Falling Balance Caps for Reward Checking Accounts

by. Ken Tumin

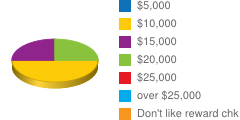

In the last month we have seen several banks and credit unions not only lower the rates of their reward checking accounts but also lower their balance caps. The balance cap is unique to reward checking accounts and is probably overlooked by the average Joe who’s not familiar with reward checking. However, savers know the balance cap is as important as the rate.

The vast majority of reward checking accounts only pay a top rate for balances up to a certain level. For example, some banks pay 2.00% APY for balances up to $25,000. The portion of the balance over $25,000 will typically earn a much lower rate like 0.25%.

One reason for the balance cap is that reward checking accounts are helped by the account holders making debit card purchases. Every reward checking account requires the account holder to make a certain number of debit card purchases each month. The bank receives a small percentage of each debit card purchase through interchange fees. I’ve heard this averages around 1% of the purchase price. So if you make $1,000 of debit card purchases, the bank receives around $10 from the interchange fees. This helps the bank pay the high interest rate.

The problem with debit card purchases is that they don’t always increase with larger balances. Someone with a $25,000 checking balance probably won’t be making 5x the amount of purchases than someone with a $5,000 balance. In summary, the value of debit card usage has diminishing value to the bank as the account balance increases.

continue reading »