The last ten years have seen a tremendous amount of change in the credit union industry. Technological improvements, regulatory updates, and social changes have all been collective catalysts that have forced credit unions into intense competition for member acquisition, retention, and economic efficiencies. Cooperatively, credit unions are striving to keep pace and are being forced to either pool resources or merge to achieve economies of scale. Traditional sources of income are being squeezed, and Peer Group 6 credit unions, wholly considered to be large credit unions, have increased in number by 74.8% in the last decade. Meanwhile, the number of smaller credit unions in Peer Groups 3 and 4 has dwindled by 30% over the same period.

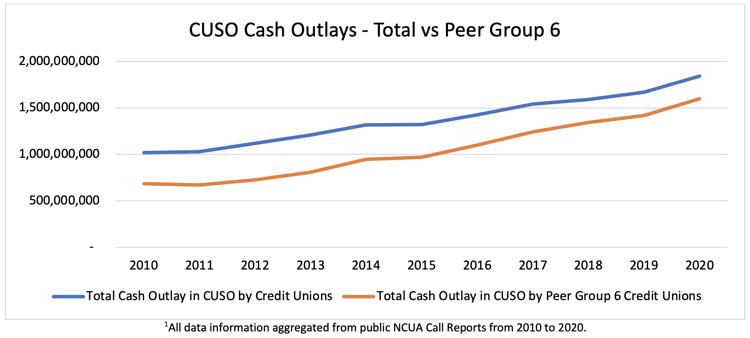

Large credit unions typically have the financial resources to respond to the demands of an ever-changing competitive environment. They do this by expanding either through internal, organic growth, or (as seen with the reduction in the total number of credit unions as a whole) by mergers and acquisitions. Many credit unions have also focused on achieving growth from other sources by exploring non-interest income opportunities. One of the primary strategies that are being utilized is investments in Credit Union Service Organizations (CUSOs) with revenue-generating opportunities. The below table shows how CUSO cash investments have increased, the majority coming from Peer Group 6.

While not a new concept, earning non-interest income through CUSO investments is a popular way forward-thinking credit unions are seeking to diversify their revenue sources. Most of this activity is found in large Peer Group 6 credit unions. However, this peer group includes a broad range of credit union asset sizes that range from $500 million in assets to those above $5 billion. Ask any CFO, and they will tell you that the investment capabilities at $500 million in assets and $8 billion in assets greatly differ.

To better examine the influence of CUSO investments within this peer group, we divide Peer Group 6 into three subcategories.

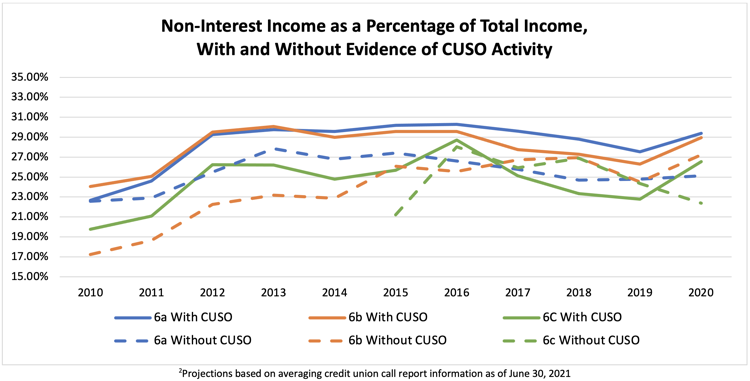

By dividing Peer Group 6 into three subcategories, we can better study the true effect CUSO investments have on non-interest income.

CUSOs are not only providing credit unions a cooperative environment to access improved technologies but are creating new efficiencies with products and services and generating non-interest income opportunities. The numbers speak for themselves. Credit unions that invest in CUSOs will, on average, realize higher non-interest income as a percentage of total income.

The million-dollar question remains: In what type of CUSO should a credit union invest? As of 2021, there are over a thousand registered CUSOs with NCUA. Many offer products and services that credit unions utilize for their day-to-day operations, with most specializing in technological development, lending, or insurance offerings. Arguably the most popular non-interest income CUSO is the insurance CUSO. As credit unions continue to endeavor into insurance CUSOs, opportunities now exist with more advanced, more lucrative insurance products that capture the needs of credit unions and their members.

For example, credit unions have generated over one billion dollars in insurance commissions for the for-profit publicly traded brokerage firms in the last ten years. Commissions that through a CUSO partnership could have been realized as substantial non-interest income for the credit union industry. To illustrate the opportunity further, as of June 30, 2021, credit unions who invested in either a Split-Dollar plan or Credit Union Owned Life Insurance (CUOLI) averaged an investment of $8.8 and $13.1 million, respectively. That is a potential non-interest income of over $199,255 per credit union.3

With the current low-interest environment and the pandemic-driven increase in deposits, credit unions now have more capital to make strategic investments and capture more non-interest income.

Contact BenefisCU to learn more about advanced insurance solutions for your credit union and your members.

BenfisCU is a CUES Premier Supplier Member.

1All data information aggregated from public NCUA Call Reports from 2010 to 2020.

2Projections based on average credit union call report information as of June 30, 2021.

3Average of credit unions invested in either Split-Dollar Executive Benefits plan or CUOLI with assets greater than $250 million. Non-interest revenue projections based upon BenefisCU model.