“The biggest risk is not taking any risk. In a world that is changing really quickly, the only strategy that is guaranteed to fail is not taking risks.” -Mark Zuckerberg

In business, just as in life, there are many areas that require a fine line to be walked. There are choices we have to make every day in order to keep a delicate balance, such as knowing when to hire new employees or when to pull the trigger on a growth initiative.

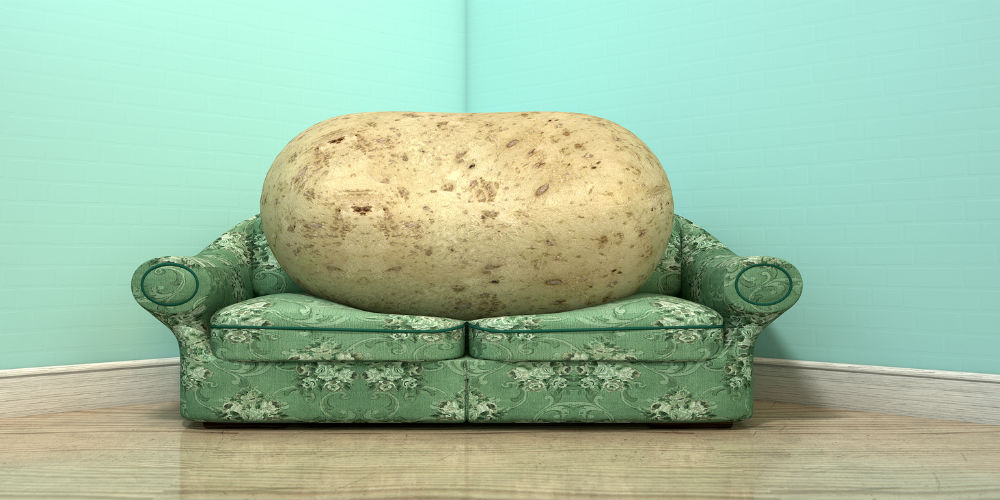

The most important fine line for the future of many credit unions is this: knowing when you are ready enough to move forward on taking action. There many innovative and successful credit unions out there, and then there are some that are shrinking year-after-year due to inaction. I call it the “Getting ready to get ready to get ready” syndrome.

The very best advice I’ve received in my career was when I interviewed in 2006 for the marketing and business development manager position for the then $37 million Members First Credit Union in Columbus, Ohio. My boss-to-be said, “We are not expecting a series of homeruns from you. We are a credit union that is successful because we consistently hit base hits. That’s how you win games.”

He also went on to tell me in my interview that they expect some of the things I try to fail and I was encouraged, because it meant I was being given permission to try new things and put us out there where we needed to be. It was this advice that made my choice to work for this credit union and CEO very easy, and it was the best decision I’ve ever made.

If you are waiting for the alignment of stars for the “perfect time” to do something - perfect economy, perfect employees, perfect budget, perfect location – I have two words for you: stop waiting. Perfect doesn’t exist. Not making a decision on something is still taking action – inaction being the action – but the result is that the situation is one you don’t control. You’re letting outside forces determine the direction of your credit union for you. As the United States Marine Corps says, “60% and go.” You’ll never have all you need to make a “perfect” decision for the “perfect” time.

That point being made, it is a delicate balance on that fine line. There are some businesses that take too much action and try everything new and shiny that comes its way in order to chase success. It’s frequently just a distraction from doing the real work of doing 2-3 things very well.

In your efforts to do a few things very well, there will be failures. Count on it. Make sure leadership is poised to reinforce the risk-taking mentality of those who are fearless in the face of potential failure, whether they succeed in a specific effort or not.

“If someone is always to blame, if every time something goes wrong someone has to be punished, people quickly stop taking risks. Without risks, there can’t be breakthroughs.” -Peter Diamandis

2016 is here. What are you going to do this week, this month, this year to move your credit union forward?