Planning to build a credit union website that sells

As I have written before, your credit union website should have one main goal: generate leads in humanized digital economy.

Let’s put it another way. Your website should be your number one selling resource. And if done right, it should outperform all of your other branches combined and be the number one revenue generator.

But to get to this point will require a different perspective on the way websites are viewed and, more importantly, budgeted for and invested in.

It’s 2014.

And it’s time to move credit union websites beyond just being glorified online brochures. Instead, they need to be highly optimized digital marketing and lead generation systems that grow leads, increase share of wallet and empower consumer advocates.

Furthermore, a website can directly help lower the cost of acquisition, improve operational efficiencies and generate additional revenue which can ultimately increase profits.

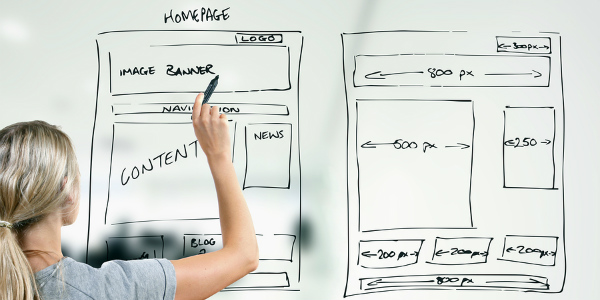

When a credit union approaches us with a need to build a new website, they are often interested in the design and look of their new site.

While aesthetics and UX (user experience) are an important part of the web development process, there are many other areas to consider when planning to develop and build a website that sells.

But your website should do so much more than just sell. It target, captures, nurtures, converts, onboards, cross-sells and refers leads.

Determining the goals of your new website

- What do you like about your current website? What don’t you like?

- Is your current website helping you to achieve your organizational goals?

- Do you need an entirely new website or can we improve the one you have now?

- What platform will you use for your new website?

- Has a realistic budget for the website been established?

- How does this budget compare to building a new branch?

- What other resources do you need to consider?

- How long should you plan for this process to take?

- Will your new website help you to:

- Attract new leads?

- Nurture current leads?

- Onboard converted leads?

- Cross-sell current account holders?

- Position yourself as a financial information resource?

- Humanize your digital channels?

Defining your digital brand

- What’s the first impression you want your website to give to a visitor?

- Does your website convey trust and authority?

- How are you currently:

- Positioning your credit union beyond another financial commodity?

- Sharing your credit union’s story? Who is the hero in the story?

- Ensuring your physical and digital channels provide the same experience?

- Helping a consumer through their buying journey?

Setting benchmarks for future review and KPIs

What are the average monthly:

- Number of visits/visitors/unique visitors to your current website?

- Visitor time on site?

- Traffic coming from mobile or desktop devices?

- Bounce rate?

- Most trafficked pages?

- Highest ranking keywords driving traffic and lead generation?

- Total of leads generated?

- Total dollar amount of loans generated?

Review and analyze the competition

- How are your competitors currently using their website? Is it strictly informational or are they using it to play a key role in their digital lead generation efforts?

- Will your new website catch you up to your competitors’ digital efforts or will you be able to gain an advantage?

- What do you believe are the three most competitive search keywords and how do you rank with them in the search engines when compared to your competitors?

- Are you comfortable having your key market segments analyze your competitors’ websites and provide feedback when compared to yours?

Technology platform considerations

- What platforms do you need to build a website that sells?

- Have you considered the following platforms: marketing automation, referral, remarketing, CRM, social selling, video hosting, etc.?

- How can these platforms integrate with the technology you have now?

- What reputation do these platforms have in regards to uptime, security and deliverability?

Defining key market segments

- Have you defined key market segments and completed consumer persona profiles for each with information beyond basic demographics?

- Will these market segments be part of the development process of your new website?

- Does your overall branding align with these key market segments?

Documenting digital journeys

- What channels drive traffic to your website?

- How are offline channel journeys impacted by your current website?

- What digital journeys do you currently have documented?

- Are the digital journeys generic in nature or are they product specific?

- How are digital journeys tailored to each key market segment?

- Have you established any benchmarks or KPIs for each digital journey?

Taking stock of digital content

- What content do you have on your website that you will keep?

- What content will need to change for the new site?

- What content will need to be created?

- How can content be used within each of these key segment digital journeys?

- How will your content help a consumer through the buying journey?

- How can content be used to humanize your credit union?

Once you have answered all of these questions, you will have a good start in planning to build a website that sells. But these are just a few of the many different areas that need to be explored in the planning process.

Some credit unions find that a digital discovery and planning session is helpful to get the ball rolling. And they also appreciate a third party objective and expert perspective as well.