“Good 2 Gross”: Credit unions are the answer for Wells Fargo customers jumping off the stage coach!

Recent admissions by Wells Fargo Bank employees that they were opening un-authorized accounts, committing fraud and invasion of privacy on their customers has rocked the financial services world leading to congressional and department of justice investigations. These employee activities have called into question ethical banking practices by the one-time cited best bank in America by noted business author Jim Collins in his best-selling book “Good to Great”.

The mantra of getting the right people on the right bus and getting them in the right direction and then sole blaming employees for its customer practices has shown a dismal failure of leadership at Wells Fargo.

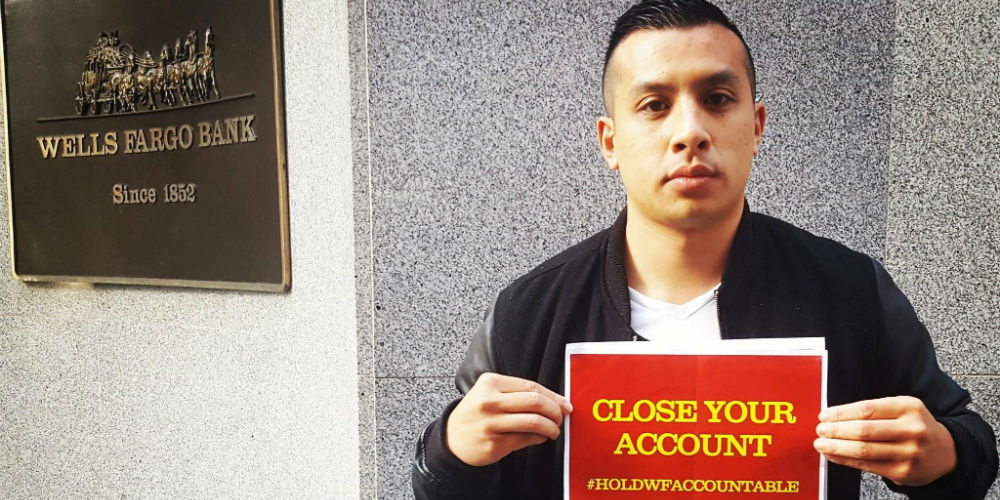

Credit Unions should take advantage of this opportunity to capture more market share in a “Bank Transfer Day 3.0” type of local campaign. Thousands of disgruntled Wells Fargo Bank customers are jumping off the stage coach and will be looking for a new ethical financial institution to do their business.

Credit Unions should leverage their locally owned “Member-Centric” People Helping People philosophy to grow their business and expand market share. They now have 4 Key competitive advantages going for them: 1) Choice 2) Access3) Resources 4) Ethical Treatment of Members.

Credit Unions offer products and services to members based on individual needs not fraudulent practices to meet sales quotas and pushing to increase accounts per household. Credit Union staff work with their members as a partner or their “Members Financial Advocate” in determining what is best for the member not the credit union.

These differences should be highlighted as part of the Credit Union Brand in promoting credit unions as safe and ethical financial institutions to join and do business with in your community.

The Ethical Treatment of Members is one of the core operating principles of the credit union movement and now more than ever that should matter when consumers decide to choose and stay engaged with a financial institution.

This is a time for Credit Unions to emphasize our greatness: why we do what we do–not what we do!