Financial education in school: It’s time to close the gap

Think back to how you learned how to manage your finances—were you taught about money from teachers in school or family members at home or were you self-taught through trial and error?

If your answer is from family members or through trial and error, you’re not alone; these are the two most common ways that Philadelphia Metro Area residents report to have learned about various personal finance topics. And while trial and error can provide invaluable learning opportunities to some extent, over the past year, there is an inherent value in being able to turn to a reputable financial source to answer any questions while wading through uncharted territory.

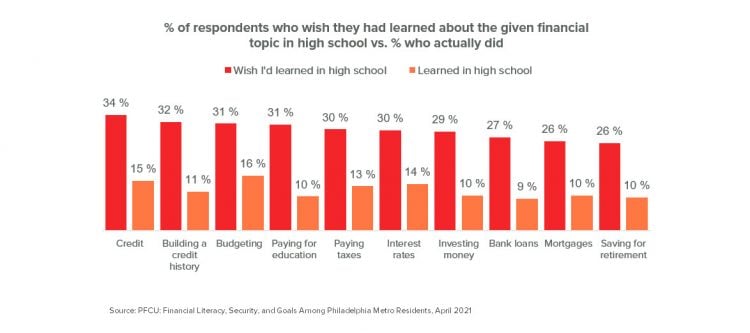

Philadelphians Wish They Learned About Personal Finance in School

A recent study conducted among more than 700 residents of the Philadelphia Metropolitan Area highlights a staggering discrepancy in financial education efforts: high school is the most common place that Philadelphians wish that they had learned about all elements of finance surveyed, but very little financial education is happening in schools. For instance, more than a third of respondents (34%) wish they had learned about credit in high school, but only 15% did. Similarly, a third (32%) wish they had learned about building a credit history in high school, but only about 1 in 10 did (11%).

The Magnified Need to Close the Gap in Financial Education

As credit union leaders, we have a duty now more than ever to ensure that our members feel supported from both a financial and educational standpoint in all of their financial endeavors. Those who didn’t have the opportunity to learn about personal finance from a teacher in school are now seeking credible resources from institutions they can trust, and we can fill that gap.

Putting Finance at the Forefront

By making educational webinars, blog posts, and other credible resources accessible, credit unions can arm their members—and others in the communities they serve—with tools and knowledge to help them feel financially savvy and secure.

But credit union leaders should take this one step further by extending any financial education efforts to reach students, particularly during their most formative years: middle and high school. Having the power to shape students’ perceptions of personal finance is invaluable, and because the subject matter taught in the classroom is largely dictated by the school district, credit unions are in a unique position to fill that gap by bringing personal finance to students in other stand-out ways.

When engaging students with content that can sometimes be rather dense, it’s important to take a creative approach, and, considering the current pandemic, an engaging one at that.

When conceptualizing a campaign designed to reach students, credit union leaders should keep these three tips in mind:

- Keep it simple

Money conversations can fall flat among students when using industry jargon or teaching concepts that don’t apply to their current situation, so keep any initiative, content, or campaign as simple as possible. What’s important is that the content or activity is approachable and that it helps establish a solid foundation of personal finance knowledge that the student can continue to build on as they navigate through life.

- Lean on your network

If the credit union has a partner—whether corporate, non-profit, or other—that is connected with students in some way, leverage that connection! To engage with middle school students through a creative contest to celebrate Financial Literacy Month, PFCU leaned on its partner Spark Philadelphia, a local nonprofit organization that engages communities to provide career exploration and opportunities that help middle school students understand, experience, and pursue what’s possible.

By teaming up with Spark, we were able to tap into local middle schools and find out what financial literacy and security mean to students, as well as what financial goals they had set for the next 5, 10, or 15 years. We found that students are more in tune with the core definition of “financial security,” and that they’re already hungry to work toward setting themselves up for financial success.

- Establish a long-term connection

If your credit union doesn’t already have a partner that is somehow connected to students, consider doing some research into local organizations to explore a partnership, as the opportunities to shape students’ minds in unique ways are endless. For example, through PFCU’s long-term partnership with Spark, we also hold workshops with middle school students, teaching them various topics such as budgeting and saving through hands-on activities—all while showing them what a career at a credit union could look like. These types of partnerships can help ensure your credit union is investing in your community in a meaningful way, further establishing your local presence and adding value to your offerings.

Closing the gap by further integrating personal finance into schools isn’t going to be an overnight phenomenon, it’s going to take time and effort. As you start to plan for the next quarter or year, think about the various ways your credit union can inspire and encourage local students to get excited about personal finance. You may be surprised at how eager they are to learn from you!