January 17, 2014

The Honorable Debbie Matz, Chairman

The Honorable Michael E. Fryzel, Board Member

The Honorable Rick Metsger, Board Member

National Credit Union Administration

1775 Duke Street

Alexandria, VA 22314-3428

RE: Federal Credit Union Loan Interest Rate Ceiling

Dear Chairman Matz, Board Member Fryzel and Board Member Metsger:

On behalf of the National Association of Federal Credit Unions (NAFCU), the only trade association that exclusively represents the interests of our nation’s federal credit unions (FCUs), I wanted to discuss the interest rate ceiling included in the Federal Credit Union Act (FCUA). NAFCU believes the current rate ceiling of 18 percent is appropriate and I would encourage the NCUA Board to maintain this rate when it considers the issue at this month’s board meeting.

NAFCU believes that lowering the interest rate will be detrimental to the safety and soundness of credit unions as it could potentially result in a loss of capital. Further, it could discourage FCUs from making loans or approving credit card applications for higher risk members. This in turn would likely lead to credit union members seeking loans from other lenders at considerably higher rates.

While section 1757 of the FCUA states the interest rate on loans by federal credit unions may not exceed 15 percent per year, as you know, the Act also provides the NCUA flexibility to increase the rate, as is currently the case. The Board may increase the rate – or in this case maintain the rate above 15 percent – if it determines interest rates have risen over the preceding six month period and that the prevailing interest rate would threaten the safety and soundness of individual credit unions. Given that the prevailing interest rates have increased over the last six months, NAFCU believes the NCUA should keep the current 18 percent rate in effect.

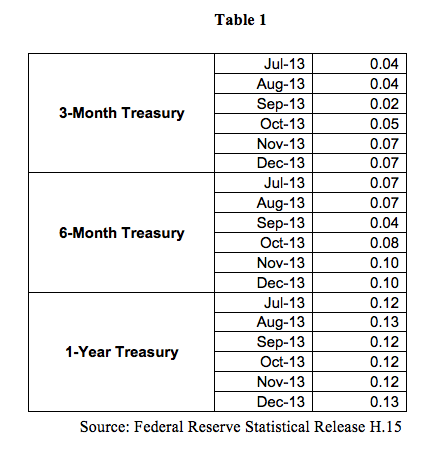

Despite the current low rate environment, the following table shows that there has been an increase in short-term interest rates during the past six months.

FCUs’ “Most Common” Interest Rates – All Unsecured Loans

Note: The 5300 Call Report only provides the “most common” unsecured interest rate which might not capture higher rates for “credit builder” or “credit rebuilder” type of loans.

Loans Larger than 15 percent

As of September 30, 2013, 316 of the 4,131 federal credit unions in the U.S. had a most common interest rate above 15 percent for their unsecured loans (unsecured credit card loans and/or other unsecured loans). This means that 7.5 percent of all federal credit unions would be required to change their rate policy if the interest rate ceiling would be lowered to 15 percent, which might discourage many of them to make these kinds of loans going forward. This would not only reduce available credit options to members in an already tight credit market, but would also reduce the competitiveness of credit unions due to the reduced loan portfolio they would be able to offer to their members.

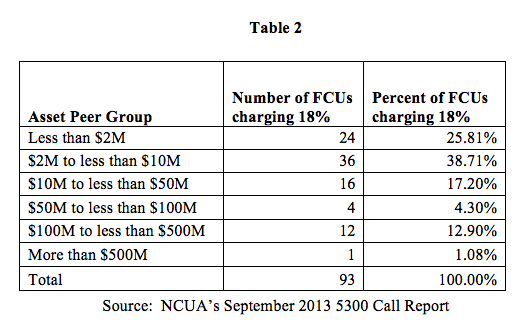

In addition, over half (50.6 percent) of the affected federal credit unions would be small credit unions with assets below $10 million. Of the 93 federal credit unions that already have interest rates equal to the rate ceiling of 18 percent, 64.5 percent are small credit unions with assets below $10 million. Their growth potential as well as their liquidity, capital and earnings levels would be negatively affected by a reduction in the interest rate ceiling.

Loans Larger or Equal to 15 percent

Loans Larger or Equal to 15 percent

If the above analysis is expanded to include federal credit unions that are currently charging 15 percent on their unsecured loans, the picture becomes even clearer. Eleven percent of all federal credit unions are currently charging 15 percent or more on their unsecured loans and 54.2 percent of those are federal credit unions with assets below $10 million.

Lowering the current interest rate ceiling would not only force all such credit unions to change their rate policy, but it would also almost certainly force many credit unions to simply stop lending to many individuals who have very few alternatives for credit. In short, lowering the interest rate ceiling will lead to credit unions significantly tightening lending standards which would, in turn, result in less credit availability at a time when there is already a significant shortage of available credit.

I hope this information is helpful, and we thank you for this opportunity to share our views. Should you have any questions or require additional information, please call me, or Michael Coleman, Director of Regulatory Affairs, at mcoleman@nafcu.org or at (703) 842-2244.

Sincerely,

B. Dan Berger cc: Mark A. Treichel, Executive Director

President and CEO Michael McKenna, General Counsel