HAWORTH, NJ (May 9, 2025) |

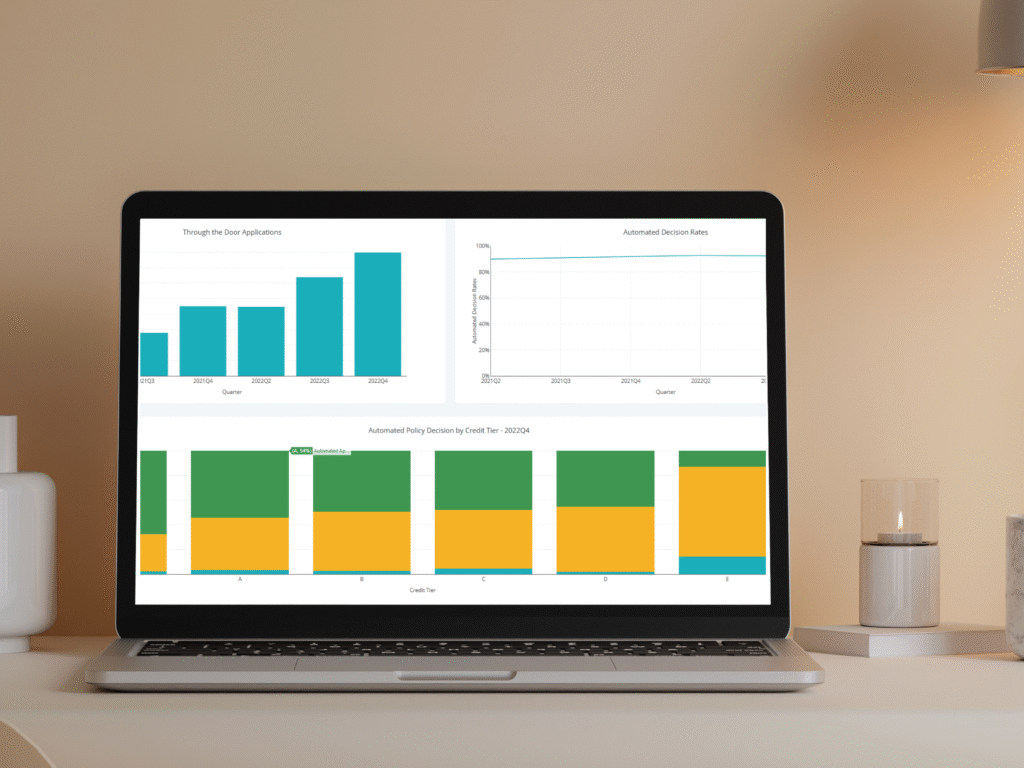

Teachers Federal Credit Union (Teachers FCU) is setting the standard for digital transformation in the credit union industry with the adoption of Corridor Platforms' RiskDecisioning.ai solution. By leveraging this smart decisioning technology, Teachers FCU has boosted its loan approval rates by up to 50%, improved real-time decision automation by over 300%, and created a seamless, enhanced member experience.

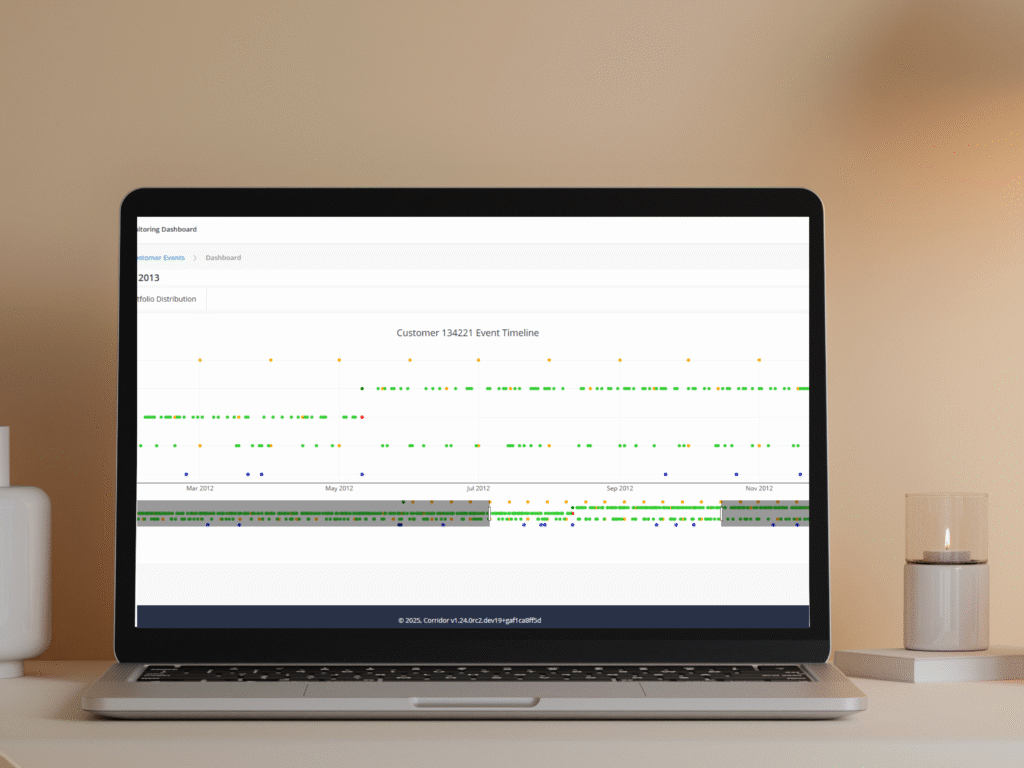

As fintechs and Tier 1 banks continue to disrupt the industry, credit unions must overcome traditional limitations to stay relevant. Teachers FCU has implemented RiskDecisioning.ai to do just that. The solution provides a 360-degree view of member behaviors by organizing their member data in one solution, improving member experiences, and increasing high-quality loan applications via custom AI models and streamlined strategies. The solution has positioned Teachers FCU to compete effectively on a national scale against sophisticated competitors while running operations with a small team of internal specialists.

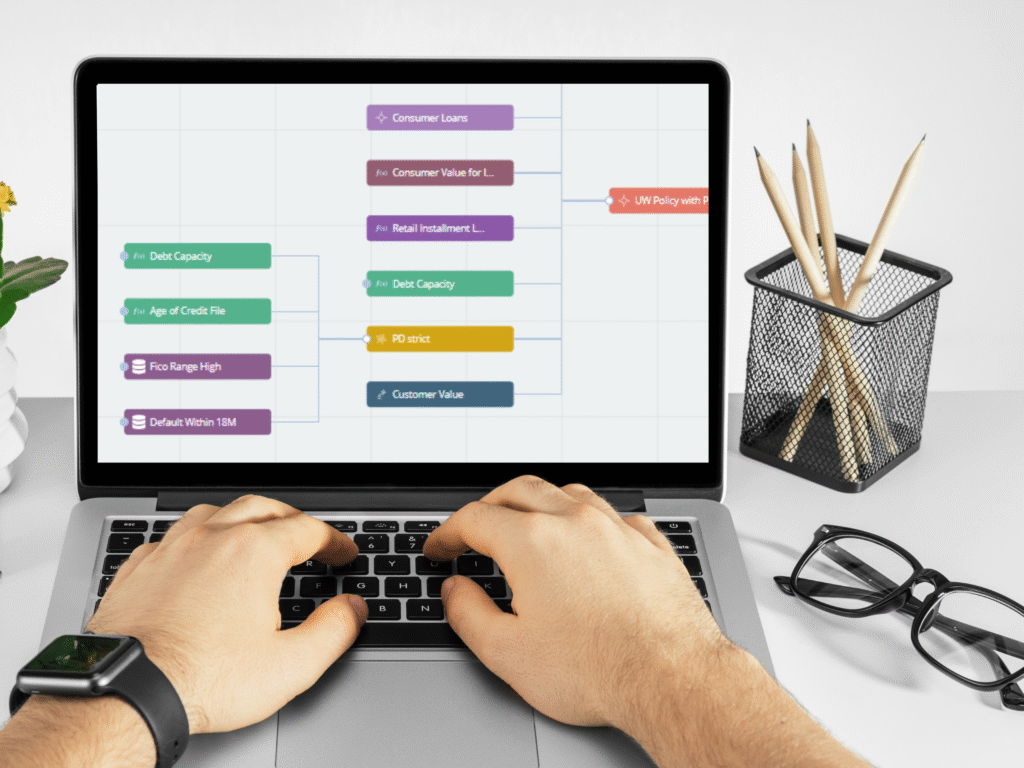

RiskDecisioning.ai is a fully integrated, turnkey solution that provides mid-market institutions with automated, no-code decisioning for loan underwriting, fraud prevention, customer marketing and collections. Credit unions can develop, test, and deploy strategies swiftly, monitor performance with AI-driven analytics, and ensure regulatory compliance through audit trails, version control, and governance. RiskDecisioning.aI helps increase wallet share by up to 1.6x and reduces losses by up to 20% by catching delinquencies early.

Recognized by Gartner as a leading decision intelligence platform, Corridor Platforms’ modular platform integrates seamlessly with existing systems, offering credit unions in-house ownership and transparency in their decisioning process. The company’s Build-Operate-Transfer model provides the credit union with complete flexibility during the operating period and Corridor Platforms transfers over to the in-house team of specialists when the credit union is ready.

“We embarked on this journey with Corridor Platforms with a clear focus on scaling effectively—leveraging automation and data-driven decisioning to enhance member experience while maintaining efficiency,” said Brad Calhoun, CEO of Teachers Federal Credit Union. “By streamlining loan approvals, we’ve significantly improved processing speed and reduced operational burden, all while maximizing our existing resources. The impact has been staggering—had we implemented this model earlier, we could have reduced charge-offs by nearly 30%. We hope to set an example for what is possible for other credit unions to upgrade their decisioning, and are exploring the idea of creating a Credit Union Service Organization based on our experience.”

“We believe the credit union sector is at a pivotal moment, and Teachers FCU exemplifies how these institutions can drive real digital transformation,” said Manish Gupta, CEO and Co-Founder of Corridor Platforms. “Through our collaboration, Teachers FCU has demonstrated how AI-driven automation and systematic governance can help all credit unions make smarter, faster decisions and achieve sustainable growth. This partnership not only elevates Teachers FCU but also sets the stage for other credit unions to follow their lead in embracing digital change.”