Millennials aren’t satisfied with their credit union’s rewards programs

The role a financial institution plays in the lives of consumers has shifted dramatically. Even though everyone knows this, many credit unions are doing far too little to adapt to the winds of change.

Thankfully there is exhaustive, independent research – like that of Accenture’s 2015 Consumer Banking Survey – that provides a blueprint on what is needed. This multi-year study is a must for credit union executives to digest, as it shows consistent year-to-year trends that represent seismic shifts in member expectations.

(Full disclosure: Buzz Points has absolutely nothing to do with this research. While this should go without saying, since many of the findings are so perfectly aligned with the solutions offered via the Buzz Points debit rewards program, it just seemed best to make that clear!)

Making Lemonade: 4 out of 5 Americans see their banking relationship as transactional.

Ticking upward each year, 79% of consumers now view their banking relationship as a commodity for paying bills and making payments. Big picture: this is bad news. Credit unions want to be a valuable part of their members’ financial well-being. But the research provides a path to overcome this trend, and to make some very sweet lemonade in the process.

The key: consumers want value-add services, and not the tried and true ones.

To wit, 54% of consumers are interested in their financial institution proactively locating discounts on purchases for them. This is the highest ranking feature – even ahead of proactively recommending financial products!

This seems crazy at first glance. A pillar of the financial community reduced to a bargain finder! But what do members use their credit union for several times a day? Making purchases. Makes perfect sense when you think of it that way.

So become better at facilitating purchases. Buzz Points is but one way to do so. The rewards program uses transaction history to present special discount offers at local businesses that are tailored to the individual member’s preferences. For credit unions, the ensuing lift in interchange revenue is the meringue on the pie.

We’ll also see how that “local business” differentiator becomes even more important in acquiring new members.

No rewards? Millennials will find them elsewhere.

The 2015 Accenture study finds that “Millennials point to high fees and poor loyalty programs as the top reasons why they are dissatisfied with their banks.”

We all know everyone hates banking fees. Turns out millennials consider a lackluster banking rewards program as equally reviling.

The significance goes beyond the fact that millennials are the largest living generation in the U.S., and responsible for $600 billion each year in consumer spending.

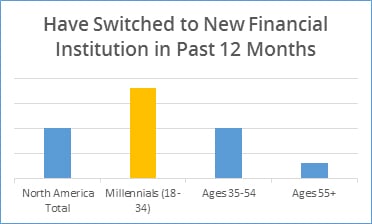

The big takeaway is that millennials are nearly twice as likely to switch from their primary financial institution as any other age group. A fact proven by them actually doing so, not just stating intentions.

Perhaps even more eye-opening is that 45% of millennials bank exclusively with their primary financial institution. No other age group is even close to this loyalty mark, and the relationship/revenue implications are obvious.

Another reason to be optimistic is who the benefactors of the millennial bank-ditching are.

The survey data shows local, community banks as the biggest “winners” with a 5% migration of millennials their way; credit unions fared well also with a 3% growth in new millennial members. Large regional and national banks meanwhile lost 16% of this age group.

This “local first” preference is not surprising. And it’s among the reasons Buzz Points aggressively promotes a “bank local, buy local” rewards program that rewards cardholders with 2X more points for buying local over a national chain.

In conclusion: we know consumers increasingly see their financial institution in a simple, transactional view. Instead of ignoring or fighting this tooth and nail, credit unions can meet members where their expectations are. There is short-term revenue to gain, but more importantly it creates a natural way to re-build the deeper relationship credit unions want from their members.

(All data from Accenture’s “2015 North America Consumer Digital Banking Survey.”)