Mortgage hedging in the secondary market: Hedging with securities

The mortgage-backed security (MBS) market has seen some changes in 2021 stemming from the Federal Housing Finance Agency (FHFA), the agency responsible for regulating Fannie Mae and Freddie Mac (the “GSEs”). Perhaps the most notable is the cash window cap, which restricts lenders to $1.5 billion in loan sales on a 4-quarter basis to each one of the agencies. In effect, this would likely lead to a growing number of MBS issuers. Agency MBS issuance has burgeoned over the last year. According to data from the Securities Industry and Financial Markets Association (SIFMA), 2020’s $3.3 trillion in Agency MBS issuance is double the prior decade’s average and the highest year on record. Whether lenders are securitizing on their own or not, now may be a good time for a refresher on hedging mortgage lending with securities.

TBA MBS

Hedging mortgage pipelines with securities involves using the to-be-announced (TBA) MBS market. A TBA MBS contract, or simply TBA, is a contractual agreement to buy/sell Agency MBS at a future date at a specified price. It is a forward contract, making it a derivative instrument. Much like futures contracts on financial instruments, these contracts can be used to manage risk, and the delivery of the underlying securities need not occur through the process of cash settling. Hedging is a tool used to ensure the price change of a group of loans is offset by the value of a change in the hedging instrument.

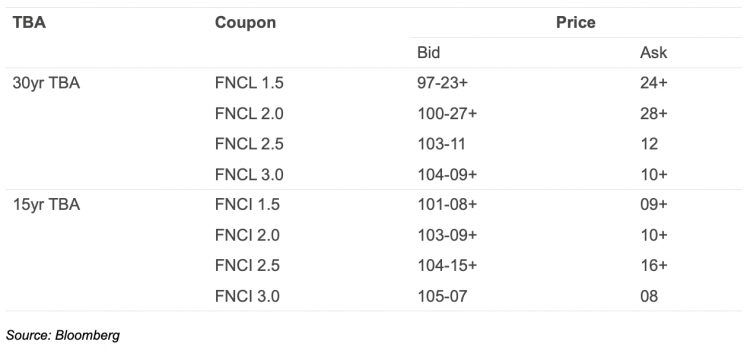

The TBA market itself is very large. As mentioned before, Agency MBS issuance is in the trillions of dollars annually with hundreds of billions of dollar volume traded daily. TBA pricing and trading can be accessed through TradeWeb, an electronic trading platform, along with numerous other market makers. Figure 1 shows an example of TBA pricing. FNCL refers to 30-year Agency MBS and FNCI refers to 15-year Agency MBS. Pricing quotes are in 32nds; a “tick” refers to 1/32nd while a “+” refers to one-half of a 32nd. For example, FNCL 2’s bid price, which is a contract to sell 30-year 2% coupon Agency MBS, is 100.86, calculated as: 100 + (27.5/32).

Cash Window

The cash window is a secondary market for conventional mortgage loans operated by Fannie Mae and Freddie Mac. It can be used as a spot market for immediate delivery, such as a 1-day or 5-day delivery, or for a future date, such as 90 days. The further out the future date, the lower the pricing, as the lower price compensates Fannie/Freddie for the carry of the asset and the cost of their hedging efforts. Thus, with cash window sales the GSEs are responsible for managing the pooling and security creation and will have to manage the risk of holding loans in between pooling cycles. The loans purchased are the raw materials which get created into Agency MBS and become tradeable in the secondary market.

The U.S. Treasury and the FHFA have mandated the continued support of small lenders through the cash window program to continue their support of broadening the secondary mortgage market. The goals are to continue supporting the mortgage secondary market and “level the playing field” for smaller lenders. As such, the GSEs are required to provide non-discriminatory and non-volume-based pricing. Cash window pricing is largely driven by TBA pricing, especially on an intra-day basis, where loan pricing may move almost exactly with the TBA market. There are a variety of other factors derived from the securities market that drive cash window pricing, depending on the product type. For example, the GSEs offer pay-ups for desirable mortgage characteristics such as low-loan balance. Also, there is no TBA market for 20-year and 10-year collateral, so these products also have associated pay-ups relative to TBA that are subject to change. Lastly, there can be some level of idiosyncratic changes from the GSEs in terms of pricing level. The Agencies have more control over cash window pricing relative to pricing in the bond market. This is mainly due to Buy-up/Buy-down grids only being posted once a month for MBS lenders while cash window execution can be adjusted when necessary.

Pooling and Securitizing

Securitization is typically done by larger lenders, where the lender would pool the loans into an Agency-guaranteed MBS security as opposed to selling the loans for cash. This security is then sold into the bond market and the lender captures the economics of the trade directly from the MBS market. Fannie calls this MBS Execution and Freddie calls this Guarantor Execution.

There is an economies of scale volume requirement since single-issuer pools require a $1 million unpaid principal balance minimum. Additionally, note rates must be pooled into the half-point coupon increments with a minimum 0.25% spread over the security coupon and a maximum 1.125% spread above the security coupon. Thus, enough volume must be generated across all product types and note rates on a monthly basis.

Managing Risk with Agency MBS

When selling at the cash window, TBAs can be used to hedge the price risk of the loan pipeline, which can give the hedger added flexibility relative to managing commitments. The TBA position is maintained for as long as necessary until the loan is ready to be sold, in which the shortest delivery option would likely be chosen to maximize price execution. Although TBAs have a monthly settlement cycle, they are always closed, or paired off, prior to settlement and cash settled. Through a process known as rolling, the hedges can efficiently be moved one month out. Thus, the position serves as a continual price hedge and no securities are delivered into the contracts.

Hedging in this manner decouples the hedge from the liquidity source, which also decouples the cash flow. Since the hedge (monthly TBA) settlement might occur at a different time than the loan sale event, gains/losses on the hedge may be received at a different time than the proceeds of the loan sale. Furthermore, a particular hedge instrument is associated with many loans, as opposed to a single loan, since the hedge is held at a portfolio level. Thus, performance should be viewed at a portfolio level over a longer time frame. However, this flexibility can be beneficial for operational and economic reasons. Depository lenders with funded balance sheets can benefit from interest carry on loans held for sale prior to being sold.

Figure 1: TBA Market Quote Example

Interested in learning more about mortgage pipeline hedging? Visit www.almfirst.com or contact us at info@almfirst.com.