Moving beyond out-of-the-box models

I’ve been working in and with credit unions for over fifteen years and in financial services for over twenty five. Based upon my experience, I believe that there is one critical area where credit unions have lost ground when it comes to capturing the consumer market for loans and other financial products; that area is, making fact-based decisions. Years ago, banks and credit unions were all in the same boat when it came to business intelligence technology. At that time, regulation was the biggest barrier for credit unions to compete against commercial banks, because computers were non-existent on both sides. Many on the banking side would now argue, with few exceptions, that regulation is less intensive on the credit union side of the equation. But banks, unlike credit unions, have embraced the insights and efficiencies that can be found in business intelligence technology. Therefore, they have created a competitive edge by understanding consumer behavior better than credit unions.

In a recent review of credit union portfolio performance data, it was found that some of the risk factors commonly used by credit unions to decision and price loans had very little impact on default risk using linear regression testing. In other words, when testing a single risk factor, keeping all other risk factors constant, there was no linear correlation between the increase in the risk factor and an increase in default risk. What was even more interesting and important to note is that the risk factors that impacted one credit union’s loan performance were not necessarily the factors that impacted another’s. So, what’s the point?

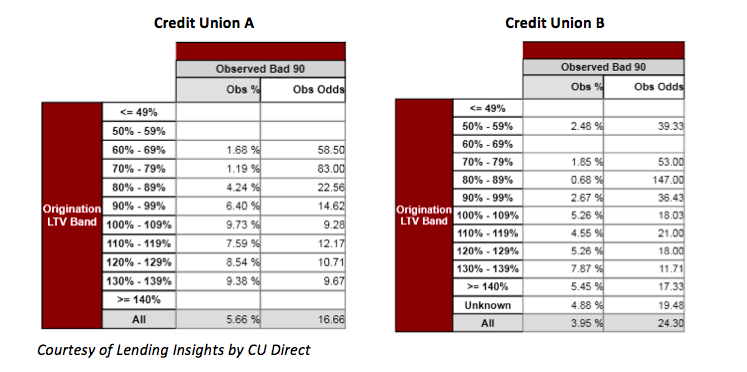

The point is, if your credit union is using risk factors and risk thresholds that you developed by cutting and pasting what other lenders have been doing in your market, and have not re-examined those risk factors over time, you may be doing more harm than good to your lending program. Here is an example of default risk from two different credit unions based on the Loan-to-Value (LTV) risk factor at origination.

In the example above, loan originations from 2012 were observed for defaults in the time since origination. It is clear, based on Credit Union A’s data, that there is a linear relationship between default probability and LTV; default probability increases as the LTV increases. However, the same pattern is not observed in Credit Union B, where the default probability seems more random. Most credit unions do not use LTV as a credit decision factor, but rather a factor in determining the maximum loan amount. However, if it is proven in the context of the credit union’s lending policies that LTV does have an impact on default risk, then perhaps it should be used in the decision criteria as well.

This reveals another issue related to risk modeling that should be considered. If the credit union is using a default or generic model of any kind, it should be understood that the model is not considering the uniqueness of the credit union in the model and is, generally speaking, statistically invalid for that credit union. In other words, what is true for the general population may not be true for a single credit union membership. This goes for credit bureau models as well as others for default prediction models. Even FICO® suggests that lenders introduce internally derived risk factors into credit risk models to be used in conjunction with a credit score. Credit unions should either do their own testing and analysis of data or contract with a vendor, like CU Direct’s Advisory Services, to conduct the testing using the credit unions own data. If this doesn’t sound like common sense to you, consider the same principle in a different context. If you have ever tried to lose weight, you know that different diets work for different people. That’s because our bodies metabolize food differently. Likewise, the uniqueness of each lender causes loans to “metabolize” in the portfolio differently.

In theory, this all sounds simple, and it is if you have the right data and technology in place. In truth, you probably already do — or have it available to you — but you simply haven’t taken the steps to capitalize on it. One of the greatest challenges that Advisory Services, or any other provider will have in assisting a credit union, is that the applicable data hasn’t been collected or hasn’t been stored in an accessible format. The credit union should be collecting and storing any information that it uses to assess risk during the application process. Common data points like credit score, income, LTV, term, etc. should be stored along with credit bureau details, such as inquiries and delinquent loan counts. This information will be invaluable when trying to determine which factors impact loan performance to the highest degree.