From payments to money movement

There are some big changes that have shaken the world of payments. It is no longer just about debit, credit, and card-based transactions. Payments is about Money Movement – a relationship between merchants, consumers, and the issuer for both consumer and business transactions.

Let us take a look at some of the innovators and also the traditional money movement providers who have reemerged:

PayPal and Venmo offer a comprehensive suite of payment options for consumers and merchants. The consumer experience they provide sets very high standards for most brands. And do not forget, PayPal owns Venmo making it another very powerful FinTech offering.

Stripe offers fast, secure, and seamless transactions for online businesses. Through a suite of API’s, they offer ease of connectivity to enable convenient money movement between the merchant and a consumer. Still a privately held company, their market valuation is over $22 Billion.

Adyen is a single payments platform that facilitates money movement for brands like Uber, Spotify, and Microsoft. They facilitate omni-channel commerce – accepting payments anywhere on any device, serving both digital and physical brands. Their market valuation is a staggering $24 Billion.

Apple launched their credit card with complete perfection. Financial institutions can learn a lot from the application and fulfillment process. In an article published by The Financial Brand, my dear friend Andre Iervolino details nine steps that make the user experience exceptional.

One97 Communications is a digital commerce platform that facilitates pay-through-mobile transactions through a subsidiary called Paytm. They are a testament to a movement that shows that a brand that can own payments, will own the financial relationship. Their transaction frequency in India is staggering.

Fiserv purchased First Data in a $22 Billion deal to address multiple opportunities in the world of money movement. The opportunities to integrate payments into the many core banking and digital banking applications offers immense promise. I addressed this merger in a prior article.

The FIS purchase of Worldpay for $34 Billion further emphasized the need for bringing together merchant and issuing solutions. Their focus now is to address the entire spectrum of money movement. My prior CUInsight article addresses the need for a secure, convenient, data rich transactional wallet.

Nimbler organizations continue to chip away and innovate to gain market share. Brands like Payveris, Payrailz, and Finovera give issuers the opportunity to offer customized user experiences. These are agile brands that will have to prove that they can scale and still offer exceptional personalization.

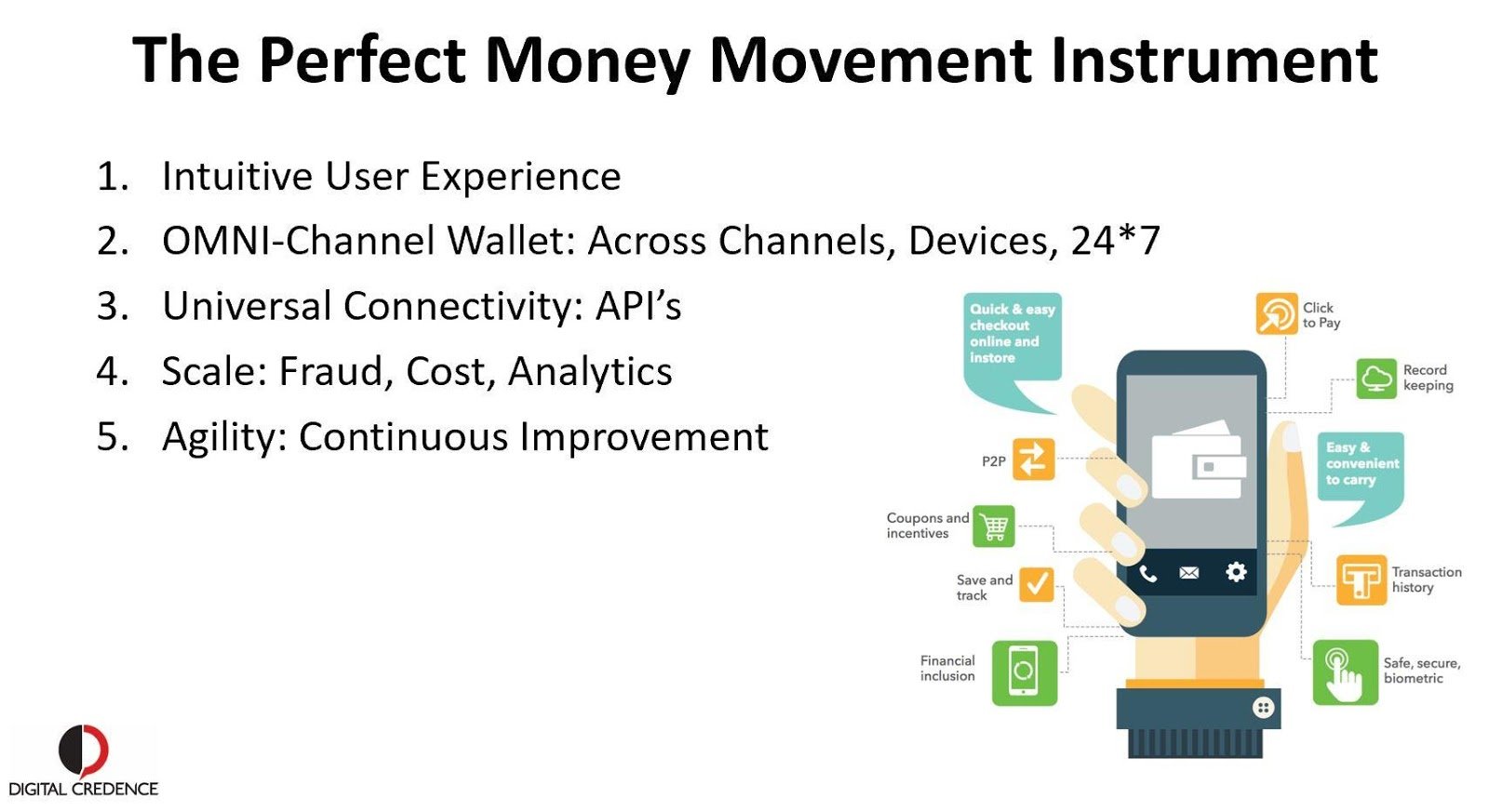

So how does one select a payments/money movement provider? Here are a few considerations:

- Can they offer what the market desires – convenience, security, and transaction incentives?

- Can they bring together merchants, issuers, and transactors?

- Can they scale to address service, fraud, and cost?

- Do they have the agility to keep innovating and delivering value?

- Can they offer exceptional, “Apple-like” experiences?

There are three parts to why consumers and businesses transact with a financial institution:

- Financial institutions offer a trusted place to collect, save, and grow money

- Financial institutions offer you loans to fulfill needs and aspirations

- Financial institutions allow you liquidity – they facilitate money movement

If your brand is seeking ways to stay top of mind with those you serve, you need to think about being relevant. Relevance comes from offering value and being part of everyday transactions – it about being part of everyday money movement.

It is about the Golden Triangle of financial services. You should lead with money movement. It is how you add value to the relationship. The consolidation in the industry is driven by an absolute need to scale. Gary Norcross, the CEO of FIS said it best, “scale matters in our rapidly changing industry.”

No doubt, money movement comes with a lot of complexity and a multitude of options. Your first step should be to put together an elaborate payments/money movement strategy. How should you go about doing this – should you hire a consultant?

Remember the fable of the two cats who asked a crow to help them equally share a fish? The crow nibbled on one side and then on the other and finally flew away with more than he gave the two cats. Do you really need to hire someone to help you define your payments strategy, help select solution providers, and then negotiate what they think is best for you?

You can do this yourself and in your best interest by having an elaborate money movement strategy. Join me on October 8th, 2019 for thoroughly researched webinar, based on interviews with over 100 payment executives, on how you can do this entire process on your own. And yes, you will keep most of the fish for yourself!

You can email me at sundeep@digitalcredence.com to join the learning.