Credit union average Net Promoter Score holding steady, while big banks show improvement

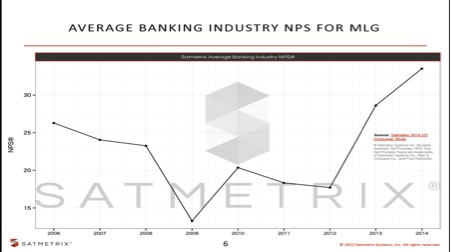

If you are like most credit unions, your service experience is a key reason why members do business with you instead of their local bank. Credit unions, based on the industry average, are well ahead of banks in terms of Net Promoter Score (NPS) and overall member experience today. According to Member Loyalty Group’s 4th quarter 2014 benchmark, the credit union industry average relationship NPS remained steady at 58. However, banks are gaining momentum, according to the Satmetrix® 2014 Annual Net Promoter Industry Benchmark Report. The Satmetrix NPS Benchmark report shows the banking average NPS rose for the second straight year to 34.

Member Loyalty Group, a leading CUSO formed to help credit unions implement and perfect organization-wide Voice of the Member programs, is the exclusive provider of the Satmetrix® Net Promoter® Software for the credit union industry. Satmetrix® publishes annual Net Promoter Industry Benchmarks and their 2014 reports rank more than 219 brands across 22 U.S. industry sectors, including financial services.

What Could this Mean for Your Credit Union?

As banks continue to invest in improving their customer experience and improve customer loyalty, it’s critical for credit unions to actively manage their own member experiences. Further analysis by Member Loyalty Group uncovered that half of participating credit unions improved their relationship scores from Q4 2013 to Q4 2014. However, the other half saw their overall relationship scores decline during the same 12-month period. This can be very disconcerting for credit unions that rely on service as their key differentiator. So, what causes a credit union’s NPS to decline?

We know that NPS is affected by changes in the member experience. When a change is seen as positive, such as extended hours or adding a mobile banking app, NPS typically improves for the members that experience the change. When a change is seen as negative, such as fee changes or branch closures, credit unions typically see a corresponding decline in NPS. With all the changes that are made within credit unions on a monthly basis, it can be challenging to predict the net impact to your scores.

When considering the potential impact of a change, you may find it helpful to ask the following questions:

- Will members see this as a positive or negative change?Put yourself in the members’ shoes when considering this. Even though a change is likely to be seen as positive in the long run, it may have a short term negative impact. Credit unions commonly experience this when making changes to their online banking systems.

- Will members’ experience be impacted immediately or will there be a delayed impact as members experience the change?Members will experience some changes rather quickly. Other changes, such as extended Saturday hours or fee changes, may take time for members to encounter and reflect in your scores.

- How many members will be impacted?Changes that affect large portions of your membership will have a greater impact on your overall NPS. Changes – even large changes – that affect smaller portions of your membership normally have a minimal impact to NPS. For example, a credit union decides to bring in/merge with another credit union. If the merger will comprise 30% of the new total membership, you should expect a significant potential negative impact to NPS. If the merger comprises 3% of the new total membership, you should expect a minimal potential negative impact.

Your answers to each of these questions will help you to understand the potential impact of a change. It’s imperative that credit unions continue to change and evolve. However, we need to do so in a way that puts the members’ experience at the center of this process. Credit unions can carefully plan ways to minimize problems, anticipate challenges and address member concerns before, during and after changes. In doing so, we can limit the impact of changes on NPS and maintain our loyalty position above banks.

Learn More

Request your free copy of the Q4 2014 benchmark overview from Member Loyalty Group today. For more information about Member Loyalty Group’s Net Promoter program in general, credit unions should visit www.memberloyaltygroup.com or contact info@memberloyaltygroup.com.

Additional best practices will be discussed during the upcoming Loyalty Live Conference this March in Phoenix.

About Net Promoter®

Net Promoter® is both a customer loyalty metric and a discipline for using customer feedback to fuel profitable growth in your business. Net Promoter® has been embraced by leading companies worldwide as the standard for measuring and improving customer loyalty. Financial Institutions obtain their Net Promoter Score® by asking customers a simple question on a 0 to 10 rating scale: “How likely is it that you would recommend the organization to a colleague, family member or friend?” Based on their responses, consumers can be categorized into one of three groups: Promoters (9-10 rating), Passives (7-8 rating), and Detractors (0-6 rating). The percentage of Detractors is then subtracted from the percentage of Promoters to obtain a Net Promoter Score®.

Net Promoter, NPS, and Net Promoter Score are trademarks of Satmetrix Systems, Inc., Bain & Company, Inc., and Fred Reichheld.