Mabuhay Credit Union: An innovation in action

Two years ago, I started my Filene i3 journey. I am learning about innovation, how to create it, implement it, considerations that are necessary for a successful launch, and how to present to get buy-in.

The i3ers have recently been challenged to find innovation in practice by a credit union or CUSO that has not been wildly adopted by all credit unions but could. The voting for the i3 group that has the best innovative idea will be ending Tuesday, February 22. The winner will be highlighted at the Filene Chair Breakfast at the CUNA GAC on Monday, February 28.

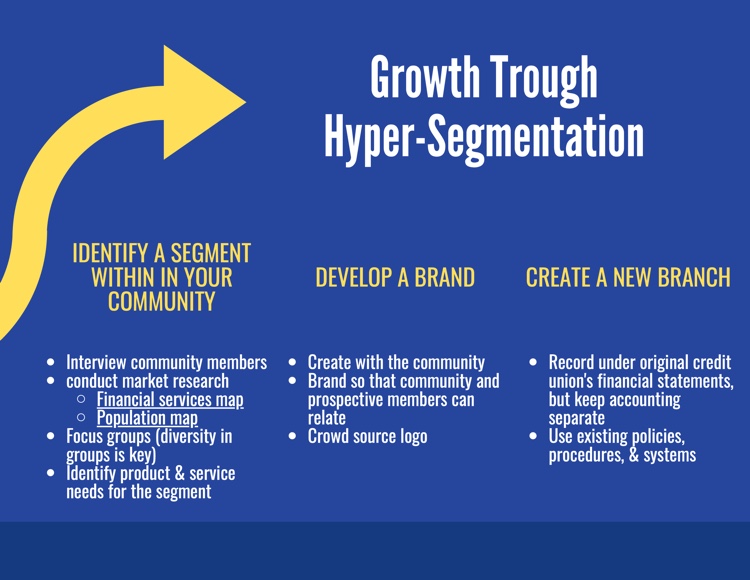

The innovation my group will be showcasing is Mabuhay Credit Union, a hyper segmented division of Nikkei Credit Union made to serve Filipino Americans. Nikkei Credit Union has served the Japanese American market for 70 years. Jon Hernandez and his team recognized their members as savers; however, they also identified a niche market within their underserved community that could use a lender. Nikkei Credit Union extensively engaged the local Filipino American community in the formation of Mabuhay by having focus groups, identifying Filipino leaders in the community, and forming an advisory council, so the new credit union represents the voices and needs of the community it serves.

The innovation is not that Nikkei Credit Union created a new credit union; they established Mabuhay Credit Union as a Division of Nikkei Credit Union; rather, the innovation is that Mabuhay Credit Union has its own distinctive brand experience but shares the same core system, website, charter, and even a dual logo of both brands on debit and credit cards. This unique strategy made it possible to move quickly to expand and grow, keep things simple, and reduce costs and overhead for the credit union.

To see more specifics, here is a link to our video and handout on the Mabuhay Credit Union. We hope we can count on your vote, but more importantly, we hope you use hyper-segmentation to find underserved parts of our communities and provide them with financial services and help, just like how Roy Bergengren, Edward Filene, and Louise McCarren Herring sought out too when they created the US credit union movement.