Evangelism: How do you communicate your credit union message?

It’s a new year and I’m catching up on my reading. Clearly the financial services sector is in a tremendous state of flux. Everyone is scrambling to ensure they have the right mobile technology. Mobile wallet inventors are squaring off like the VHS versus Betamax showdown of the late ‘70s. The industry’s effort seems to be in response to a wake-up call – give the customer what they want, how they want it, when and where they want it. Perhaps Meg Ryan’s line in Top Gun sums it up, “Take me to bed or lose me forever!” That cheeky assertion aside, it seems like the financial world is taking an increasingly customer-centric focus. It should… survival depends on it.

Some of the things I’m reading have a loftier tone. Rising above the business-to-customer plane, they attempt to lift our consciousness about the institution-to-community interface. All of the work I do is with community-scale financial institutions. Almost without variation, when I ask them about the underpinnings of their success, they point out community involvement. This seems to bring up big questions:

How are you evangelizing your community?

How are you delivering your message in an industry and marketplace that is increasingly crowded and noisy?

I believe that there are three key aspects that will help secure the community institution in their role and contribute to their overall success:

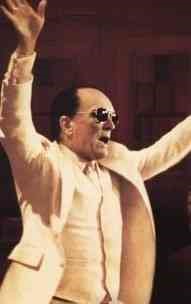

- Evangelist – At the top levels, the management team must believe – truly believe – that their institution offers something that the community needs. This is NOT about increasing shareholder value; that’s an outcome. This is about active participation in the community because the institution contributes something that is needed.

- Educated Faithful – The Evangelist can’t do the job alone. A word that is getting increasing play in the financial circles is execution. From the frontline staff and on up the ladder, employees must be well versed in the institution’s vision. More importantly, they must be able to translate and apply the institution’s capabilities to meet the needs of those they encounter – in the branch, online, and in the community.

- Demonstrable Evidence – The testimony of those who have benefitted by interaction with the institution becomes the proof that leads to increased opportunity. We all understand about the power of word-of-mouth advertising. Leverage the success stories to demonstrate how the institution supports the consumers and businesses in the community.

A couple of “for instances” to make my point:

A very successful financial institution in Texas counts the community as one of its four stakeholder groups. The company says they “put the community back into community banks.” Their CEO famously point out that a rising tide lifts all boats. By this, he means that as the community grows and prospers so do the bank’s customers, employees, and the bank itself. Further, the bank’s community involvement is more than just making donations. They take active roles in key organizations – not just as board members, but in leadership roles. They focus their involvement on organizations that are making fundamental, visionary differences within the community. This positions the bank to add financial resources that help an organization meet their mission and ensure their future.

A growing financial institution in Louisiana uses community involvement rather than a marketing/advertising budget. They are in an enviable position in their market, controlling the lion’s share of the market and leveraging the “big guy” advantage. They credit this success to the visibility of their executives in the community and focus. The institution sponsors numerous local events and shows up with their “cooking rig” to serve up traditional Louisiana favorites rather than the typical hamburgers and hot dogs. This change in menu makes them stand out in the crowd.

Rereading what I’ve written, it looks like my Southern Baptist roots are showing. Community institutions that are truly part of their communities occupy an enviable position in terms of their connection to local businesses and consumers. Couple that with an evangelical enthusiasm for helping the community and the institution should become so deeply rooted that it can withstand any economic storm.