Credit union branch transformation begins with culture

Over the past few years, trade publications have been awash with articles and advice on branch transformation. This is an extremely important topic given the transaction trends we read about. With members coming into the branch less frequently, credit unions need to be poised to make the most out of each member interaction.

As the story continues, we learn that the nature of the retail branch is changing. Its past role as a transaction venue is being supplanted (rightfully so) by a role as a solution and sales center.

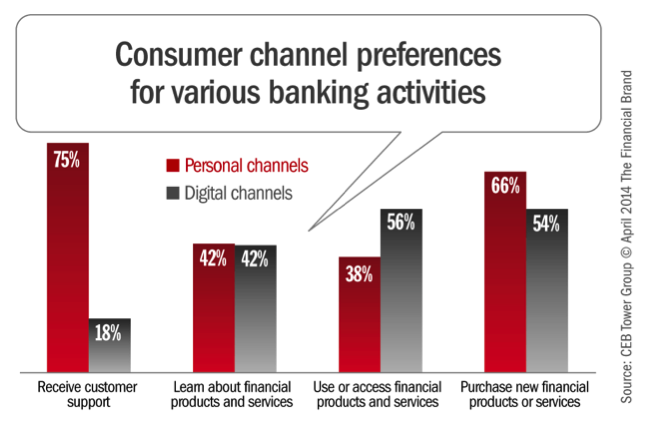

Think of it this way: If a member bypasses the credit union’s ATMs, web site, mobile app, and phone center and has the AUDACITY to walk into a branch, that member must need something that he or she perceives can be accomplished best in a branch. Common sense and research data reveal that those activities include resolving problems and “big ticket” sales.

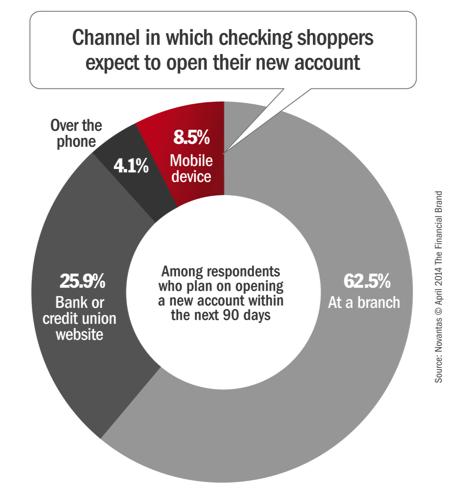

While online and mobile account opening are capabilities at the forefront of electronic service delivery, nearly two-thirds of consumers expect to open new accounts in the branch.

Further, consumers have a pronounced preference for personal interactions when resolving a problem or receiving member support.

There are lively discussions about branch layout, universal bankers, teller pods, and ITMs. Experts wax poetic about customer engagement and the motivations that customers have for coming into a branch. All of that is fine information and many institutions have done a great job transforming their branches, but the big issue is one of culture. Specifically, the big question is: Are your branch employees trained and prepared to address problems and discuss products as a financial authority?

Without a well-trained, engaging culture, branch transformation – simply focusing on remodeling facilities – may fall flat. Said differently, the branch environment must support a culture in which well-trained, engaging employees work directly with their members to resolve issues, address concerns, and connect their customers with appropriate products and services. Four key activities are needed before embarking on a complete branch transformation journey:

- Cultural Assessment – Within the institution’s current environment, is the culture one of proactive member support? This is a question that requires candid self-analysis. It’s OK if the answer is “no.” That helps determine where the branch transformation process begins.

- Cultural Goal – What is the desired customer experience within the branch? This is a “blue sky” question. It’s important to think broadly and conceptually about this topic. There is a tendency to limit thinking to what happens in the current branch rather that what should happen if there were no preexisting conditions (see the next question).

- Branch Assessment – Is the current environment focused on transactions or member engagement? Frequently, traditional branches may put barriers (sometimes literally) between employees and customers. The institution must come to a good understanding of what does and does not support their cultural goals. This sets the stage for planning facilities that are aligned with cultural and member services objectives.

- Action Plan – The institution can plan and implement branch transformation most effectively once it understands its cultural condition, cultural goal, and the conduciveness of its branches in supporting the goal. Responses to these conditions may result in changes to hiring and training, branch staffing, technology and core processor decisions, and branch design-build (remodels or new facilities).

Tremendous results are possible when these factors are properly balanced. Banks and credit unions that embrace a complete solution experience dramatic results.

- A bank in Middle Tennessee transformed its customer service culture and then transformed a very busy branch to support the culture. As a result, employee overhead was reduced, customer engagement and satisfaction were improved, and the payback on the investment was achieved in less than two years.

- According to FDIC reports, a community bank in the Southwest organically grew its assets from $1.0 billion to $3.5 billion in five years by transforming its customer service culture and supporting that transformation with appropriate branch designs.

- NCUA loan and asset data prove a credit union in Tennessee grew its loan portfolio by 50% in four years, and another in the Carolinas grew its book of business by over $100 million in a similar period, both by combining cultural and physical transformations.