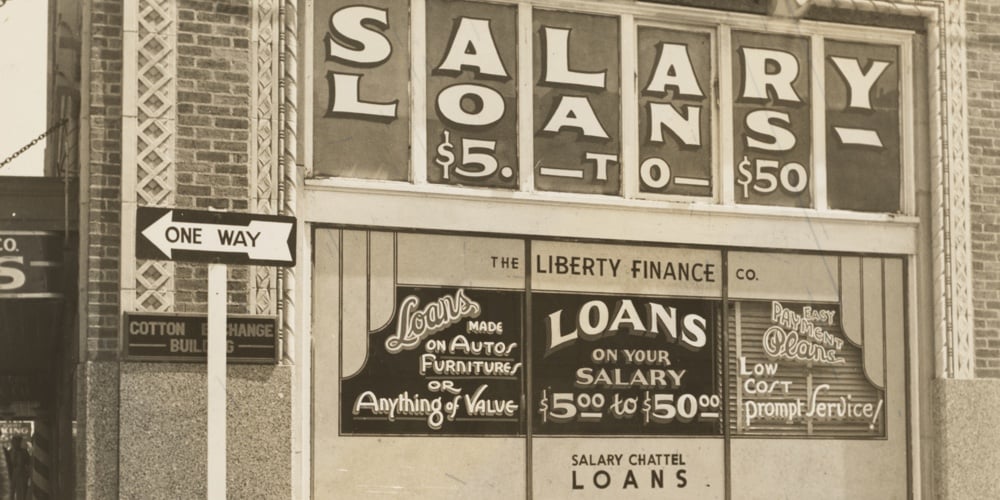

Are NSF fees a thing of the past?

I just read an article about UW Credit Union in Madison, WI reducing their NSF fee by more than 80% to just $5 per occurrence. I think that’s less than we charged in the ‘80s when share draft accounts were in their infancy. This comes on the heels of Ally Bank announcing they are eliminating overdraft fees.

Why is This Happening?

According to the Ally article, “Ninety-five percent of the consumers who paid $12.4 billion in overdraft fees in 2020 were ‘financially vulnerable’ and disproportionately Black and Latino.

UW Credit Union President and CEO Paul Kundert said, “Everyone comes up short sometimes, from a student managing their first bank account to families who lose track of their current balance. Our goal for all members is to help them accumulate wealth, not erode it.”

The History of Credit Union Share Draft Accounts (checking accounts)

According to a Washington Post article dated December 24, 1980, “Share drafts were begun back in 1974. Two of the first credit unions to introduce them were those in Dearborn, Mich., home of Ford Motor Co., and Travis Air Force Base. Pilot programs soon were approved for a number of credit unions across the country. Commercial banks sued to stop credit unions from paying interest on checking accounts or share drafts, but the courts bucked the issue to Congress.” That’s right, credit unions paid dividends on checking account balances. The article goes on to say:

“Nearly half of the 33 respondents (surveyed) said they plan to or already do offer share drafts packaged with other services. The most frequently mentioned were savings accounts and overdraft protection.”

And that’s exactly what we did in the ‘80’s. When a member came in to open a share draft account, we first would get their permission to pull from savings in the case of an overdraft and then would try and qualify them for a $500.00 overdraft protection line of credit. That signature loan not only protected them from returned checks and NSF fees, it helped them establish a credit history. Rarely did a member not qualify or not see the wisdom in this protection.

I learned today that processing a small dollar loan, such as an overdraft line of credit, costs as much to originate and close as larger loans; on average $113.81, according to Kohl analysis. That does make them cost prohibitive, which is why many credit unions stopped this practice.

Enter Courtesy Pay

According to an article on Cushion.ai dated January 15, 2021, “Courtesy pay is credit unions’ form of standard overdraft protection., According to Cushion’s analysis, the average courtesy pay fee costs $27.30, most often running $25, $29, or $30 per overdraft charge. Courtesy pay fees charged by credit unions are slightly lower than overdraft fees charged by banks, which hover around $35. In general, credit union fees tend to be lower than bank fees.”

In August of 2018, Senator Cory A. Booker wrote a report titled “An Analysis of Bank Overdraft Fees.” He tells this story of a single mom and the impact of NSF fees:

I remember a time when I was working at JC Penney’s but struggling to cover rent and groceries. I got hit with two overdraft fees, $60 or $70 in total in one week. I am a responsible adult but did not understand why these fees would accumulate. I may have been off 15 cents or a bill came in early. So, the banks became who I worked for. At one point I ended up making cloth diapers for my children out of t-shirts and an old sweater for liners, not because I wanted to but because I had no choice. It felt like the banks legally stole my money.

The Consumer Financial Protection Bureau (CFPB) found that nearly 80% of overdraft-related fees are borne by only 9% of accounts, who tend to carry low balances—averaging less than $350—and have relatively low monthly deposits. For one group of hard-hit consumers, the median number of overdraft fees was 37, nearly $1,300 annually.

A Credit Union’s Solution for Financial Inclusion

On July 16, 2021, Finopotamus announced the winners of the 2021 Tekkie Awards. Northwest Community Credit Union in Eugene, OR won for the category of Data Analytics.

In most instances, a credit score below 650 severely limits a person’s ability to borrow money at a reasonable interest rate. So, in an effort to ensure all of its 107,000-plus members had accessibility to fair small dollar loans, especially during the pandemic, Northwest Community Credit Union partnered with QCash Financial.

“Our credit union is a “Low Income Designated Credit Union”’ in Oregon with a high portion of membership from low-income households,” said Northwest Community Credit Union’s CFO Qing Lu. “Our analysis during 2017, based on our member transactions, identified a group of a couple of thousand members regularly making payments to external payday lenders and obviously exploited by extremely high interest rates. Using data analytics, Northwest Community Credit Union was able to specifically target those members who were most in need of the product, and offer them the financial relief they needed to help bridge potential income gaps,” said Lu.

“The member experience is streamlined,” noted Lu. “It only takes six clicks within minutes (depending on how fast a member reads the loan disclosure document) to see the approved borrowed amount in the member’s checking account.”

There’s zero loan officer interaction and the platform does not use FICO to decision. It gives more members access to affordable options when those life events happen. It helps members get through their worst day with dignity and compassion. That’s the credit union difference.

For more information about QCash Financial CUSO’s life event loan program contact info@qcashfinancial.com or go to www.qcashfinancial.com