Looking back on 2019: A financial institution’s perspective on what’s to come in the new year

2019 will undoubtedly go down as one of the ugliest political circuses in U.S History. However, 2020 may top it with the upcoming election, ongoing impeachment and anticipated onslaught of negative rhetoric. There was economic and monetary uncertainty, as well as political instability, at home and abroad that expanded throughout the year, yet the markets showed a strong resilience with the DOW, NASDAQ and S&P up for the year.

Dow Jones (as of 1/3/2020)

NASDAQ (as of 1/3/2020)

S&P 500 (as of 1/3/2020)

Despite the tumultuous backdrop, the Atlanta Fed anticipates the Q4 GDP will end strong, around 2.27 percent, with consumer spending experiencing the best back-to-back quarters in nearly a half decade, as GDP was steady throughout 2019.

In addition to consumer spending, a resolution for trade issues is the catalyst that the economy needs to maintain momentum into the new year. The effects of the U.S./Canada/Mexico trade deal will begin to take hold in 2020, along with phase one of the U.S. China trade agreement. Economists and the Fed have forecasted continued growth in 2020 by upwards of 2 percent. Rising wages and low unemployment have also provided fuel for consumer spending.

There is still concern, however, that the current political environment and global instability could prove to be toxic to the economy. With the pending impeachment and upcoming election, the mainstream media message of perpetual doom and gloom could affect consumer sentiment.

In other news, the U.S. again remains the largest global producer of oil in front of both Russia and Saudi Arabia. Additionally, the Federal Open Market Committee is projecting a neutral position on interest rates in 2020 after aggressively tightening into mid-2019. The drop in interest rates has led to a rebound in the housing market during the second half of 2019 and contributed to the stock market rally.

Federal Open Market Committee (FOMC) – Rate Adjustment

The yield curve inverted in June 2019, but has since normalized. Historically, the market looks for inversion between two and ten years as an indicator of a potential recession. The Fed reacted quickly to provide liquidity access to the markets and stimulus, which proved to promote growth.

The Fed reversed course in 2019 with three rate cuts totaling 75bps. In addition, the Fed was forced to begin interacting in repo operations in September 2019 to the tune of $100 billion plus in effort to provide liquidity to the overnight markets. The Fed also began a $60 billion per month T-Bill purchasing program that they do not want to call QE (Quantitative Easing). Tepid inflation has left the Fed leeway to ease even with steady economic growth.

Whether these actions were beneficial in the long run remains to be seen, but markets clearly benefited from monetary policy in addition to solid economic growth in 2019.

Regulatory Factors

From a regulatory standpoint, on Dec. 12, 2019, the FDIC proposed new rules for governing brokered deposits. The proposal includes:

- The definition of deposit broker

- Exemptions to the definition such as primary purpose

- Application process to qualify for exemptions

Some of the main provisions are:

- Clarification of the term facilitation as it pertains to sharing third party information with financial institutions;

- Creation of exemption for wholly owned subsidiaries of a financial institution in which deposits are placed with that financial institutions;

- Broadening of the primary purpose definition to include deposit placement activities that are less than 25% of total assets under management in specific business line;

- Broadening of the primary purpose to include placement by agent or nominee for purpose of enabling payments by the depositor;

- Clarifying where non-exemption would exist in circumstances to savings programs; and,

- Formalizing the process to apply for Primary purpose exemption.

Based on the outcome of new FDIC proposal, financial institutions should have access to additional funding sources that were previously deemed brokered.

Deposit Factors

Throughout 2019, a major theme among financial institutions was to grow or maintain deposits by staying short in duration. With potential rate cuts, financial institutions looked to stay short by protecting their cost of funds. Depositors became more rate sensitive, setting up a situation of competitive rate shopping.

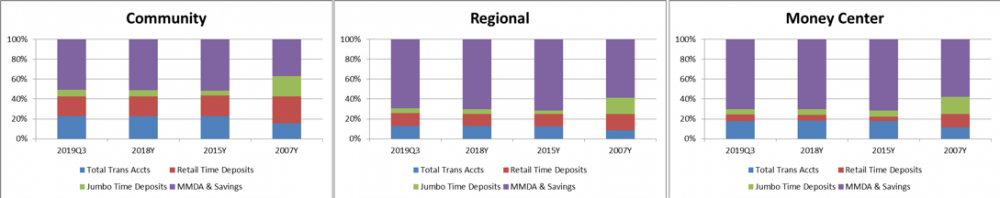

Figure 1 above highlights the changes in deposit types (Time Deposits, Non-interest Deposits, and MMDA Deposits) for community, regional, and money center financial institutions. There are a few major observations from these charts. First, since 2007, all financial institution sizes have increased their balances of MMDA Deposits. However, since 2015, larger financial institutions, like regional and money center institutions, have grown their usage of time deposits from both retail and jumbo clients. Community-sized financial institutions have remained fairly steady in their deposit composition.

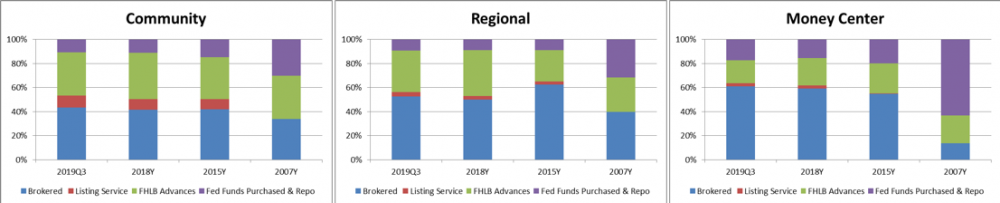

Switching gears, and looking at wholesale funding vehicles in Figure 2 (Brokered Deposits, Listing Service Deposits, and FHLB Advances, and Fed Funds), we can see some trends on how financial institutions have been funding recent deposit growth. Since 2015, both money center and community-sized financial institutions have grown their usage of brokered deposits. However, more regionally sized financial institutions have grown their usage of FHLB Advances. Also noticeable is how all financial institutions have grown their usage of listing services deposits.

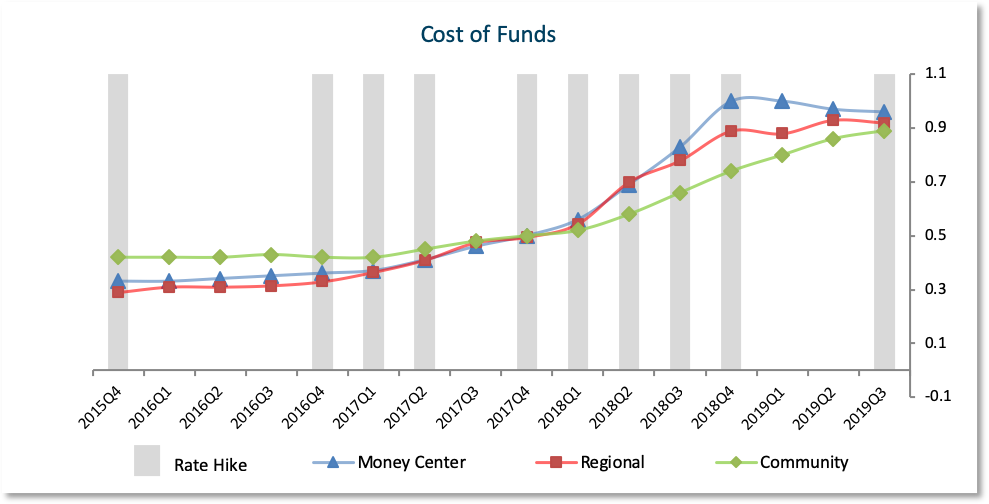

Figure 3 above highlights the cost of funds on a quarterly basis for all financial institutions, with the bars highlighting the quarter during which a rate hike occurred. 2019 saw a convergence of cost of funds amongst all financial institution sizes. However, depending on the institutions size, there was a mixed experience from a beta perspective. Money center intuitions saw gradual decreases in their cost of funds, as they price deposits more closely to market based indices. Regional financial institutions remained relatively flat from a year ago, but saw some volatility in their cost of funds in the beginning of the year. Notably, community financial institutions continued to see their cost of funds rise as their deposit pricing models tend to lag the market.

Conclusion

From a financial institution perspective, the Fed policy change to a more accommodative approach, though with multiple rate cuts and liquidity injection, put the economy on stabile footing to promote growth. In addition, the resolution of trade issues should promote additional corporate investing, along with strong consumer spending, and has the potential to fuel strong loan growth. Lastly, with the introduction of redefining brokered deposits, financial institutions have the potential to open up a variety of funding sources that were previously considered brokered deposits to help promote funding loan growth.

Co-author: Todd A. Terrazas