Best practices in auto lending: Risk vs. reward

The auto lending arena grows more competitive with each passing year. In a time when the pool of prime borrowers has shrunk significantly, dealers are offering 0% financing to capture a large percentage of new auto volume. Big banks have the ability to offer dealer incentives via indirect channels to capture another large portion of this volume. As credit unions struggle to remain relevant to prime auto borrowers, we have witnessed an unprecedented reduction in auto rates in an effort to originate volume in the highest credit tiers. Oftentimes this will leave credit unions competing for D and E paper, unwittingly creating for themselves a subprime auto niche.

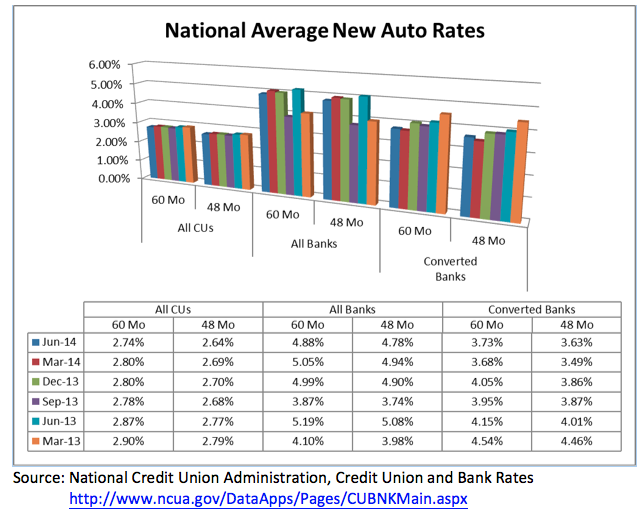

The table below illustrates the disparity in new auto rates offered nationally between credit unions and banks, as well as twenty-seven credit unions which were converted to banks. While offering lower rates to attract volume, steps must be taken to ensure profitability.

Mitigating Risk

One prevailing mantra heard throughout the credit union industry is to serve the underserved. Members with subprime credit scores certainly fit that bill, and there are ways to mitigate the risk of lending to these borrowers.

Adherence to a strong risk based lending program is crucial. In a true risk based lending environment, credit score drives the decisioning process as well as pricing of each loan. The credit union establishes a credit tier matrix based upon similar credit characteristics displayed by the membership within a range of credit scores. Underwriting requirements become more stringent moving down the credit tiers.

Several key components to mitigating risk through the program include:

- Define the appetite for credit risk by establishing concentration limits for the lowest credit tiers within the Loan Policy. These metrics should be monitored and reported to ALCO or the Board of Directors.

- Price products competitively, while ensuring established margins are being met by reviewing a Net Weighted Yield Report as often as necessary.

- The loan policy must dictate loan amount, debt-to-income, loan-to-value, and income documentation standards not only for auto loans, but for each loan type. As stated above, these metrics will be more stringent for the lowest credit tiers.

- Ensure established loan officer lending limits make sense. The most experienced loan officers should be underwriting the riskiest loans.

- Track all exceptions to the loan policy, and establish a procedure for granting exception loans. Strong mitigating factors should be present on a case-by-case basis for exception loans.

- Monitor default loans closely, and establish a warning system to flag problem loans early in the default process. Know your member and their financial circumstances. Do not manage default loans passively.

- Conduct a third party revalidation process for the risk based lending program every two years.

Ensuring Profitability

Allowing credit risk in the portfolio demands close monitoring. In order to determine whether the current pricing margins are sufficient to recover actual and anticipated costs, evaluate the net yield for each product type by credit tier.

This process takes into consideration the net weighted interest rate for each product/tier, as well as historic charge-off rates, and costs of origination, servicing, and default management. The cost factor is generally the most difficult component for credit unions to establish a value. In lieu of time studies, The Rochdale Group’s revalidations have utilized the four quarter rolling average for the credit union’s cost of funds, plus a portion of the four quarter rolling average net operating expense. It makes sense that expenses applied to lower credit tiers witnessing higher default rates and charge-off activity will be elevated compared to any expenses applied to the higher credit tiers.

Quarterly monitoring of the net weighted yield report will bring to light pricing anomalies, as well as bringing to light a clear picture of the most profitable products and trending defaults. This is an important tool in pricing loans to be competitive in the marketplace, while ensuring proper margins are being realized in order to meet budgeted goals.

Making the Most of Membership

As the U.S. economy continues crawling out from under the Great Recession, many credit union members are struggling to restore their prime credit standing lost due to unemployment, excessive defaults, bankruptcy, or foreclosure. These members now find themselves with credit scores south of 640, making it difficult to qualify for loans with affordable rates. However, they are also highly motivated to recapture their former standard of living by making timely payments and restoring their good credit.

As part of an early default detection process, Rochdale recommends rescoring the consumer loan portfolio periodically to track fluctuations in credit scores. Just as a substantial decline will trigger a loan to be flagged for default management, an improvement in a member’s credit score can provide the credit union with a refinance opportunity which will help their member financially. Taking extra small steps such as this creates a sense of loyalty in membership, and assists the credit union in minimizing risk in the portfolio.

Risk vs. Reward

Serving the underserved certainly has its rewards.

When administered properly, a risk based lending program effectively mitigates the risks associated with lending to members in lower credit tiers. The keys include knowing your membership, knowing your market, and knowing the intimate minutiae required to produce a meaningful net weighted yield report.

The rewards include improving the financial health of the membership while maintaining a profitable loan portfolio, thereby contributing to the financial health of the credit union.

For more information regarding The Rochdale Group’s loan pricing revalidation services, contact Joe Karlin (jkarlin@rochdalegroup.com) or Robyn Diehm (rdiehm@rochdalegroup.com).