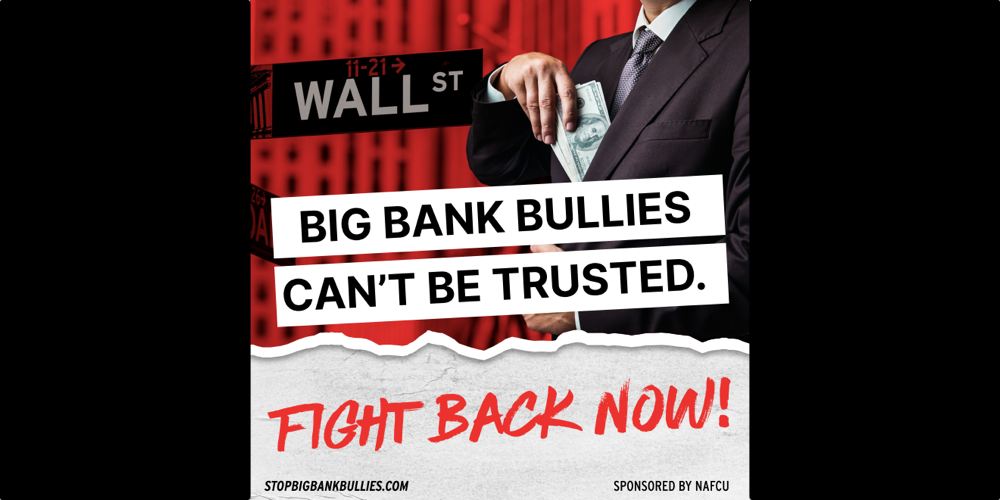

New NAFCU campaign, ‘Stop Big Bank Bullies,’ calls out banking industry misconduct

NAFCU today launched a national digital campaign with the goal of educating Americans on how they can limit the influence that Big Wall Street banks have over their finances and the economy. In addition, the campaign focuses on ways that banks take advantage of consumers in order to make a profit and urges consumers to join consumer-friendly credit unions instead.

The association launched this campaign in response to the continuous wrongful attacks banks and their trade associations have made against the credit union industry.

In the “Stop Big Bank Bullies” campaign, NAFCU underscores the $243 billion in fines paid by Big Wall Street banks for the harm they’ve imposed on consumers after violating numerous consumer laws. In addition, the campaign highlights the billions of dollars banks have spent buying back shares of their own stock in order to line their own pockets.

“It’s time for banks to be held accountable; their bad behavior has been overlooked for far too long,” stated NAFCU President and CEO Dan Berger. “Consumers have the power to stop these bullies by leaving their bank and joining a credit union. Credit unions put their 127 million consumers first and provide better quality financial products and services that consumers need. At a time when financial services are needed most, banks abandoned countless underserved communities resulting in a sprawl of banking deserts across our nation.”

continue reading »