Branch transformations: Plausible technology

Are branch visitors expecting their financial institutions to ramp up technology in the branch? What role is technology playing in this “branch transformation”? And, what technologies are financial institutions choosing to implement in their branches? As the conversation about “branch transformation” continues in the industry, one has to wonder what FIs are doing to close the gap between the modern, tech-savvy consumer and the traditional banking center.

In my last article, I discussed how a few of the megabanks, such as JPMogan and Bank of America, have made huge investments to evolve their branches. Reflecting the changing behavior of the modern consumer, these huge financial institutions made it a point to focus their efforts on technology, both in and out of the branch. The technology being experimented with and implemented by these megabanks come with an extremely large price tag. Technologies such as express banking kiosks (or souped-up ATMs), biometrics used to identify people on unique physical traits, palm scanners, and mobile banking kiosks are all amazing advances for the financial industry. However, for most financial institutions, investing in branch technology comes down to what’s possible vs. what’s plausible.

Codigo recently surveyed around 150 financial institutions regarding their current branch transformation and new branch build projects. The survey covered a wide range of issues from branch size reduction, the downsizing of branch staff, and the technology being implemented in the new branches. The majority of respondents represent financial institutions ranging from 1 to 25 total branch locations (93%) which, according to the Credit Union National Association’s 2013 Year End Credit Union Profile, is a good representation of the average bank or credit union today (Avg. Number of Branches: Bank – 14, CU -3).

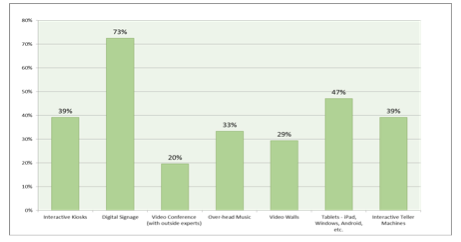

Now, for most of the institutions polled, biometrics, retina scanning, and multi-million dollar express banking kiosk are not plausible branch technologies, at this early stage. So, what technologies are the average-sized financial institutions using in their new branch projects? Well, according to Codigo’s survey, most of these intuitions are putting their focus on customer engagement through a combination of technologies. Here’s how the results broke down:

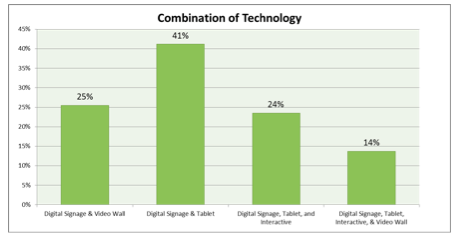

With most respondents saying that a combination of digital signage and tablets will be used in their branches, it’s fair to say that average-sized financial institutions are looking to implement technologies that help branch employees educate and sell branch visitors on products and services offered by the institution. These types of technologies are what the modern tech-savy consumer expects to see and at a price point that won’t exactly “break the bank”.