Finally a Tailwind?

With declining interest rates and anemic total loan growth for the last three years, it’s nice to see the winds may be changing. In the October Credit Union Trends Report, Dave Colby talked about year-to-date loan growth increasing to 2.7% driven by a surge in auto loans within the industry. We thought we’d share some additional industry analysis and key market drivers that lead us to be optimistic around continued auto loan growth.

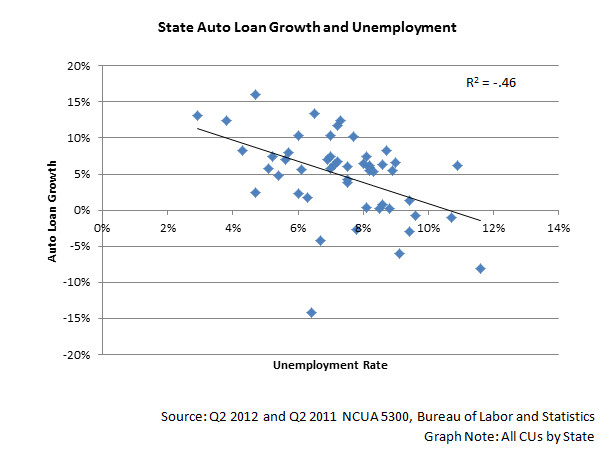

Our analysis shows that there is a significant correlation between auto loan growth and the unemployment rate of the state in which the CU is located. North Dakota, for example, had a 2.9% unemployment rate in June 2012 with auto loan growth of approximately 13% over the last year.

It’s also no surprise that membership growth is correlated to auto loan growth as you have to be a member to get a loan. Could the hardships of the captive auto finance companies and credit unions’ willingness to lend in a challenging economic environment be driving the strong membership growth in the system?

Although we saw strong correlations with location and membership, the size of the credit union doesn’t appear to be of any significance.