Engaging your cardmembers with a slick and secure credit card mobile application

During these uncertain times, consumers are taking advantage of banking digitally. In a recent study by J.D. Power, 48% of consumers reported increased usage of mobile banking (as of August 2020).

Consumers perceive their digital experiences as an integral part of a provider’s brand, which puts the pressure on credit unions to offer online and mobile experiences that measure up to their expectations. Consumers want banking on their smartphones to be as seamless and user-friendly as posting on a social media app.

As a notable slice of the digital payments pie, credit cards, and specifically credit card mobile applications, the apps that allow cardmembers to manage their credit cards via smartphone, should not be overlooked. According to a study by PYMNTS and Elan, more than 40% of all U.S. credit card owners have downloaded at least one mobile card app, a number that jumps to 77% of those between the ages 18 to 24. These apps do not sit idle on cardmembers’ smartphones. More than 60% of those who downloaded a credit card mobile app reported using it at least a ‘couple of times’ per week. Considering the significant number of credit card users, these apps provide a crucial touchpoint for cardmember engagement.

The cost of developing and running a credit card mobile app that keeps pace with rapidly changing technology is daunting, especially for smaller- and mid-sized credit unions whose resources may be stretched. However, for credit unions running a credit card program, having a simple, easy-to-use credit card mobile app is not optional. It’s mandatory.

Four Pillars of an Effective Credit Card Mobile Application

Credit unions offering credit card programs must recognize the imperative of offering secure and intuitive mobile application experiences with robust functionality to attract and retain cardmembers.

These four basic tenets must be the focus of a credit card mobile application designed to meet cardmember expectations:

![]()

- Security & Fraud Prevention

Security and fraud prevention are two of the top concerns for cardmembers, especially those with credit cards vs. debit cards. In a recent study by PYMNTS and Elan, protection against theft of funds was cited as a motivating factor for 35% of credit card users — twice the share of debit card users with this view. Consumers also appear to have more confidence in the overall data security of credit cards: 27% of credit card users cite data security as a motivating factor while only 14% percent of debit card users do the same. This suggests that, while both debit and credit card issuers could do better in assuring consumers of the security of their offerings, such concerns are elevated among debit card users.

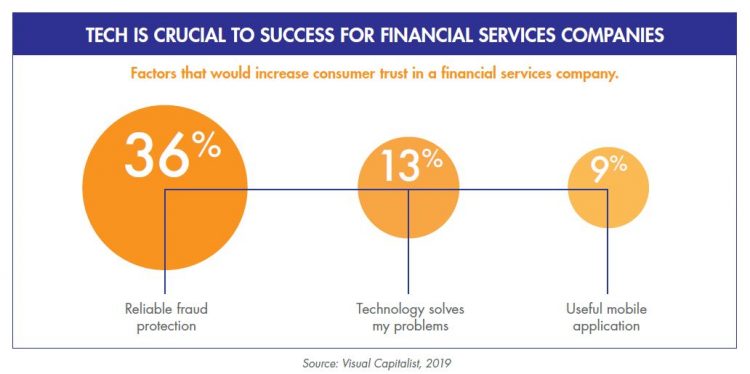

36% of consumers report reliable fraud protection as a factor that would increase their trust in a financial services company. As security is top-of-mind, credit card mobile apps should provide added layers of protection to vulnerable cardmember information. Cardmembers want to be assured that their data is protected in-app just like it is when they swipe their card at a physical store or shop online.

- Transaction Insights

Cardmembers want to see their transaction information in a way that makes it easy to recognize where and when they’re using their card. A recent study found about 40% of consumers would be very interested in downloading highly functional mobile card apps that can be used to manage multiple cards, track spending and issue transaction alerts, among many other features.

Apps should be designed to only include pertinent information for the cardmember, and cardmember feedback on the app should be collected and incorporated to ensure a best-in-class user experience.

- Seamless DIY Service

Do-it-yourself (DIY) is becoming more prevalent in today’s increasingly digital environment; cardmembers expect the capability to perform their desired servicing via their credit card’s mobile application. Desirable servicing activities for credit card mobile apps include redeeming rewards, turning cards on or off, setting spend limits, identifying recurring transactions, etc. Cardmembers don’t want to use other channels to fix issues they can solve themselves in less time and more conveniently.

For those running credit card mobile apps, striking the balance between offering a robust set of DIY servicing features and providing an easy-to-use interface to avoid cardmember confusion is challenging. Heavy investment in technology is oftentimes necessary to develop a competitive app. Finding a partner that can dedicate the time and resources into app development and maintenance may be a good choice for credit unions who may not have the resources to invest.

- Customized Engagement

Consumer expectations now go beyond simply having an app that’s easy to use. Today’s consumers want app experiences that are tailored to their use. For a credit card mobile app, this should come in the form of personalized advice and offers from their issuer. A recent survey found that consumers who feel their financial institution looks out for them are far more profitable and loyal. Consumers report higher levels of financial wellbeing when they strongly agree that their financial institution understands their financial situation, makes it easy for them to manage their finances and helps them make more informed financial decisions.

Elan Financial Services Offers a Robust Credit Card Mobile App

Elan partners offer their cardmembers access to Elan’s mobile app, which makes managing their credit union’s credit card easy. Elan’s mobile app allows cardmembers to seamlessly manage their credit card with insights into transactions and a user-friendly interface.

Partnering with Elan allows credit unions to offer a digitally-enabled credit card program with full fraud protections, 24/7 live customer service, and attractive products with compelling rewards, all without upfront investment and ongoing cost. Credit cards are branded with the credit union’s name and logo, so cardmembers see the name they trust on the card in their wallet. And best of all, Elan shoulders all regulatory and compliance burdens associated with running a credit card program so partners can focus on their core business and their members.

Learn more and read the full whitepaper “Engaging your cardmembers with a slick and secure credit card mobile application.”

About Elan Credit Card

As America’s leading agent credit card issuer, Elan serves over 250 active credit union partners. For over 50 years, Elan has offered an outsourced partnership solution that provides credit unions the ability to offer a competitive credit card program. Elan has developed industry-leading technologies to improve cardmember satisfaction and drive growth all while sharing the program economics with our partners. For more information, visit www.cupartnership.com.