Personal loans, credit cards lead loan growth in December

Credit union loans outstanding increased 1.0% in December, compared to a 0.6% increase in November of 2021 and a 0.2% increase in December of 2020, according to CUNA’s latest Monthly Credit Union Estimates.

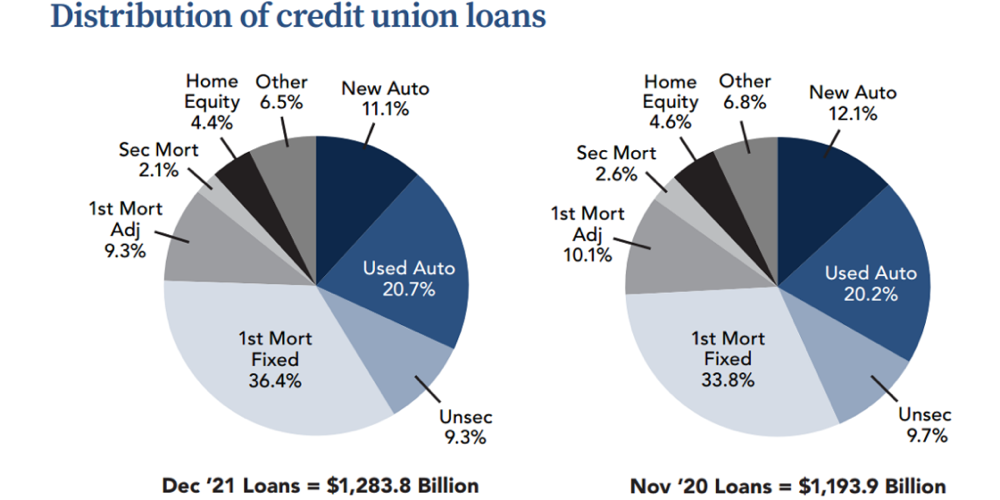

Unsecured personal loans led loan growth during the month rising (2.6%), followed by credit card loans (2.3%), fixed-rate mortgage loans (2.0%), home equity loans (1.2%), adjustable-rate mortgages (1.0%), used auto loans (0.7%), and new auto loans (0.3%). On the decline during the month were other loans (-1.8%) and other mortgage loans (-0.6%).

Credit union savings balances increased 1.4% in December, compared to a 0.1% increase in November of 2021 and a 1.9% increase in December of 2020. Share drafts led savings growth during the month, rising 3.5%, followed by money market accounts (1.4%). On the decline were one-year certificates (-0.5%).

Credit unions’ 60+ day delinquency remained at 0.5% in December like last November.

continue reading »