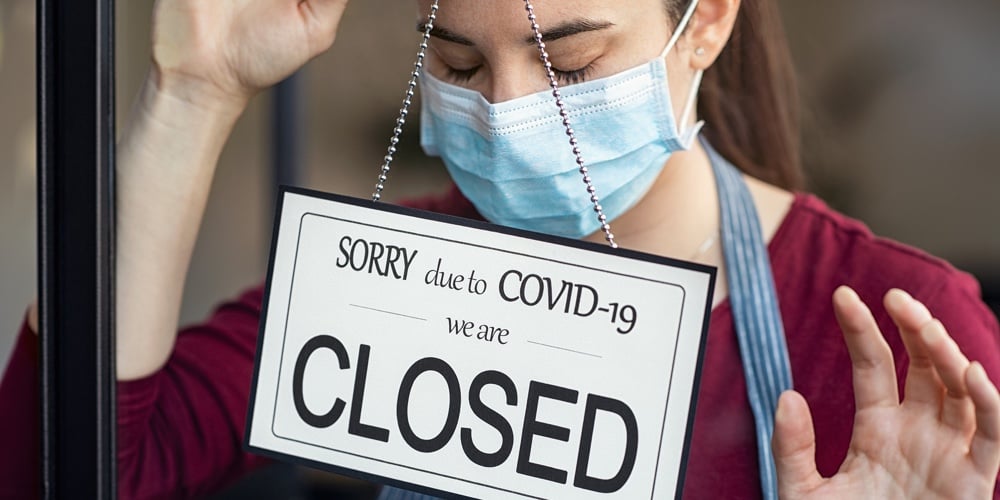

Clock ticking for small businesses squeezed out of government loans, now have a few months or less to survive, survey reveals

The 30.7 million small businesses on Main Street that generate 50% of U.S. GDP have been hard-pressed to receive the government relief they need to stay in business.

According to the CNBC/SurveyMonkey Small Business Survey released Monday, which surveyed 2,200 small business owners across America, while the $660 billion Paycheck Protection Program was instituted to give them a lifeline through the coronavirus and economic shutdown, only 13% of the 45% who applied for the PPP were approved. Among all respondents, 7% already received financing and 18% are still waiting for a response from a lender.

The experience small business owners have had applying for the $10,000 Economic Injury Disaster Loan was worse. Only 3% of all small business owners surveyed were approved for such funding, and 16% are awaiting a response from a lender, the survey revealed.

Both relief programs are run by the Small Business Administration. PPP loans are capped at $100,000 per employee and can range in size. The $10,000 advance from EIDL does not have to be repaid, making it effectively a grant.

continue reading »