Which comes first: Data warehouse or business intelligence?

Many credit union’s are struggling with which one should come first; clean-up data/build data warehouse or build business intelligence center?

Obstacles

Data warehouse and governance issues– Many of our credit union clients find themselves grappling with big projects of first cleaning-up the data. This is often tasked to a focused team and the team starts off hot and heavy in pursuit with visions of a shiny pristine data warehouse everyone can trust and everyone uses! Then 6 months in to the project they are pulled in different directions and the dedicated team is now focused on the project less and less. The timeline of the project is extended and business analytic projects are moved down the priority list. In parallel, other business units are concerned with the now 2-year data project and how effective it will be with the other data sources they do not own. This is common conundrum for most credit unions.

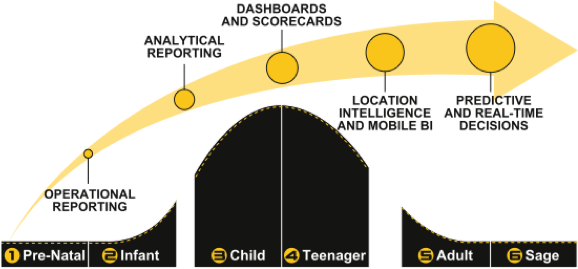

Data can have a “Use by date” and by the time you get the data and clean the data, the data is old. Additionally, dirty data and/or smaller data samples can drive to poor decisions. These are common pitfalls in data governance projects. With these issues to consider the default normally is to follow the maturity curve, by putting a stake in the ground where you are currently and follow the next steps in the maturity curve.

Considerations

I have heard on many occasions reasons why analytic projects are delayed or slow to implement. The considerations are normally because of limited staff or back to the data obstacle issues and Business Intelligence is waiting on the Data Warehouse.

A Bold suggestion to consider: Pick where you want to be now with your Business Intelligence and that is where you put your stake in the curve; NOT where you are currently. That does not lead to innovations.

Taking a bold and calculated approach can not only give you a competitive advantage over your competition; it can also give you actionable insight to help you and your members make better decisions. A question to consider, if 71.6% of new loans originated are for autos and new homes (2016, January, CUNA Monthly Credit Union Estimates). Consider if your Credit Union had a way to quickly identify your best mortgage members and what makes them a best member. Think about how helpful you would be to your current members and future members if you have analyzed their attributes. Then take that algorithm and apply a predictive analytic algorithm to that and push out the results to your Marketing Team and Loan Officers! Consider a phased approach; pick your top 3 KPI’s or questions you want to know and start working your way through the data and BI solutions from there. The BI Maturity cure – is not a journey from infant to sage – hack the curve!