregulated and run by tech startups with little experience in risk management.

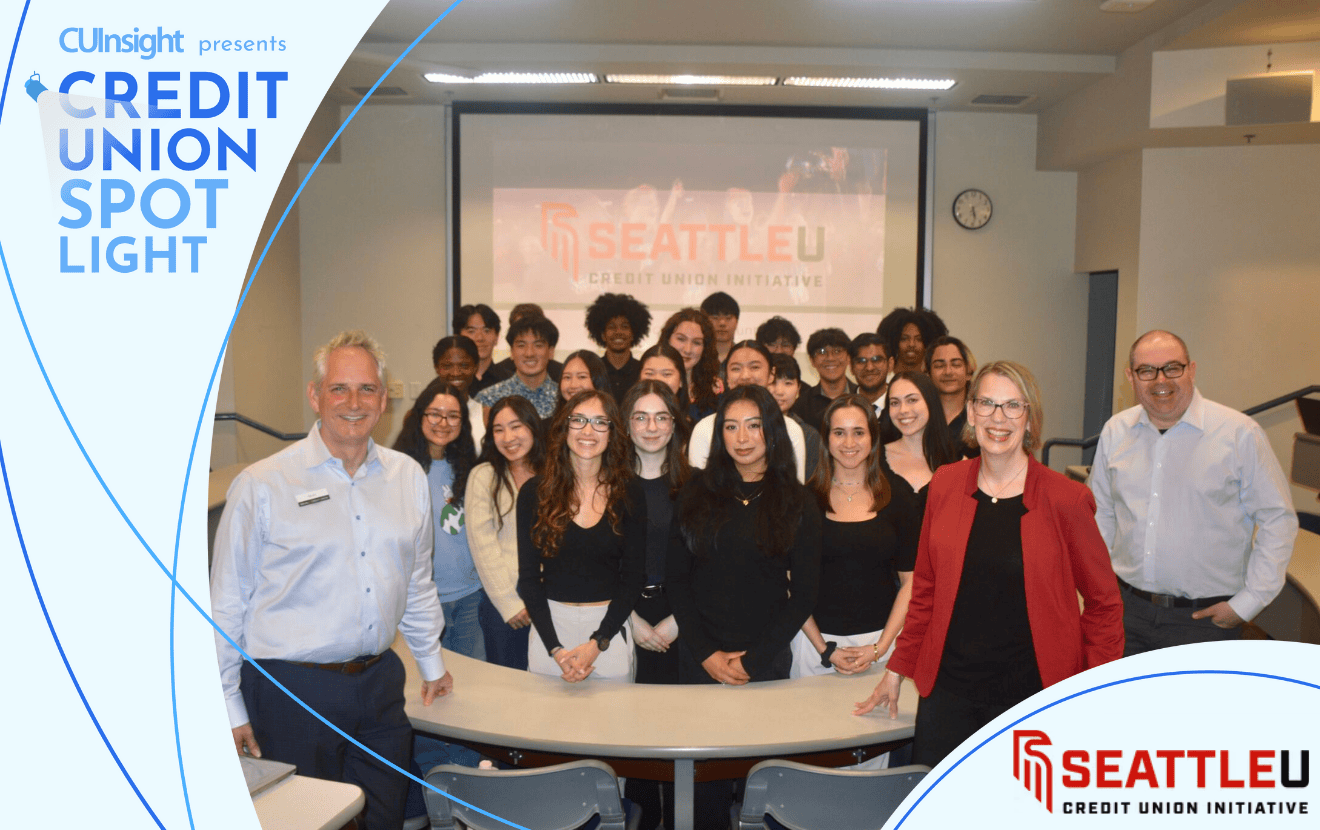

For credit unions, regulation is, of course, the elephant in the room, and the state of regulation is decidedly unsettled at present. From July to October of this year, the National Credit Union Association (NCUA) shared a Request for Information and Comment to seek input from credit unions about “current and potential uses [for digital currencies] in the credit union system, and the risks associated with them.” Many credit unions shared concerns about compliance management.

Credit unions aren’t the only ones debating the risks. As of August 2021, 18 bills had been introduced to Congress related to cryptocurrency and blockchain.

- What do credit unions risk by not exploring cryptocurrency?

Considering the risks, not opting into cryptocurrency might seem like the smart choice, but it could mean your credit union will miss critical opportunities to meet member needs.

In a December 2020 consumer survey from Cornerstone Advisors cited by Forbes, nearly two-thirds of cryptocurrency owners would use their banks for their cryptocurrency investments—but only 2% of banks showed an interest in handling these currencies. There’s evidence that’s starting to change—just Google “banks that offer cryptocurrency.”

According to the Financial Brand, the 2021 State of U.S. Crypto Report from Gemini, a cryptocurrency company, found that roughly 14% of the U.S. population — or 21.2 million adults—already own some form of cryptocurrency. They found the average crypto owner to be male, 38 years old and with an annual income of about $111,000, though when it came to the “crypto-curious” (those who were interested but didn't yet own), 53% were female.

Other payment resources have already made inroads in this space. For instance, PayPal added Bitcoin and Ethereum (another popular cryptocurrency) to its wallet app in 2020, which means PayPal’s customers can buy, sell and pay for retail purchases with cryptocurrencies held through PayPal. Plus, PayPal offers the same fraud protections for cryptocurrencies as it does for other transactions.

In the not-too-distant future, not being able to accept and use cryptocurrencies through your credit union could hurt your ability to attract and retain members. Plus, credit unions’ entry into this marketplace could be a way to ensure members have access to safer cryptocurrency options.

- Where should a crypto-curious credit union start?

Offer cryptocurrency trading through an external provider. Want to give your members a way to buy and spend bitcoin within their existing accounts without facing onerous regulatory requirements? Work with a third party.

According to Forbes, banks and credit unions will be able to give consumers access to cryptocurrency through a deal between NCR, an enterprise payments company, and NYDIG, a digital-asset management firm. Consumers will be able to buy, sell and trade Bitcoin and other currencies through a mobile app. From the consumer perspective, these transactions will appear to take place through their financial institution—just one more service option. The reality: Nydig holds the actual cryptocurrency assets, and the attendant risk.

The Wall Street Journal recently reported that Mastercard and crypto firm Bakkt have partnered to enable cryptocurrency card payments, meaning that financial institutions “that issue cards through Mastercard will be able to issue cryptocurrency debit or credit cards that let people make payments and earn rewards in bitcoin.”

The risk for your credit union in these scenarios is largely reputational. If the value drops, a member might logically know your credit union had nothing to do with it, but they may still associate your name with their loss of holdings.

On the other hand, think back to that Cornerstone Advisor stat—that nearly two-thirds of cryptocurrency owners would like to work through their financial institution. Learning what percentage of your members either already own or are interested in holding cryptocurrency could be a valuable nugget of information to inform your way forward.

Provide crypto custody services. According to TCS, there are a wide range of services that can fall into the category of “crypto custody services”: Safekeeping, analytics, asset servicing, lending , pricing and valuation, trading, payments and settlements and collateral.

For credit unions that want to make a limited foray into crypto services, safekeeping services could be a good place to start. In this role, your credit union provides the crypto “vault” that’s used to safeguard the numeric key a member needs to access their cryptocurrency funds. Considering that there’s typically no way to access the funds without this key, this is a critical service. The risk, of course, lies in your credit union’s ability to safeguard the vault. Like any digital transaction, this will come down to strong digital security.

- What opportunities in the space are unique to credit unions?

Credit unions are sensitive to being perceived as behind the technology curve compared to big banks and fintechs. Cryptocurrency could offer an opportunity for credit unions to position themselves as a savvy partner members can rely on for the latest in financial services and tools.

And, credit unions that offer currency exchange services will help members access a service they want in a way that’s safer than many alternatives—which could have long-term benefits for your credit union.

Perhaps most importantly, credit unions are always looking for better ways to meet the needs of the unbanked and underbanked. Financial inclusion is one of the big benefits of cryptocurrency: It democratizes money and gives the unbanked and underbanked an affordable way to access funds.

Another important member segment that could benefit from remittances: immigrants. If your credit union counts a large number of immigrants among its membership, you’re likely always on the lookout for better ways to offer remittance services. Cryptocurrency has been suggested as an option—especially after El Salvador’s June 2021 decision to accept Bitcoin as legal tender.

It could be a fast, secure and less expensive way for immigrants to send money home—and certainly worth further discussion. As outlined in this overview from the FintechTimes, the pros are at least somewhat offset by the cons—the need for technical knowledge and familiarity with currency options and available exchange platforms, the potential for loss with two money conversions during the process and the importance of accuracy, given that transactions can’t be reversed and consumer acceptance might be limited. We’re not there yet, but the day may not be far off when immigrants can bypass Western Union altogether — and save a significant amount of money in the process.

Ultimately, it’s probably worth a question or two in your next member survey to gauge your membership’s interest in and appetite for cryptocurrency. At the very least, a webinar or workshop might be helpful for your members, many of whom are probably just as confused and curious as you are.

As we’ve become overwhelmed with articles about making (or losing) insane amounts of money, we do have to look harder to find the “real story” of cryptocurrency, which is more about improving access, privacy, and security — themes that are relevant to your members and anyone who cares about their financial wellness.