Amazon Prime Day was three months late in 2020, but welcome all the same, with total transactions and dollar amounts on Amazon increasing by more than 51 percent for both credit and debit charges compared to 2019.

According to data collected and analyzed by CO-OP Financial Services, total credit and debit transactions on Amazon increased 51.2 percent comparing October 13-14, 2020 (Amazon Prime Day 2020) with July 15-16, 2019 (Amazon Prime Day 2019). The total dollar amount spent on credit and debit purchases during the same two two-day periods showed a 51.4 percent increase in 2020 compared to 2019.

In total, according to ROI Revolution, “Digital Commerce 360 estimates that Amazon Prime Day 2020 sales hit $10.4 billion – up from $7.16 billion (+45.2%) over Prime Day 2019 and from $4.19 billion (+148.2%) over Prime Day 2018.”

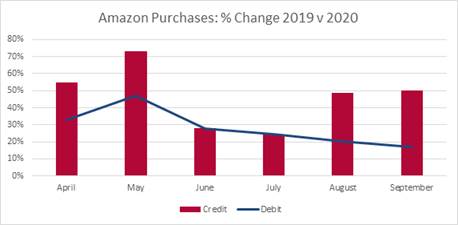

Even so, Amazon Prime Day’s economic impact may not be as markedly significant as in years past. CO-OP’s analysis points to a general trend towards ecommerce during the pandemic. Since April, Amazon credit card transactions in 2020 compared to 2019 have increased 48 percent.

In addition, CO-OP found that Amazon Prime Day 2020 actually had a more significant impact with debit transactions, which saw a 79 percent increase from the day prior (I.e., October 12). For credit transactions, Amazon Prime Day 2020 only saw a 33 percent increase from the day prior.

“This is meaningful in the payments space because it demonstrates credit cardholders are leveraging their credit cards for their daily Amazon transactions in ‘essential’ categories,” said Beth Phillips, Director, Strategic Portfolio Growth for CO-OP. “Meanwhile, debit cardholders demonstrated a higher response rate during the big event, most likely for larger or wish list items.”

An additional way of looking at Amazon Prime Day 2020 results is to examine bookstore credit card transactions, the largest Amazon merchant category, comparing October 13-14, 2019, to October 13-14, 2020. CO-OP found transactions up 77 percent. “This means it is more important than ever for credit unions to educate their cardholders on how to place your card in their accounts at their online retailers, then remind and incentivize them that your card should be their preferred card,” said Phillips.

To help credit union executives, CO-OP Financial Services commissioned Filene Research Institute to study the socio-economic and technological changes expected to have the greatest impact on consumer behaviors and preferences. The study, titled “Payments, Personal Financial Management and Prospects for Credit Union Growth” is now available here.

“The increase in ecommerce totals throughout the pandemic supports our belief that enabling digital payments for members is the path to growth,” said Todd Clark, President/CEO, CO-OP Financial Services. “Encouraging members to have your card top-of-wallet for events like Amazon Prime Day and Cyber Monday leads to deeper penetration, usage and engagement with your credit union.

“Even if you weren’t able to put together a campaign ahead of Amazon Prime Day, we anticipate that given the close proximity between Amazon Prime Day and the holidays, this year we’re going to see a prolonged spending boost that will last over the next several weeks,” said Clark.

To learn more about how CO-OP’s SmartGrowth team can help credit unions with their member card use campaigns, visit SmartGrowth Consultation here.