A mobile-first approach: What is driving the competitive landscape?

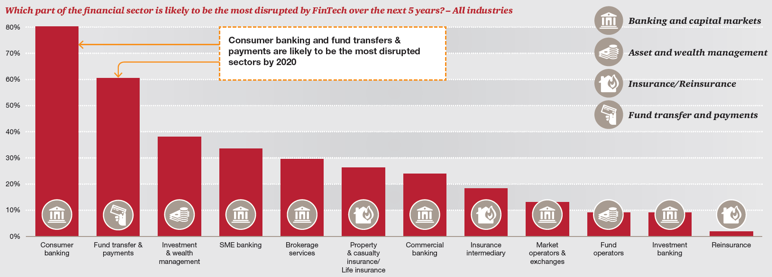

Finance and technology are colliding at a faster rate than the industry has ever seen. Evolving consumer behavior and expectations, in combination with the increasing presence of fintechs, are two main forces currently shaping the finance industry’s advances in digitization. PwC issued a report in 2016, revealing the sectors most likely to be disrupted over the next five years. The consumer banking sector was at 80%, (see Figure 1), making the banking industry the most likely sector to be impacted by current and upcoming technological advancements.

Figure 1

Source: PwC. “Blurred Lines: How FinTech is shaping Financial Services.” 2016.

When building or buying a mobile and online platform, there are basic technology requirements which all institutions look for, but innovation goes a long way in today’s marketplace. Below are a few emerging approaches which banks should consider.

Leveraging Location Services

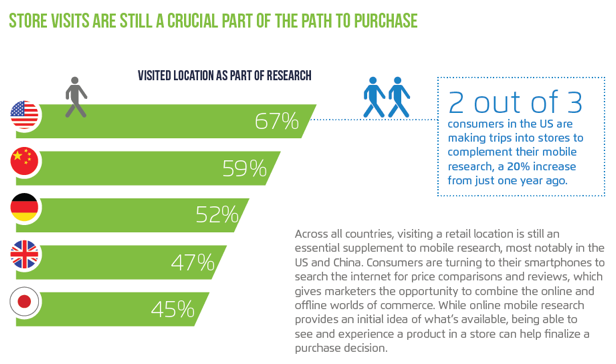

These days, when a consumer hops into their car, they likely look to their smartphone to tell them where to go, how long it will take to get there, and the fastest route available. Innovative approaches to a consumer’s location can allow banks to leverage these capabilities and turn them into portfolio growth. In a study performed by xAd, geared toward the purchase behavior of the retail shopper, research found that, “2 out of 3 consumers in the US are making trips into stores to complement their mobile research, a 20% increase from just one year ago.” (See Figure 2)

Figure 2

Source: xAd, Inc. “Mobile Path To Purchase: The Global Retail Shopper.” 2016.

A consumer onsite at a car dealership could receive a text from their bank that they are pre-approved for a car loan. Or a customer at a furniture store could access a personal line of credit while browsing for a new living room set. Accessibility to your current customer base through location services is a relatively new tactic to the mobile-first approach, but it is becoming a popular method across all industries.

Speed is Crucial

While being present in the mobile world is important, without speed (powered by a robust backend solution), a customer’s demand for an instant response cannot be met, potentially resulting in lost opportunities. Even if that response is a rejection, consumers want to know, and they want to know right away. To support this demand, it is important that banks own a strong backend decisioning engine, and also deliver easy-to-use technology, including the ability to support the consumption of data without asking the consumer to manually enter it (such as driver’s license-scanning capabilities and prepopulating data from multiple external sources).

Personalized Services and Products

Being in the consumer’s pocket can be extremely powerful, especially because it opens the door to offer additional products and services. Consumer data can be leveraged to automatically evaluate and display products and services tailored to the consumer’s behavioral history and demographics – ensuring that your offer is of value to your customer. Banks should demand technology that can provide these personalized, pre-approved capabilities, right in your customer’s pocket.

Voice Recognition

In today’s world consumers are able to talk to their smartphones for functions like sending emails or to look up movie times and recipes. They can talk to their television or speakers to change the channel or volume. Products that provide smart services such as Google Home and Amazon Echo are coming to the market at a swift rate. These types of major technology companies are defining consumers’ expectations and behavior, and this trickles down to the retail world, including the financial services sector. It won’t be long before consumers expect banks to provide voice recognition technology.

Open API Architecture

Application programming interfaces (APIs) are the most important building block for banks when evaluating or revamping their mobile-first approach. Technology solutions that house APIs will provide a scalability that can serve as the foundation for banks looking to remain competitive, or even pull ahead. Allowing your bank to be boxed in by the technology capabilities of one provider is limiting in today’s market, and will hinder any future endeavors. With an easy-to-use API, it’s easier to attain innovative offerings and support emerging market demands like those covered in this article. A single financial services technology partner may not encompass all of the tools necessary to meet consumers’ behavior; however, access to an API can help both the vendor and the bank deliver on those expectations.

The race to deliver a mobile-first approach is on. How will your bank compete?