Debit trends, benchmarks, and revenue opportunities

The 2015 Debit Issuer Study is here. The annual report commissioned by PULSE® has been a bellwether for card issuers for the past ten years, providing key measurements, trends, and invaluable insights.

This year’s study delivers more qualitative and quantitative data derived from meticulous primary research (conducted by Oliver Wyman). Here we’ll take a look at just a few of the data points, and how they can inform a credit union’s growth strategy when considered with more industry analysis.

Numbers geeks…..get ready to have some fun. But if you’re the type to get lost in a narrative of numbers….you can probably just skim the headlines and still get the full picture.

Debit Increasingly Integral to DDA Growth, Profitability

A good starting point is some baseline metrics, then we’ll dive deeper. Most key performance indicators (KPIs) stayed constant, with a little growth in others. Average transactions per active card per month rose 5% up to 20.2, driving an increase in annual spend per active card from $8,875 to $9,291.

Perhaps it’s no surprise that penetration rates are higher among new accounts (83%) than overall (76%). Given that the overall figure includes the new accounts as well, the disparity is even greater than this seems. This makes sense as most issuers now make linking a debit card part of the process to open a checking account, and more new accounts are being opened by younger generations.

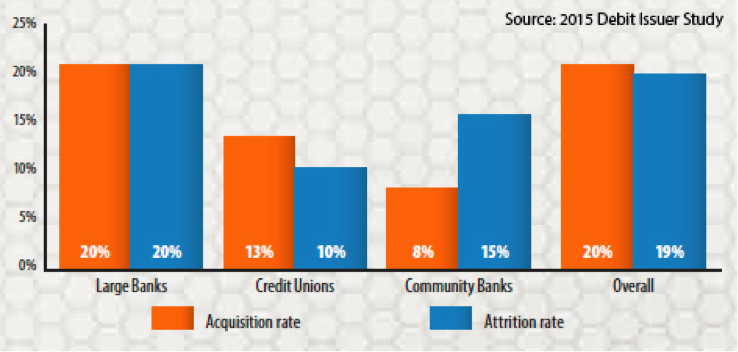

This gets interesting when attrition is also considered. Overall financial institutions (FIs) are losing accounts as fast as they’re gaining them. But community banks are struggling more than most FIs, losing significantly more than they’re gaining, while credit unions are performing the best. But as the study points out, even for credit unions “It is very difficult to grow when facing the headwind of so much churn.”

Average DDA acquisition and attrition rates

Debit Rewards Key to Combatting Attrition

Putting a halt to all this churn should be a top priority for long-term profitability. Given the continued rise in debit usage among Americans and importance of the accompanying non-interest income, the debit card is a great place to start.

In one measure of nearly a half million cardholders, those enrolled in the rewards program offered by their FI had a 46% lower churn rate than those not enrolled in the rewards program.1 This real-world data echoes the sentiment delivered in consumer surveys. Among the eye-openers, 88% of Americans say rewards are a top priority in choosing where they bank (ranking higher than anywhere/anytime access)2 and 65% are willing to increase their wallet share with an FI that offers rewards.3

Looking at the attrition problem from every angle, we see that:

- Debit rewards are critical to attract new account holders,

- They’ll lead to greater wallet share (i.e., interchange revenue)

- Cardholders active in a rewards program have much lower attrition rates

EMV Increasing Expenses and Fraud Loss, Especially on Signature Transactions

EMV is on everyone’s agenda. Literally. With 100% of FIs in the 2015 Debit Issuer Study reporting they have either already begun or plan to begin issuing EMV chip cards.

While this isn’t exactly news, the various points of increased costs are to some issuers. Starting with the plastic itself, which comes in at a 100% estimated cost increase per EMV debit card over magnetic-stripe cards.

Additionally, financial institution executives echo industry analyst predictions that the EMV rollout will create a significant uptick in fraud loss rates. Irony aside, this needs to be accounted for in projections and growth strategies. Interestingly, the greatest threat of increased fraud – and the accompanying expense – is on signature-based transactions.

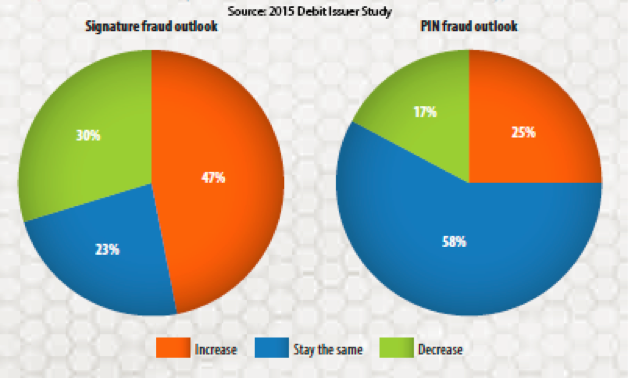

Citing migration to card-not-present transactions following EMV adoption, nearly half (47%) of issuers expect an increase in fraud loss rate for signature transactions, compared to just 25% expecting an increase in PIN fraud loss rates. This is even more monumental when considering credit unions’ fraud loss rate on signature transactions is already 13X greater than PIN transactions.

Issuers’ Expectations for Fraud Over the Next Two Years

Debit Rewards Mitigate Increased EMV Costs

More transactions and larger tickets generated by debit rewards programs yield more revenue, which becomes even more important considering the increased costs of chip cards. In “A New Idea for Stronger, Cost-effective EMV Rollout,” we see how a well-timed rollout can increase enrollment and magnify the revenue impact of a rewards program.

An old-school philosophy was to structure such a program toward signature-only transactions. The economics of this hasn’t made sense in years, with signature-only programs underperforming (more on that in “Rewards Come Roaring Back…with a New Twist”). The PIN/signature fraud projections outlined above add more fuel to the more successful strategy of providing rewards on all purchases, PIN and signature.

A (Missed?) Opportunity for 2015

Tucked away on the last page of data in the 2015 Debit Issuer Study is a look at what banking executives consider to be key challenges and opportunities. Among exempt FIs, 29% view debit card rewards as a key opportunity for 2015.

This may seem strong at first, given that it represents nearly a third of all community financial institutions. But considering the insights and impacts of rewards programs outlined in this article – profitability growth, consumer demand, reduced churn, EMV cost mitigation – it seems 71% of community financial institutions are missing this gift horse that’s hiding in plain sight.

Unless otherwise noted, all data from “2015 Debit Issuer Study,” commissioned by PULSE.

1Buzz Points analytics, 2015

2Wall Street Journal, “Consumers Say More Rewards Is Their Top Demand From Banks,” 2014

3EY, “EY Global Consumer Banking Survey,” 2014