Credit union industry assets grew 13.2 percent year-over-year as of June 30, topping $2 trillion for the first time in industry history. Credit unions continue to guide the financial lives of their members as they recover from the effects of the COVID-19 pandemic.

That was among the takeaways from the second-quarter 2021 Trendwatch webinar by Callahan & Associates that drew more than 1,200 attendees last week.

Some of the more notable lending trends highlighted in the webinar include:

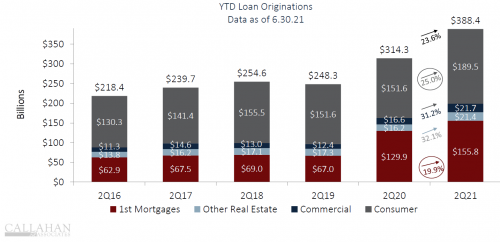

- Credit unions are supporting economic recovery by lending to members at an unmatched pace. Total year-to-date loan originations increased by more than 20 percent in dollar terms over each of the past two years.

- Credit unions originated 22.5 million loans for $388.4 billion in the first half of 2021, including a record $206.7 billion in the second quarter. As recently as 2014, the credit union industry had never collectively generated $388.4 billion in loan volume throughout a full calendar year, let alone over six months.

- While 1st mortgages drove loan originations over the first six months of last year, consumer lending – consisting predominantly of auto loans and revolving credit - is surging in the first half of 2021, outpacing 1st mortgage origination growth over the same period. Although the mortgage market remains hot in our low-interest-rate environment, the rebound of consumer lending is a hopeful sign for a recovering economy.

- Strong origination performance is starting to convert to balance sheet growth, as outstanding loan balances expanded over the second quarter across all major loan products.

The industry’s loan-to-share ratio increased between March and June for the first time since the third quarter of 2019, as credit unions utilized some of their liquidity to meet member loan demand.

Year-to-date loan origination totals ($) increased by double digits annually in every major reported loan category between the first half of 2020 and the same period in 2021. Data source: Callahan’s Peer-to-Peer

The Trendwatch webinar also highlighted industry performance in areas outside of lending.

A total of 5.1 million Americans joined a new credit union in the past 12 months, as membership expanded 4.1 percent year-over-year to reach a total of 128.8 million.

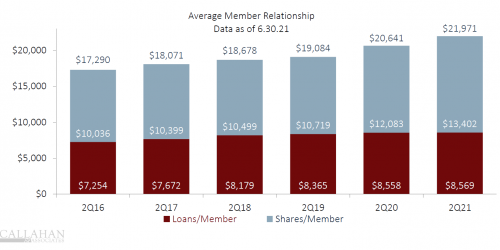

Members have also turned to credit unions to help them save. Total share balances increased $228.6 billion (15.2 percent) over the past year. Notably, member checking account balances have jumped 32.0 percent since last June as more than six in 10 members have checking accounts at their credit union today. Millions of American consumers (and growing) continue to turn to credit unions as their trusted primary financial institution.

“Credit unions continue to provide a growing proportion of the American public with responsible and timely financial products and services. The challenges of the resurging pandemic lay before all of us, but the experience gained so far since COVID-19 began and the century-long foundation on which the member-owned financial cooperative rests give me confidence that together, the movement can again help millions of members weather the storm,” said Jon Jeffreys, president and CEO of Callahan & Associates.

Credit unions have both increased total membership and deepened existing relationships over the past year. The average member relationship grew $1,130 over the past twelve months. Data source: Callahan’s Peer-to-Peer

The Trendwatch webinar also included a presentation by Karen Church, president, and CEO of ELGA Credit Union ($1.2B, Burton, MI). Church focused on how her cooperative has parlayed a long commitment to risk-based lending that looks beyond credit scores, and a broad focus on the Flint community, into metrics such as compound annual growth of about 15 percent per year for the past 10 years in assets and loans.

A recording of the Aug. 11 Trendwatch can be viewed here. Click here for more takeaways from a Callahan analyst.