Sign of the times: Banking without borders

There’s a long history of trade in both goods and currency alike, but these exchanges have taken on many forms over time. The invention of currency allowed people to trade goods and services without having to barter to arrive at an appropriate price. Since its inception, conveniences continue to emerge and evolve over time through technology advances resulting in global usability.

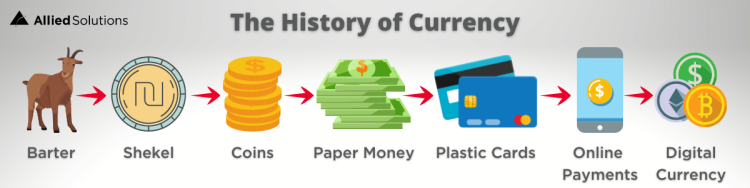

The Changing Forms of Exchange

Before any concept of money existed, people bartered goods and services for what they needed. Lumber for livestock as a more direct exchange, or sometimes, seeds were borrowed to sow and in turn, the lender was paid back upon harvest. Thousands of years ago, the people of Mesopotamia invented the first form of currency called the shekel. The shift to coin was one of the first modifications in the history of money. Coins were one of the first currencies that allowed people to pay by count instead of weight, allowing trade to travel farther and with greater ease than livestock or harvest. After coins came paper money, then plastic cards, all in an effort to modernize convenience. From there, online payments developed with quick adoption and since then further transformation continued with digital currency allowing individuals to invest in potentially growing currencies and spend money in a way that’s more convenient and virtually borderless.

Cryptocurrency, also referred to as digital currency or crypto, is the mystical exchange of nothingness. Or is it? A cryptocurrency is a digital currency used as an alternative form of payment or investment. It uses encryption algorithms which serves as currency and a virtual accounting system. While some believe investors are tossing money into the void with nothing more than wishful thinking, others swear by the logic and freedom of being their own bank.

continue reading »