Lack of urgency could doom the future development of an ‘intelligent bank’

Are traditional banks and credit unions prepared to invest the time and money required to become intelligent financial partners to an increasingly demanding consumer? More importantly, are they prepared to expand their service offering to take advantage of open banking regulations while still protecting the customer data that provides the basis for differentiation?

The status quo in retail banking is tottering. It’s under siege from new technologies, new consumer expectations, new competitors and new regulations. This has forced banks and credit unions to modify their business models, re-prioritize investments, change products and services offered and ramp up innovation efforts. There has also been a rethinking of distribution options, with digital channels significantly increasing in importance.

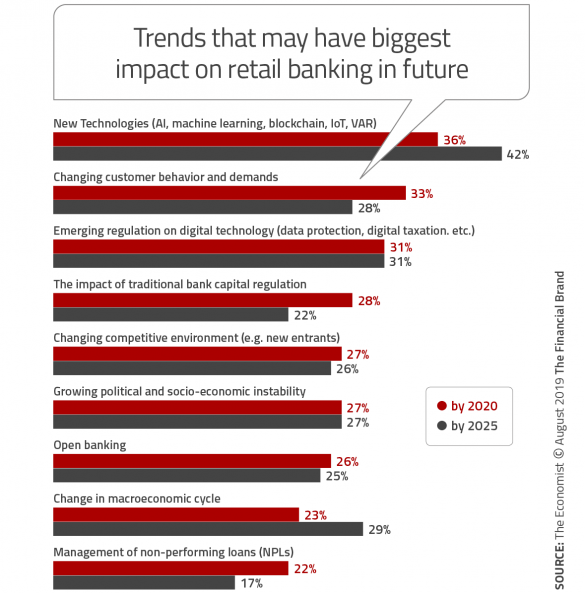

These shifts are reflected in the sixth iteration of a study of the future of retail banking conducted by The Economist Intelligence Unit, on behalf of Temenos. Until this year, the changes in consumer behavior were believed to be the primary impetus for changes in retail banking strategies. For the first time, the key driver for change is considered to be new technologies, such as artificial intelligence, machine learning, blockchain, the Internet of Things and other technologies underpinned by data and advanced analytics. And the forecast from those surveyed is that the importance of new technologies will only get greater in the future (2020 to 2025). This is reinforced by the importance of regulations on data technology – which is also projected to increase in the longer view.

continue reading »