ROCHESTER, MN (May 14, 2025) |

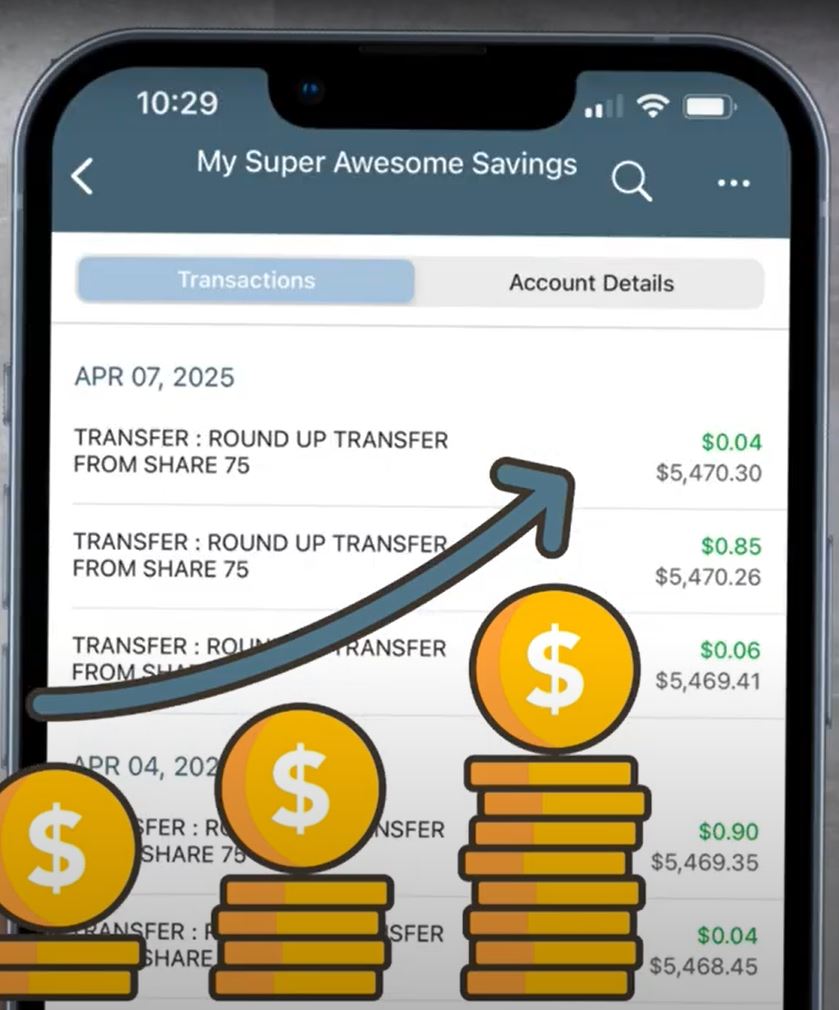

First Alliance Credit Union is excited to announce the launch of its new Round Up Savings program. This innovative service is designed to help credit union members build their savings effortlessly, one debit card swipe at a time. With this program, every purchase made with a First Alliance debit card is rounded up to the nearest whole dollar amount, and the difference is automatically transferred from the member’s checking account in to their savings or money market account.

Kristina Kovacevic, AVP of Retail Experience at First Alliance Credit Union, shared her excitement about the program: “Saving money doesn’t have to be hard work. The Round Up Savings program makes it easy to build your savings while still enjoying life. Whether you’re saving for a rainy day or a bigger goal, this program does the work for you. Every time you swipe your debit card; you’re moving closer to achieving your financial goals!”

Here's a real-life example of how the Round Up Savings program functions: Suppose your morning coffee costs $6.10; the transaction total will be rounded up to $7.00. The extra $0.90 is immediately transferred to your First Alliance savings account. Participants in the pilot program for Round Up Savings typically saved an extra $30 each month.

The Round Up Savings program is an easy and effective way to save for both short-term and long-term financial goals without having to think about it. Once enrolled, members can start saving by simply making everyday purchases with their First Alliance debit card. The rounded-up amount will be transferred into the designated savings account after each transaction.

“We’re always looking for ways to help our members achieve financial success, and this program is a perfect fit,” said Kovacevic. “It’s designed to be easy, automatic, and hassle-free. We want to give our members the tools to save for the things that matter most to them.”

Whether it’s for an emergency fund, vacation, or any financial milestone, the Round Up Savings program helps First Alliance members save without even thinking about it. It’s a simple, automatic way to put spare change to work.

At First Alliance Credit Union, our mission is to provide access to financial opportunities for everyone in our community. The Round Up Savings program is a practical tool for First Alliance Credit Union members to reach their financial goals. For more information about the Round Up Savings program and how to enroll, visit www.firstalliancecu.com/round-