Beyond traditional stress testing

On March 13th, a national emergency was declared in response to the COVID-19 pandemic. The economic impact of the pandemic has raised questions about capital adequacy in the ongoing coronavirus crisis. Economic shutdown and stay-at-home mandates forced many service sector businesses to close and trim their workforce. As a result, businesses suffered from liquidity and solvency constraints, leading to record high initial jobless claims, vastly surpassing the previous recession in 2008. In response, the Federal Reserve and U.S. Treasury launched unprecedented monetary and fiscal measures. Despite the stimulus and economy reopening, consumer behavior and spending are still very much impacted by the public health concern COVID continues to pose. This is expected to negatively impact earnings and GDP in the second half of 2020, which raises the question: Is my financial institution adequately capitalized to sustain the economic fallout? To provide some insight, we reference the latest stress test reports released by the Federal Reserve Board.

Dodd-Frank Act Stress Test Results

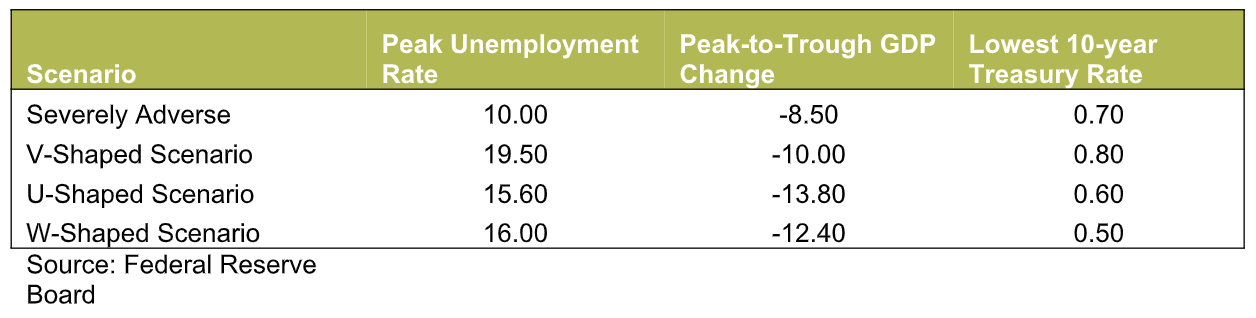

The financial crisis of 2007-2008 revealed major liquidity and solvency risks that may exist in the banking system. Consequently, the Federal Reserve Board has been releasing the annual Dodd-Frank Act Stress Test (DFAST), which includes a severely adverse scenario to understand the industry’s sensitivity to severe financial crises. This year, the Board included three additional scenarios particularly relevant to the COVID pandemic. The new scenarios included are a rapid v-shaped recession and recovery, a slower u-shaped recession and recovery, and a double-dip w-shaped recession. 33 of the largest financial institutions were tested over a nine-quarter scenario, spanning from the first quarter of 2020 to the first quarter of 2022. Moreover, the impact of fiscal policy and lending facilities of the Federal Reserve are excluded from the results. Exhibit 1 below, shows the three, primary variables in each scenario.

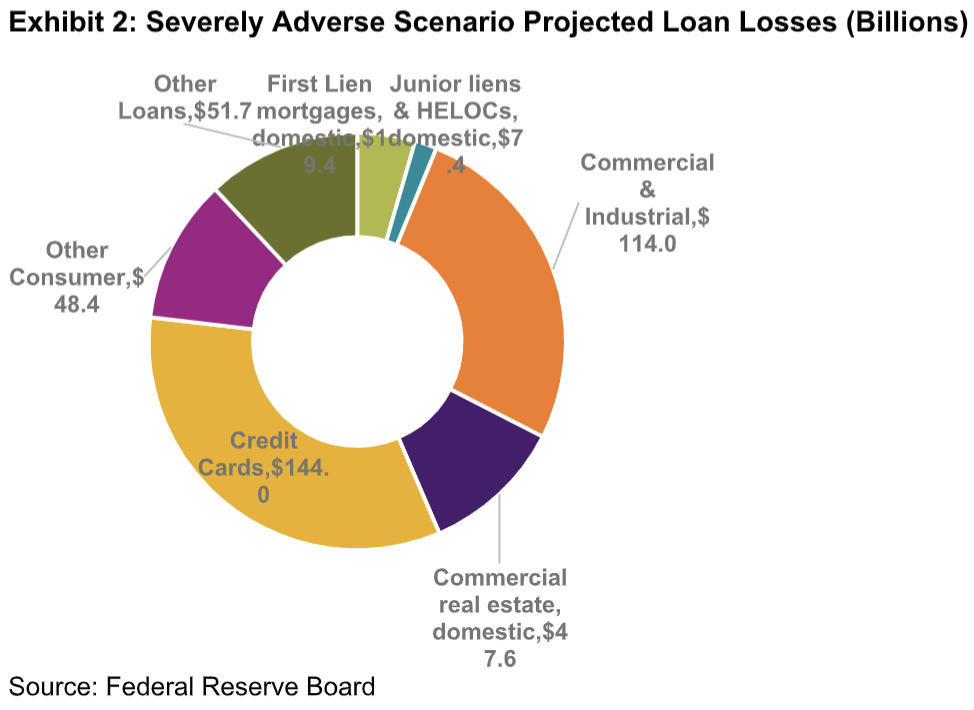

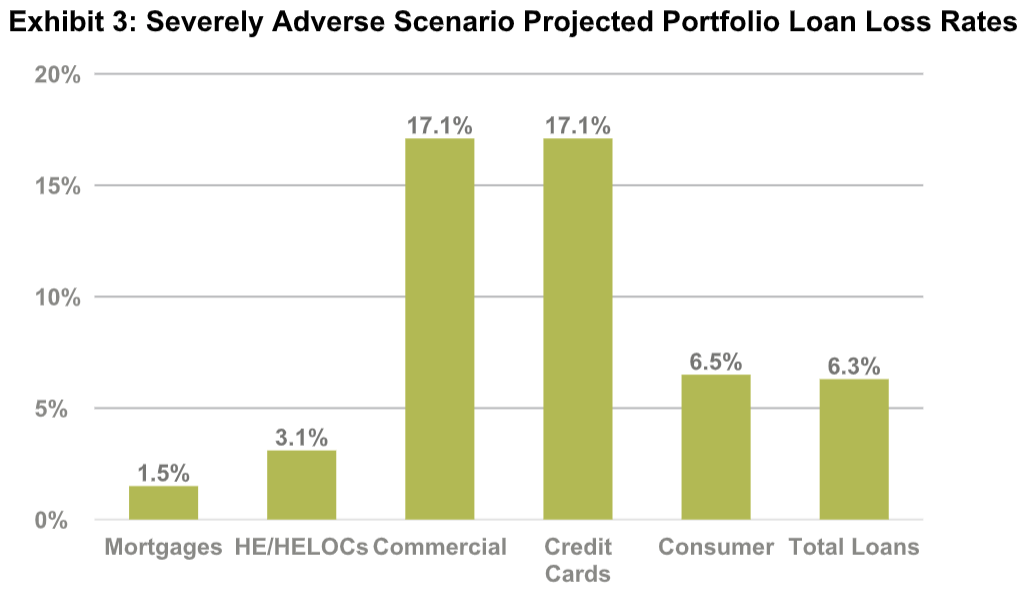

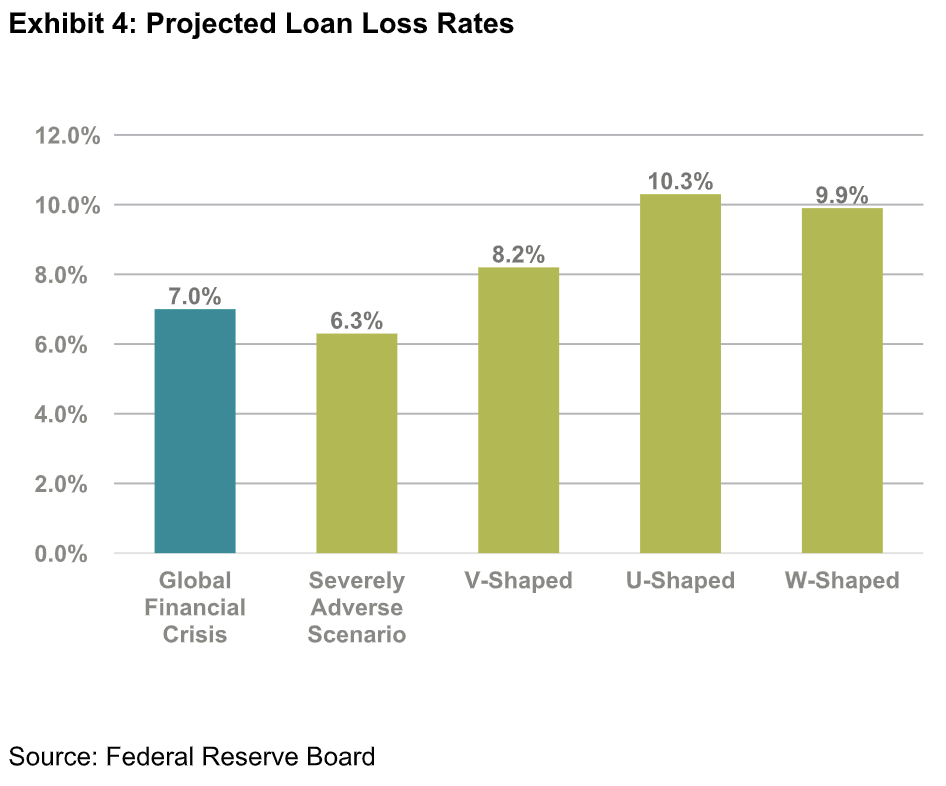

The Federal Reserve Board defines the severely adverse scenario as a “severe global recession accompanied by a period of heightened stress in commercial real estate and corporate debt markets.” In this scenario, aggregated projected loan losses are expected to be $433 billion. The steepest losses are credit cards ($144 billion or 33%) and commercial loans ($161.6 billion or 37%), particularly impacted due to higher unemployment and wider credit spreads. The cumulative loan loss rate for all 33 firms is 6.3% over the nine quarters. However, the loan loss rate varies across firms due to unique portfolio structure and risk characteristics. Exhibit 2 splits out the projected losses and Exhibit 3 shows the projected loan loss rate by loan type. Additionally, the loan loss rate progressively worsens in the three new scenarios. Exhibit 4 displays the projected loan loss rates under each scenario and compares them to the global financial crisis in 2008.

Exhibit 2: Severely Adverse Scenario Projected Loan Losses (Billions)

Source: Federal Reserve Board

Potential Impact to a Depository Institution

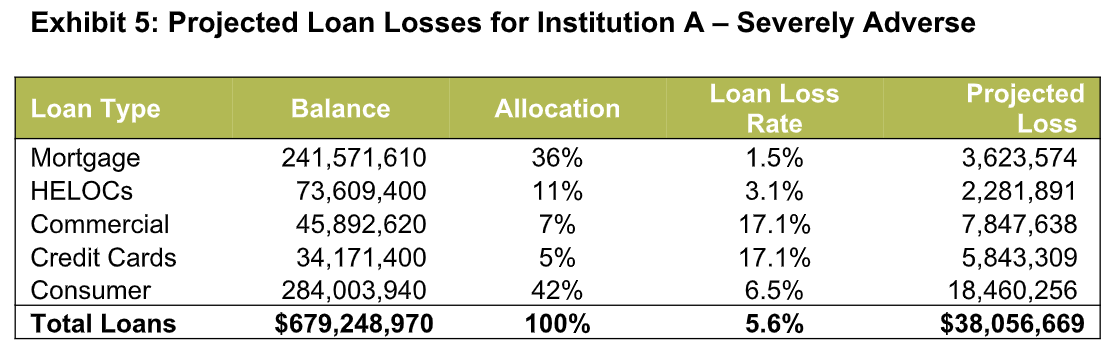

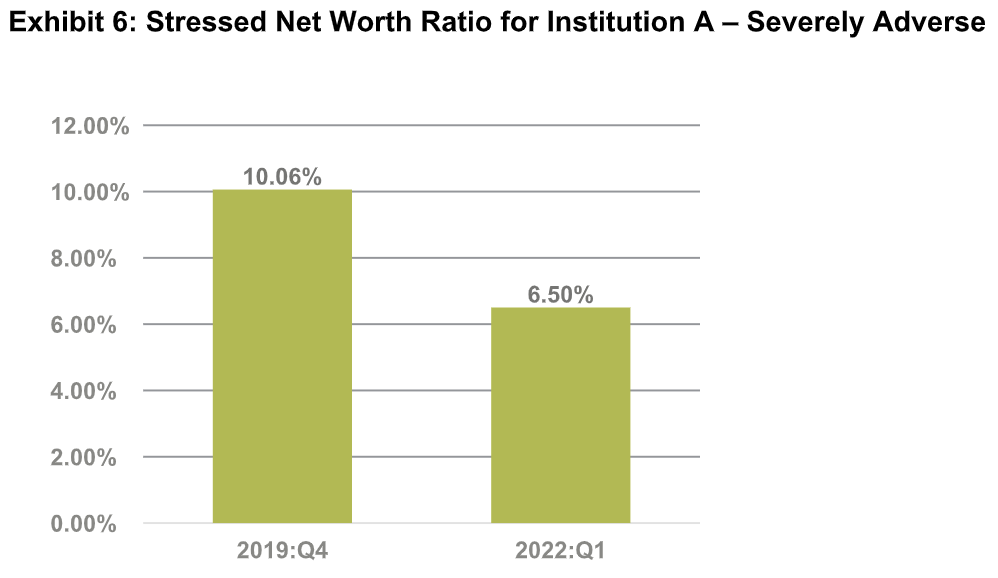

Given the projected portfolio loan loss rates from the DFAST, we can evaluate the potential impact to capital for a depository institution. Consider the balance sheet composition of hypothetical institution A (represented in Exhibit 5). Institution A starts with a net worth ratio of 10.1% in the fourth quarter of 2019, then declines to 6.5% by the first quarter of 2022 in the severely adverse scenario. Since the ratio remains above the typical, minimum of 4%, Institution A is still considered adequately capitalized. Exhibit 5 and 6 show the results of the stress. Note: Investments and deposits were not stressed in the results below.

An institution with larger allocations to credit cards or commercial loans, would experience greater loan losses, resulting in a lower net worth ratio. This could vary depending on borrower characteristics and regional economic factors. If your institution is over exposed to credit cards or commercial loans, consider testing scenarios focusing on these potential vulnerabilities.

As shown above, building a stress test is an exhaustive process. In the next section we divert our focus to the preliminary process of developing a stress test.

Considerations for Building Stress Test Scenarios

Initially, stress testing can be a challenge. But establishing a framework can enhance the process. We recommend you begin by understanding the composition and structure of the balance sheet, and how each asset class behaves in different interest rate shifts (ALM reporting is a great starting point). Once the risk profile has been determined, start selecting tangible scenarios, not captured by interest rate shifts. This could include the standard spread and prepayment shifts for regulatory requirements. However, testing goes beyond meeting regulatory hurdles. Testing should also include macroeconomic factors like the unemployment rate or GDP to capture the macro landscape, similar to how the DFAST incorporates such factors. Including these factors can allow testing for potential tail risk, not reflected in the ordinary scenarios. Once a scenario has been established, it is critical to have data readily available. A reliable IT infrastructure is essential, as this could affect the results of your scenario. Subsequently, as results are assembled, interpret the variations, and formalize a strategy to mitigate or neutralize the potential outcomes. In addition, having a flexible policy that allows for customization is recommended. A policy which is adaptable to economic elements may improve preparedness and execution.

Closing Remarks

Almost no one could have predicted a global pandemic resulting in an economic shutdown, yet the anticipation of unfavorable interest rate shifts, liquidity shortages, and credit events may be utilized to develop a strategy for preparedness. The coronavirus crisis is a learning lesson and it has reminded us the importance of stress testing for asymmetric events. We recommend depositories of all sizes take this opportunity to analyze their capital adequacy. We believe, ALM First’s new Strategic Net Worth Analysis was designed to enable your depository to determine the appropriate amount of capital and develop a strategic growth road map for the future. Interested institutions may learn more by visiting www.almfirst.com.

Disclaimer: All investing is subject to risk, including the possible loss of the money you invest. “ALM First” is a brand name for a financial services business conducted by ALM First Group, LLC (“ALM First”) through its wholly owned subsidiaries: ALM First Financial Advisors, LLC (“ALM First Financial Advisors”); ALM First Advisors, LLC (“ALM First Advisors”); and ALM First Analytics, LLC (“ALM First Analytics”). Investment advisory services are offered through ALM First Financial Advisors, an SEC registered investment adviser with a fiduciary duty that requires it to act in the best interests of clients and to place the interests of clients before its own; however, registration as an investment advisor does not imply any level of skill or training. Moreover, ALM First Financial Advisors, LLC (“ALM First Financial Advisors”), an affiliate of ALM First Group, LLC (“ALM First”), is a separate entity and all investment decisions are made independently by the asset managers at ALM First Financial Advisors. Access to ALM First Financial Advisors is only available to clients pursuant to an Investment Advisory Agreement and acceptance of ALM First Financial Advisors’ Brochure. You are encouraged to read these documents carefully. Balance sheet advisory services are offered through ALM First Advisors