Capital: How much is enough?

Capital is an important portion of any financial institution’s balance sheet, as it can be used to absorb losses and designates the percentage of assets a financial institution can stand to lose without becoming insolvent. The overarching intention of capital is to reduce system risk and protect depositors and insurance funds.

While capital is clearly at the core of an institution’s ability to grow and succeed, answering the question “How Much Capital is Enough?” remains challenging as there is no single right answer, other than “It Depends.” A financial institution needs sufficient capital to protect itself from negative events. Simply put, if you take more risk, you need more capital. The trick is to understand how much additional risk you are taking and how much additional capital is needed to cover losses in the event that adversarial events occur. Models can provide you these answers. Let’s examine some of the basics.

A Strategic Net Worth Analysis Process

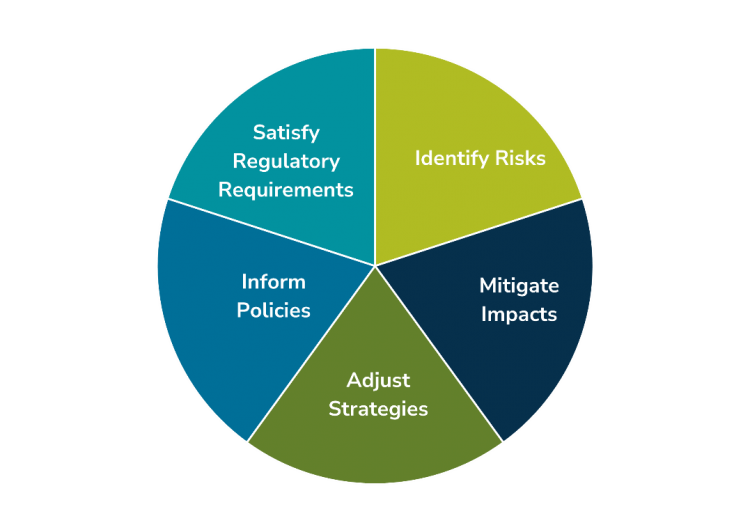

A Strategic Net Worth Analysis is a tool for defining the level of capital required to satisfy regulatory requirements, absorb losses from various risks, and to support strategic initiatives. A Strategic Net Worth Analysis allows you to analyze your current position and will answer that question of “how much capital is needed.”

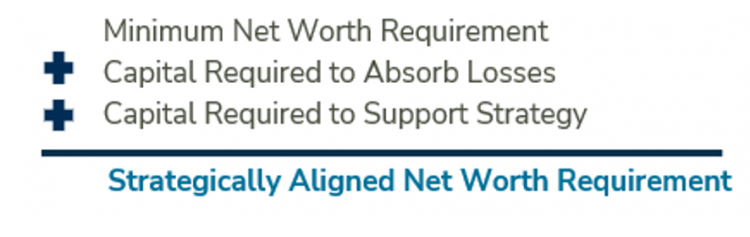

The basic concept is the formula below:

Most credit unions start with NCUA’s definition of well-capitalized, which is having a net worth to assets ratio of 7% or greater. Added to that is an amount of capital required to absorb losses given severely adverse scenarios which requires some form of stress testing. This analysis investigates exposures in risk areas such as credit, concentration, liquidity, operation, and reputation, along with interest rate risk, in order to better quantify an institution’s risk position and strategic capital requirements.

Examples are shown below of economic scenarios that can be performed:

- NCUA Supervisory Scenarios: Baseline, Severely Adverse used for Capital Planning and Stress Testing (CPST)

- Idiosyncratic Scenarios: Institution-specific risks, such as natural disasters, cyber security threats, large deposit runoff

- Systemic Risk Scenario: such as the COVID-19 pandemic

The best way to determine a proper capital holding requires a solid understanding of your current position, smart planning, and strong analytics. The analysis requires a good amount of data gathering and preparation to develop test scenarios. Specifically, the maintenance of historical data is critical, policies should be put in place, risks should be identified so that they can be modeled, and assumptions must be made given adverse impacts. Credit projections should include at a minimum, assumptions such as LGDs (loss given defaults), CDRs (credit default rates), and VPRs (voluntary prepayment rates). Each loan should be modeled separately and assumptions made specific to their loan to values, coupons, and weighted average lives.

Financial regulators require such testing for institutions with more than $10 billion in assets, but we’ve found it to be an important exercise for financial institutions of all sizes. Annual stress tests aim to provide answers. Financial institutions will then have the ability to quickly adjust their balance sheets. The most critical part of the process.

Additional benefits of the analysis

Properly performing a thorough capital stress test can take a good amount of time, effort, and money, but there are other benefits besides providing adequate capital levels.

- If the analysis is conducted accurately by projecting credit losses throughout the history of loans, the analysis can validate or even provide CECL results.

- It can inform an institution of any particular credit concentrations that exist. Such information gives an institution the ability to confirm its concentration policies.

- While not intended to be a forecast or budget, the results of stress testing and analysis can help an institution evaluate its current position and strategically plan for the future.

Why Excess Capital Is a Bad Idea

Now that we have examined how to answer the question of “how much capital”, let’s focus on the risk of guessing. Most credit unions hold too much capital. This can be costly.

Excess capital is expensive and carries more risk for investors than debt securities or deposits. A financial institution holding excess capital must earn higher profits, all else equal, to generate the same return on equity for capital providers. The government’s deposit guarantee also makes excess capital less valuable, and ultimately transfers risk from the government to the investor.

When stress testing is only performed to meet regulatory requirements, institutions may be missing the added benefit of analyzing whether stressed returns are worth the allocated capital or if their capital is diversified enough.

A “Must Do” Task for Institutions of All Sizes

Even if your institution is well-capitalized, efficiencies can still be gained through comprehensive analysis and stress testing. As we’ve all learned over the past 18 months, economic environments can change rapidly, limiting time to develop a reactionary strategy. By actively managing risk and authoring contingency plans now, your institution could minimize future losses.

We believe stress testing and analysis can be beneficial for institutions of all sizes, not just those required to perform this task. If properly planned and implemented, the results can potentially provide critical information in aiding strategic planning, making it a “must do” task.

“ALM First” is a brand name for a financial services business conducted by ALM First Group, LLC (“ALM First”) through its wholly owned subsidiaries: ALM First Financial Advisors, LLC (“ALM First Financial Advisors”); ALM First Advisors, LLC (“ALM First Advisors”); and ALM First Analytics, LLC (“ALM First Analytics”). Investment advisory services are offered through ALM First Financial Advisors, an SEC registered investment adviser. Access to ALM First Financial Advisors is only available to clients pursuant to an Investment Advisory Agreement and acceptance of ALM First Financial Advisors’ Brochure.

The content in this article is provided for informational purposes and should not be relied upon as recommendations or financial planning advice. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.