Here’s what 1,500 consumers said about the importance of payments and financial wellness

A new report from Filene Research Institute (commissioned by CO-OP), reveals that credit unions’ best growth opportunities emerge when they connect payments to the financial wellness of their members. Analyzing the responses of more than 1,500 consumers across two nationally-administered surveys, the report reveals what today’s consumers what and need from a Primary Financial Relationship.

Download the full report, “Payments, Financial Wellness, and Prospects for Credit Union Growth,” now.

Key Report Findings:

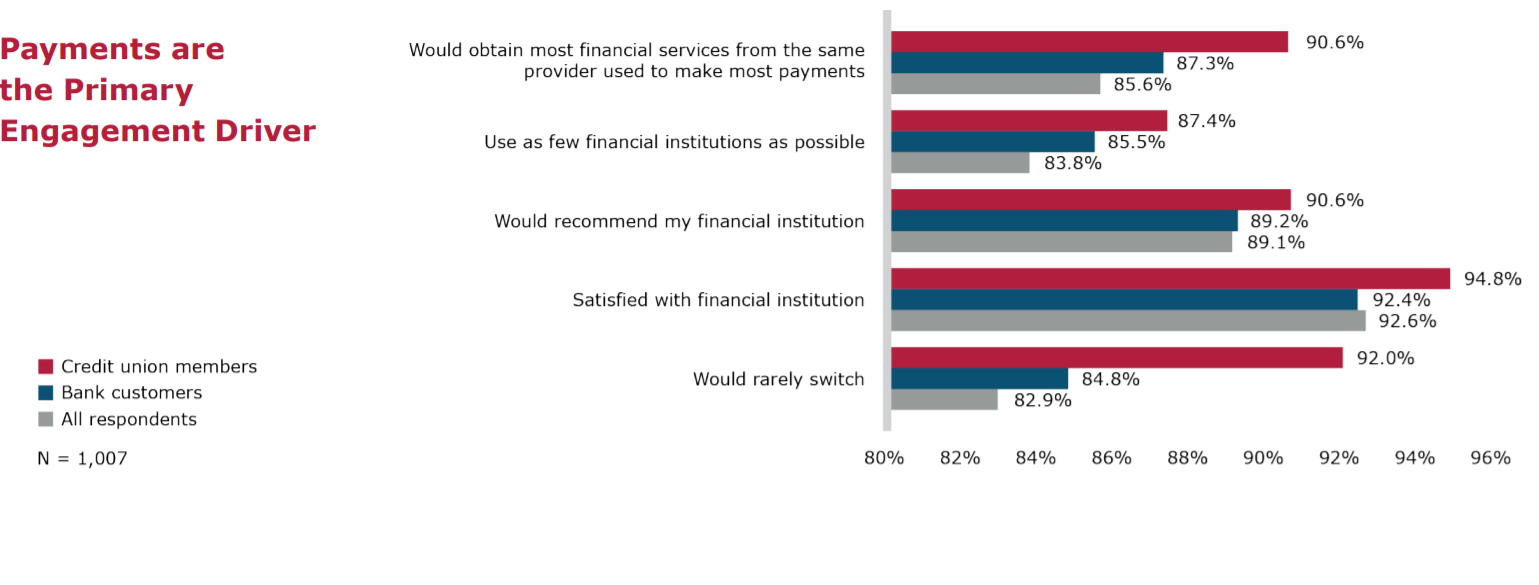

- 84 percent of consumers surveyed preferred using as few financial institutions as possible. Despite having access to more financial providers than ever before, today’s consumers prefer to aggregate financial services whenever they can.

- 86 percent said they would prefer to obtain most of their financial services from the same institution they use to make most of their payments. Payments are the primary engagement driver, and offer the clearest path for credit unions to support the daily lives of their members.

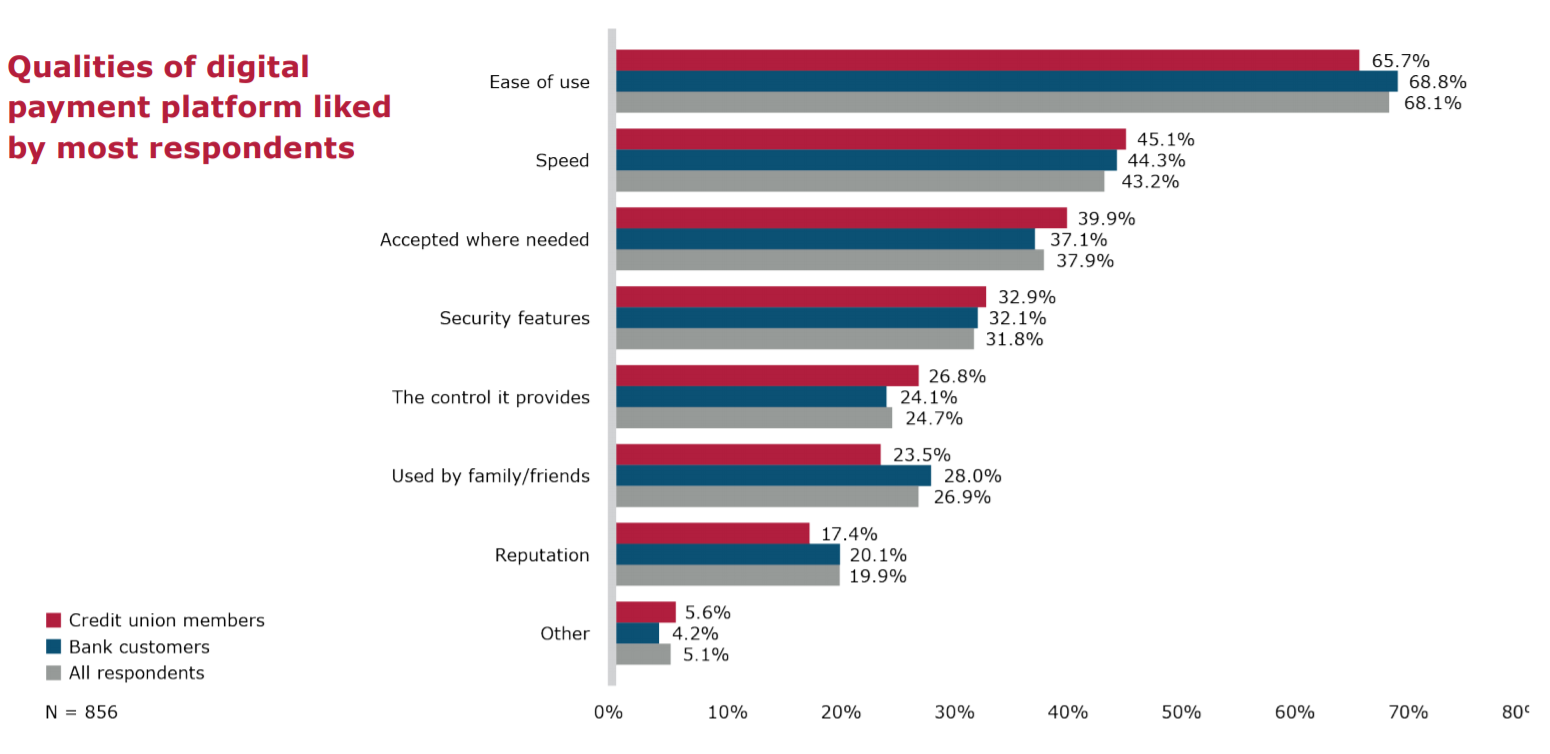

- When it comes to choosing a payments provider, respondents were most attracted to these qualities: ease of use, speed and widespread payment acceptance.

- Financial fragility increases dissatisfaction. Almost half (43 percent) of those with household earnings below $50,000 a year would consider switching financial providers, compared to just 13 percent of those earning above $50,000 a year. Nearly a third (29 percent) of those currently looking for work and 22 percent of unemployed respondents said they would consider changing providers.

- Financial wellness is more important than ever Consumers are now facing new financial challenges due to the COVID-19 crisis. The study found that 31 percent of consumers would have difficulty covering an unexpected $400 emergency expense. In addition, 34 percent don’t pay off their credit card balances in full each month – indicating an unhealthy reliance on debt. This level of financial instability has been rising in recent years as wages have stagnated and the gig economy has taken hold, resulting in a situation where just one financial shock can destroy a member’s household savings.

5 Recommendations for How Credit Unions Can Respond

Even as we begin to recover from COVID-19, credit unions must continue to prioritize their members’ financial wellbeing, offering products and services that help provide stability for their most vulnerable members.

This paradigm presents a strong opportunity for credit unions because they have always prioritized the financial wellbeing of their members. We witnessed this commitment to assist struggling members in the early months of the pandemic when numerous credit unions stepped up to offer payment relief solutions like skip-a-pay, fee waivers and proactive credit line increases.

Tools like card controls and alerts help members manage their spending. Analyzing member spend data within credit and debit portfolios can help credit unions unlock opportunities to improve the lives of members. Going forward, payments data will become even more important to understand as credit unions strive to strengthen the financial wellness of their members over time.

Credit unions must also continue to partner together, investing in the technologies and services that earn member trust and loyalty – and that lead to stickier member relationships down the road. That is where cooperatives come in – allowing credit unions to coordinate a long-term strategy by collectively participating in research and then developing future technologies that ultimately put all credit unions in a better position to compete.

The CO-OP/Filene report concludes with five recommendations on how credit unions can increase their understanding of members, address their financial needs, and ultimately become their Primary Financial Relationship (PFR).

To discover those five recommendations and how to implement them at your credit union, download the new CO-OP/Filene Research Institute report, “Payments, Financial Wellness, and Prospects for Credit Union Growth.”